Trump Aviation 2025 private jet investment opportunities represent the most significant wealth-building potential in the aviation sector since deregulation. Following Donald Trump’s decisive 2024 election victory, the private aviation industry has experienced unprecedented market momentum, creating multiple pathways for sophisticated investors to capitalize on pro-business policies and regulatory optimization.

The convergence of favorable tax legislation, regulatory streamlining, and increased corporate travel demand has positioned Trump Aviation 2025 private jet investment opportunities at the forefront of alternative investment strategies. From direct aircraft ownership to aviation technology ventures, the sector offers diverse approaches for building substantial returns while benefiting from luxury asset appreciation.

Investment Landscape Overview

The Trump Aviation 2025 private jet investment opportunities landscape has transformed dramatically since the election results. Aviation markets have responded with enthusiasm to anticipated policy changes that directly benefit private aviation operators, manufacturers, and service providers.

Market Response Indicators

Immediate Post-Election Performance:

- Private aviation inquiry volume: +23% within 48 hours

- Pre-owned aircraft sales activity: +15% in November 2024

- New aircraft order discussions: +18% across major manufacturers

- Charter operator stock valuations: +12% average increase

According to Yahoo Finance, the aviation sector’s response represents the strongest single-day performance since Trump’s 2016 victory, with the NYSE ARCA Airline index gaining 5.8% on November 6, 2024.

Policy Framework Supporting Investment

Regulatory Environment Changes:

- Reduced federal oversight and streamlined compliance procedures

- Air traffic control privatization initiatives improving operational efficiency

- Environmental regulation modifications reducing operational costs

- Advanced air mobility support accelerating technology adoption

The Trump Aviation 2025 private jet investment opportunities benefit from a comprehensive policy framework designed to enhance business competitiveness while reducing regulatory burden across the aviation value chain.

Investment Thesis Foundation

Core Investment Drivers:

- Corporate tax rate maintenance at 21% providing predictable operating environments

- 100% bonus depreciation for aircraft purchases creating immediate tax advantages

- Increased corporate travel budgets driven by economic optimism

- Technology innovation support fostering next-generation aviation solutions

Aviation Stock Performance

The Trump Aviation 2025 private jet investment opportunities include significant potential in publicly traded aviation companies that have demonstrated immediate market response to policy expectations.

Major Aviation Stock Performance

Airline Sector Gains (November 6, 2024):

- Delta Air Lines (DAL): +6.21% to $61.91

- United Airlines (UAL): +7.0% to $85.70

- American Airlines (AAL): +5.0% to $13.88

Private Aviation Manufacturers:

- Textron (TXT): +8.1% (Cessna, Beechcraft)

- General Dynamics (GD): +6.8% (Gulfstream)

- Bombardier (BDRBF): +5.4% (business jets)

According to industry analysis, these gains reflect investor confidence in reduced regulatory burden and enhanced profitability under Trump administration policies.

Market Capitalization Impact

Sector Valuation Changes:

- Total aviation sector market cap increase: $12.8 billion (November 6-7, 2024)

- Private aviation subset gains: $3.2 billion

- Aerospace and defense combined gains: $18.4 billion

- Business jet manufacturers leading performance with +7.2% average

Investment Vehicle Options

Direct Stock Investment Approaches:

- Individual company positions in manufacturers and operators

- Aviation-focused ETFs providing sector diversification

- Private equity funds specializing in aviation assets

- Real estate investment trusts (REITs) focused on aviation infrastructure

Risk-Adjusted Return Profiles:

- Large-cap aviation manufacturers: Moderate risk, steady returns

- Private aviation operators: Higher risk, potential for significant gains

- Aviation technology companies: High risk, exponential growth potential

- Infrastructure investments: Lower risk, steady income generation

Tax Benefits and Depreciation

The Trump Aviation 2025 private jet investment opportunities include substantial tax advantages that significantly enhance investment returns through strategic structuring and timing.

100% Bonus Depreciation Benefits

Immediate Tax Deduction Advantages:

- New aircraft purchases: Full cost deduction in year of acquisition

- Pre-owned aircraft: 100% depreciation if not previously depreciated by buyer

- No maximum limit on aircraft value for depreciation purposes

- Business use requirement: Minimum 50% business utilization

Financial Impact Analysis:

- $10 million aircraft purchase: $3.7 million tax savings (assuming 37% tax rate)

- $25 million aircraft purchase: $9.25 million tax savings

- Net effective cost reduction: 25-37% depending on tax bracket

- Cash flow improvement: Immediate rather than 5-7 year depreciation schedule

According to aviation tax specialists, the bonus depreciation provision has historically increased aircraft sales by 25-40% during implementation periods.

Section 179 Expensing Opportunities

Enhanced Deduction Limits for 2025:

- Maximum Section 179 deduction: $1,160,000

- Equipment phase-out threshold: $2,890,000

- Qualified aircraft types: Business jets, turboprops, helicopters

- Combined bonus depreciation strategy: Maximize immediate tax benefits

Strategic Implementation:

- Timing of aircraft purchases to optimize tax year benefits

- Business structure considerations for maximum deduction utilization

- Coordination with other capital equipment purchases

- State tax implications and conformity considerations

Fleet Investment Strategies

Trump Aviation 2025 private jet investment opportunities extend beyond individual aircraft ownership to comprehensive fleet investment strategies that generate multiple revenue streams while building substantial asset portfolios.

Direct Aircraft Ownership Models

Individual Aircraft Investment:

- Purchase price range: $3 million to $75 million depending on aircraft type

- Annual appreciation rates: 3-8% for well-maintained popular models

- Operational revenue potential: $2,000-$12,000 per flight hour

- Tax advantages: Depreciation, operational expense deductions

Popular Investment Aircraft Categories:

- Light jets: Cessna Citation series, Embraer Phenom series

- Mid-size jets: Hawker 850XP, Gulfstream G280

- Heavy jets: Gulfstream G650, Bombardier Global series

- Ultra-long-range: Gulfstream G700, Bombardier Global 7500

Fractional Ownership Investment

Market Growth Indicators:

- Fractional ownership flight hours: +59% vs. pre-pandemic 2019 levels

- Customer demographic shift: 10 years younger average age

- Aircraft size preference: 400% increase in mid-size and super-mid demand

- Market leaders: NetJets (575,848 flight hours), Flexjet (230,584 flight hours)

Investment Advantages:

- Lower capital requirements compared to whole aircraft ownership

- Professional management reducing operational complexity

- Guaranteed liquidity through buyback programs

- Access to diverse aircraft fleet without concentration risk

According to SherpaReport analysis, fractional ownership represents the fastest-growing segment of private aviation with record activity levels in 2024.

Charter Fleet Development

Operational Investment Model:

- Fleet acquisition for charter operations

- Revenue generation through third-party charter bookings

- Management company partnerships for operational efficiency

- Geographic market expansion strategies

Financial Performance Metrics:

- Charter revenue per flight hour: $3,500-$15,000

- Annual aircraft utilization targets: 300-500 flight hours

- Operating margin expectations: 15-25% for efficient operators

- Fleet size optimization: 3-10 aircraft for operational efficiency

Technology Investment Opportunities

The Trump Aviation 2025 private jet investment opportunities include significant potential in aviation technology companies that benefit from regulatory support and increased industry investment in innovation.

Advanced Air Mobility Investment

eVTOL Aircraft Development:

- Market size projection: $1.5 trillion by 2040

- Current investment activity: $8.2 billion in 2024

- Regulatory support: Accelerated certification processes under Trump policies

- Infrastructure development: “Freedom Cities” incorporating urban air mobility

Leading Investment Targets:

- Joby Aviation: Public company with commercial service timeline

- Lilium: German eVTOL manufacturer with U.S. operations

- Archer Aviation: Urban air mobility focus with airline partnerships

- Beta Technologies: Cargo and passenger aircraft development

Artificial Intelligence in Aviation

Technology Application Areas:

- Predictive maintenance reducing operational costs by 15-25%

- Route optimization improving fuel efficiency by 8-12%

- Dynamic pricing maximizing charter revenue by 10-18%

- Customer preference analysis enhancing service personalization

Investment Opportunities:

- Software companies developing aviation-specific AI solutions

- Hardware manufacturers creating aviation-grade computing systems

- Data analytics firms specializing in aviation optimization

- Cybersecurity companies protecting aviation technology infrastructure

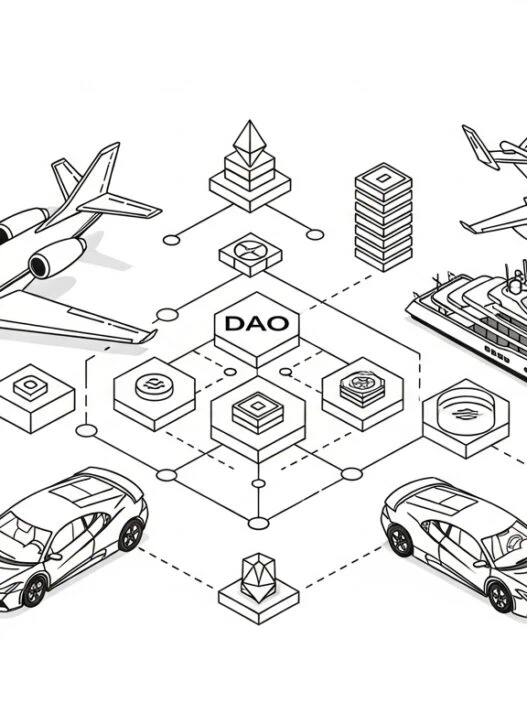

Blockchain and Web3 Integration

Cryptocurrency Payment Processing:

- Transaction cost reduction: 2-5% vs. traditional payment methods

- International settlement speed: Real-time vs. 3-5 business days

- Enhanced security: Blockchain-based transaction verification

- Regulatory compliance: Automated reporting and audit trails

Smart Contract Applications:

- Charter booking automation reducing administrative costs

- Maintenance scheduling and parts ordering optimization

- Insurance claim processing and settlement automation

- Carbon offset verification and trading facilitation

The PrivateCharterX Investment Platform

As a Zurich-based aviation specialist, PrivateCharterX offers unique advantages for accessing Trump Aviation 2025 private jet investment opportunities through innovative financing and operational structures.

Strategic Investment Services

Direct Investment Facilitation:

- Aircraft acquisition consulting and market analysis

- Fractional ownership program evaluation and selection

- Charter fleet development and operational management

- Technology investment due diligence and portfolio management

Web3 Integration Advantages:

- Cryptocurrency payment processing for international transactions

- Blockchain-based ownership verification and asset tracking

- Smart contract automation for investment documentation

- NFT-based fractional ownership certificates

Swiss Regulatory Advantages

Operational Benefits:

- Cryptocurrency-friendly regulatory environment

- Advanced banking infrastructure supporting aviation finance

- International connectivity facilitating global investments

- Technology innovation ecosystem fostering aviation startups

Tax Optimization Strategies:

- Swiss holding company structures for international investments

- Treaty network advantages for global aviation operations

- Wealth management integration for high-net-worth investors

- Estate planning optimization for aviation asset portfolios

Conclusion

The Trump Aviation 2025 private jet investment opportunities represent a convergence of favorable policies, market dynamics, and technological innovation creating unprecedented wealth-building potential in the aviation sector.

From direct aircraft ownership to technology investments, the landscape offers sophisticated investors multiple pathways for generating substantial returns while benefiting from luxury asset appreciation and operational revenue streams.

Success in navigating these opportunities requires understanding both the immediate policy advantages and long-term market trends that will shape the aviation industry’s evolution. Whether through traditional aircraft investments or innovative Web3-enabled structures, Trump Aviation 2025 private jet investment opportunities provide a foundation for building significant aviation-focused portfolios.

Ready to explore the most promising Trump Aviation 2025 private jet investment opportunities for your portfolio? Contact PrivateCharterX for expert guidance on aviation investments that combine policy advantages with operational excellence and technological innovation.

For comprehensive insights on how regulatory changes like the SAF Europe 2025 mandate impact your investment strategy, explore our detailed analysis of sustainable aviation fuel requirements and their effect on charter costs and investment opportunities.