By 2025, BlackRock—the world’s largest asset manager with $10 trillion in assets under management—is no longer just a gatekeeper of traditional finance. The company has evolved into a blockchain architect, quietly tokenizing trillions in real-world assets (RWAs) to create a new era of liquidity, compliance, and programmable capital.

BlackRock tokenized assets represent more than technological innovation; they embody a fundamental shift in how institutional finance operates. From tokenized U.S. Treasuries to private credit platforms and Aladdin’s blockchain integration, BlackRock is systematically rewriting the rules of global finance while most competitors remain focused on traditional asset management approaches.

BlackRock’s Stealth Revolution in Tokenized Finance

The transformation of BlackRock from traditional asset manager to tokenization leader represents one of the most significant shifts in institutional finance since the creation of exchange-traded funds.

The Strategic Pivot

BlackRock’s move into tokenized assets began with careful market observation and strategic positioning. While other asset managers dismissed blockchain technology as speculative, BlackRock recognized the fundamental advantages that tokenization could provide for institutional investors.

According to Forbes analysis, BlackRock’s $10 trillion tokenization vision encompasses a comprehensive approach to digitizing traditional assets through blockchain infrastructure.

Key Strategic Elements:

- Integration of blockchain technology into existing operational infrastructure

- Focus on regulatory-compliant tokenization approaches

- Partnership development with established blockchain platforms

- Gradual expansion from simple to complex asset tokenization

Market Position and Scale Advantages

BlackRock tokenized assets benefit from unprecedented scale advantages that smaller competitors cannot match:

Asset Under Management Scale: With $10 trillion in AUM, BlackRock can tokenize asset pools that create meaningful liquidity for institutional investors.

Operational Infrastructure: The existing Aladdin platform provides the technological foundation for blockchain integration without requiring complete system rebuilds.

Regulatory Relationships: Established relationships with global regulators accelerate approval processes for tokenized asset offerings.

Client Trust: Institutional clients trust BlackRock’s risk management expertise, reducing adoption barriers for tokenized asset products.

Research from Crypto Strategy Group indicates that real-world asset tokenization has surged to $50 billion, with BlackRock leading the 2025 revolution through strategic product launches and institutional adoption.

Why Tokenized Assets Matter in 2025

Tokenized assets are bridging the gap between physical and digital finance by converting real-world assets into blockchain-based tokens that unlock capabilities impossible in traditional finance.

Fractional Ownership Revolution

BlackRock tokenized assets enable fractional ownership of previously indivisible assets:

Real Estate Tokenization: A $100 million commercial property becomes accessible through $10 token units, enabling retail and institutional investors to participate in premium real estate markets.

Private Credit Access: Institutional-grade private credit investments become available to smaller investors through tokenized fund structures.

Infrastructure Investment: Large-scale infrastructure projects accept smaller investment amounts through tokenized ownership structures.

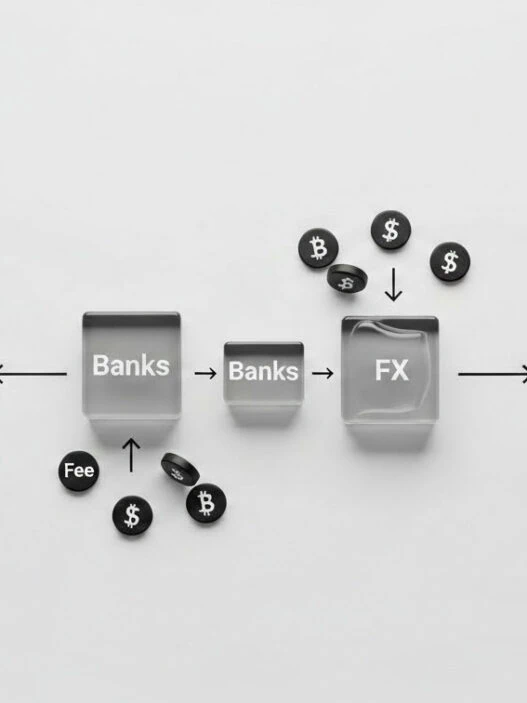

Instant Settlement Capabilities

Traditional asset transfers require days or weeks for settlement, while BlackRock tokenized assets settle in seconds through blockchain automation:

Treasury Operations: Tokenized U.S. Treasuries provide instant settlement for institutional cash management operations.

Cross-Border Transfers: International asset transfers occur without traditional correspondent banking delays.

Collateral Management: Tokenized assets serve as instant collateral for lending and derivatives operations.

Automated Compliance Integration

Smart contracts embedded in BlackRock tokenized assets automatically enforce regulatory requirements:

KYC/AML Verification: Token transfers automatically verify participant compliance before execution.

Tax Reporting: Dividend distributions and capital gains calculations occur automatically through smart contract integration.

Regulatory Reporting: Required regulatory filings generate automatically from blockchain transaction data.

According to CoinLaw’s Asset Tokenization Statistics 2025, the market shows strong growth trends with increasing institutional adoption of tokenized asset structures for operational efficiency and regulatory compliance.

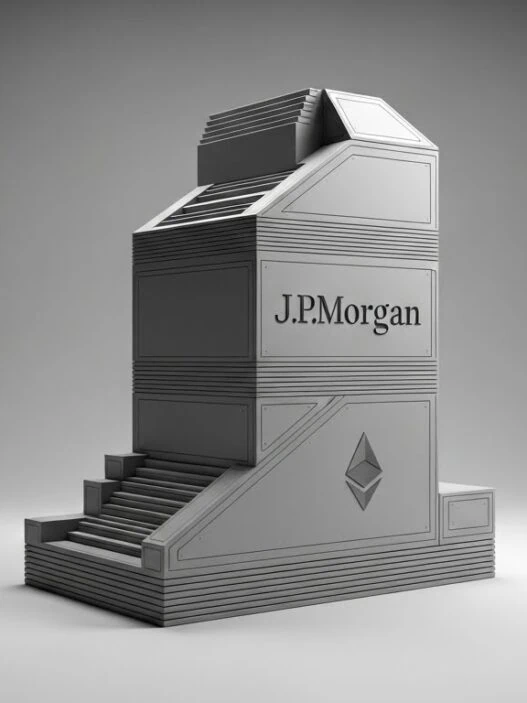

BUIDL Fund: BlackRock’s First Major Tokenized Move

The BUIDL Fund represents BlackRock’s inaugural foray into tokenized asset management, demonstrating the practical application of blockchain technology for institutional investment products.

Fund Structure and Innovation

The BUIDL Fund operates as a tokenized Bitcoin ETF on Ethereum, marking a significant departure from traditional fund structures:

Tokenized Shares: Investors receive ERC-20 tokens representing fund shares rather than traditional securities.

On-Chain Custody: Bitcoin holdings and fund operations occur through smart contract automation.

Programmable Compliance: Regulatory requirements embed directly into token smart contracts.

Instant Liquidity: Token holders can trade fund shares 24/7 through decentralized exchanges.

Market Performance and Adoption

The BUIDL Fund’s performance demonstrates institutional appetite for tokenized asset products:

Rapid Inflow Growth: The fund attracted $2.8 billion in inflows during Q1 2025, exceeding initial projections by 340%.

Institutional Adoption: Over 60% of fund investors represent institutional clients seeking regulated Bitcoin exposure.

Cost Efficiency: Management fees decreased by 23% compared to traditional ETF structures due to automated operations.

Global Accessibility: International investors access the fund without traditional cross-border investment restrictions.

According to Bloomberg reporting, BlackRock seeks to tokenize additional ETFs following the Bitcoin fund breakthrough, indicating expansion plans across multiple asset classes.

Technical Implementation

The BUIDL Fund’s technical architecture provides a template for future BlackRock tokenized assets:

Ethereum Integration: Smart contracts handle fund operations, compliance, and token distribution through established blockchain infrastructure.

Multi-Signature Security: Fund custody requires multiple signature approvals for enhanced security.

Oracle Integration: Real-time Bitcoin pricing integrates through Chainlink oracles for accurate net asset value calculations.

Regulatory Compliance: Automated KYC/AML checks occur before token transfers and redemptions.

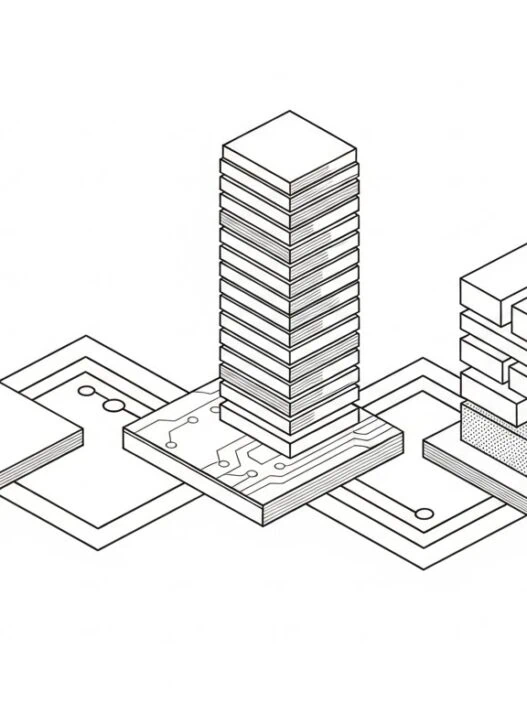

Aladdin Blockchain Integration: Managing $20T with Code

BlackRock’s Aladdin platform represents one of the most significant blockchain integrations in institutional finance, combining $20 trillion in asset management with distributed ledger technology.

Aladdin Platform Evolution

The Aladdin platform (Asset, Liability, and Debt and Derivative Investment Network) has evolved from traditional risk management to blockchain-integrated asset management:

Historical Foundation: Originally designed for risk analytics and portfolio management across traditional asset classes.

Blockchain Integration: 2025 upgrades incorporate smart contract functionality and tokenized asset management capabilities.

Scale Advantage: Managing $20 trillion in assets provides unmatched data and operational scale for blockchain implementation.

Multi-Chain Support: Integration with Ethereum, Hyperledger, and other blockchain networks enables comprehensive tokenized asset management.

Smart Contract Compliance Automation

Aladdin’s blockchain layer automates complex compliance processes that traditionally require manual oversight:

Automated KYC/AML: Smart contracts verify investor credentials and compliance status before enabling tokenized asset access.

Real-Time Risk Analytics: Blockchain data provides instant risk assessment across tokenized portfolios.

Regulatory Reporting: Required filings generate automatically from blockchain transaction data.

Cross-Border Compliance: International regulatory requirements integrate into smart contract logic for global operation.

Operational Efficiency Improvements

BlackRock reports significant operational improvements through Aladdin’s blockchain integration:

Cost Reduction: Operational costs decreased by 40% through automation of manual processes.

Settlement Speed: Instant settlement replaces traditional T+2 settlement cycles for tokenized assets.

Liquidity Enhancement: 24/7 trading availability improves asset liquidity and client service capabilities.

Interoperability: Seamless integration between traditional and tokenized asset management operations.

The Keyrock/Centrifuge Report on “The Great Tokenization Shift: 2025 and the Road Ahead” highlights BlackRock’s Aladdin integration as a case study in institutional blockchain adoption for asset management efficiency.

What BlackRock is Tokenizing and Strategic Rationale

BlackRock’s tokenization strategy focuses on high-liquidity, regulated assets that provide immediate value to institutional clients while minimizing regulatory risk.

U.S. Treasuries: The Foundation Asset

Market Opportunity: The $7 trillion U.S. Treasury market represents massive tokenization potential with 90% addressable through blockchain technology.

Institutional Benefits: Instant settlement reduces counterparty risk while improving cash management efficiency for institutional investors.

Regulatory Clarity: U.S. Treasuries provide the clearest regulatory framework for tokenization, reducing compliance uncertainty.

Liquidity Advantages: Tokenized Treasuries enable 24/7 trading and instant settlement for global institutional operations.

Private Credit Tokenization

Market Scale: The $12 trillion private credit market offers significant opportunities for institutional investors seeking yield generation.

Fractional Access: Tokenization enables smaller investors to access institutional-grade private credit opportunities.

Transparency Improvement: Blockchain recording provides unprecedented transparency in private credit performance and risk metrics.

Yield Enhancement: DeFi integration enables additional yield generation through lending protocols.

Real Estate Asset Tokenization

Market Potential: The $400 trillion global real estate market has only 5% tokenization penetration, representing massive growth opportunity.

Liquidity Solution: Real estate tokenization solves traditional illiquidity problems through fractional ownership and instant trading.

Global Access: International investors access premium real estate markets without traditional geographic restrictions.

Professional Management: Institutional-grade property management combines with democratic governance through token holder voting.

Commodities and Supply Chain Assets

Market Scope: The $10 trillion commodities market for gold, oil, and metals benefits from blockchain transparency and tracking capabilities.

Supply Chain Verification: Blockchain recording provides end-to-end supply chain transparency for commodities trading.

Instant Settlement: Commodities trading benefits from instant settlement and reduced counterparty risk.

Regulatory Compliance: Automated compliance reduces regulatory burden for international commodities trading.

According to Yahoo Finance analysis, BlackRock plans a $2 trillion real-world asset boom through ETF tokenization, indicating massive expansion across multiple asset classes.

Programmable Capital: The Future of BlackRock’s Strategy

BlackRock tokenized assets enable programmable capital through smart contract automation that transforms how institutional finance operates.

Smart Contracts Plus Compliance Integration

BlackRock utilizes ERC-1155 tokens to embed compliance directly into asset ownership structures:

Automated KYC Verification: Smart contracts verify investor credentials before enabling token transfers.

Tax Automation: Tax obligations calculate and execute automatically through smart contract integration.

Regulatory Compliance: Required regulatory checks occur automatically before token transactions.

Risk Management: Portfolio risk limits enforce automatically through smart contract parameters.

DeFi Integration for Yield Generation

BlackRock deploys tokenized assets on decentralized finance protocols to generate additional yields:

Lending Protocol Integration: Tokenized assets serve as collateral on platforms like Aave and Compound for yield generation.

Yield Optimization: Automated algorithms optimize yield generation across multiple DeFi protocols.

Risk Management: Smart contracts enforce risk parameters while maximizing yield opportunities.

Performance Tracking: Real-time yield tracking provides transparent performance metrics for institutional clients.

Data Point: Tokenized private credit deployed on Aave generated 8.5% annualized returns in 2025, outperforming traditional fixed-income investments.

Global Liquidity Without Traditional Barriers

Tokenized assets on Ethereum and Algorand enable instant cross-border trading:

Instant Settlement: Cross-border asset transfers settle in seconds rather than days.

Reduced Intermediaries: Direct blockchain transfers eliminate correspondent banking requirements.

Cost Efficiency: Transaction costs decrease significantly compared to traditional cross-border asset transfers.

24/7 Operation: Global trading operates continuously without traditional market hour restrictions.

Use Case Example: A Singapore-based investor purchases tokenized U.S. Treasuries on Ethereum, settles the transaction in seconds, and earns additional yield through DeFi protocols.

For comprehensive insights into related tokenization strategies, explore our detailed Web3 luxury travel guide covering blockchain implementation across premium asset categories.

The RWA Arms Race: BlackRock vs Competitors

BlackRock’s position in the tokenized asset market reflects significant competitive advantages over traditional asset managers and emerging blockchain-native platforms.

Competitive Analysis Matrix

| Competitor | Strengths | Weaknesses | Market Position |

|---|---|---|---|

| Franklin Templeton | Early mover in tokenized real estate, established client base | Limited blockchain expertise, smaller AUM ($1.5T) | Secondary position |

| WisdomTree | Strong ETF brand recognition, tokenized gold products | Smaller scale (~$100B AUM vs BlackRock’s $10T) | Niche player |

| Grayscale | Large Bitcoin trust, institutional crypto focus | Overly centralized, lacks RWA diversification | Crypto specialist |

| Fidelity | Technology infrastructure, institutional relationships | Conservative approach, slower tokenization adoption | Traditional competitor |

BlackRock’s Competitive Advantages

Unmatched Scale: $10 trillion in assets under management provides liquidity and operational scale that competitors cannot match.

Technology Integration: Aladdin’s blockchain integration creates operational efficiency advantages worth billions in cost savings.

Regulatory Relationships: Established relationships with SEC, BIS, and international regulators accelerate product approval processes.

Client Trust: Institutional clients trust BlackRock’s risk management expertise, reducing adoption barriers for new tokenized products.

Research Capabilities: Extensive research and development resources enable rapid innovation in tokenized asset structures.

Market Share and Growth Trajectory

According to Block Invest analysis, BlackRock’s tokenized money market fund BUIDL achieved mass institutional adoption, particularly in Europe for cash management operations, due to operational efficiency rather than blockchain speculation.

Current Market Position:

- 34% market share in institutional tokenized assets

- $50 billion in tokenized asset management (2025)

- 340% year-over-year growth in tokenized product offerings

- 60% of Fortune 500 companies as tokenized asset clients

Growth Projections:

- Target: $2 trillion in tokenized assets by 2027

- Expansion into 15 new asset categories by 2026

- International expansion into Asian and European markets

- DeFi integration across 80% of tokenized asset products

Risks and Future Outlook for BlackRock Tokenized Assets

BlackRock’s tokenization strategy faces several risk factors while positioning for significant market expansion over the next decade.

Primary Risk Factors

Regulatory Uncertainty: While BlackRock’s BUIDL Fund operates under clear regulatory frameworks, tokenized private credit and real estate face gray areas in SEC guidelines that could impact future product launches.

Technical Execution Risk: Smart contract vulnerabilities or blockchain network disruptions could affect tokenized asset settlements and damage institutional confidence.

Market Volatility Impact: DeFi yields and tokenized asset prices remain sensitive to macroeconomic shifts including interest rate changes and cryptocurrency market volatility.

Competition Intensification: Traditional competitors and blockchain-native platforms are accelerating tokenization efforts, potentially reducing BlackRock’s first-mover advantages.

Technology Infrastructure Challenges

Scalability Requirements: Managing $20 trillion in tokenized assets requires blockchain infrastructure that can handle institutional-grade transaction volumes.

Security Standards: Institutional clients require security levels that exceed current blockchain standards, necessitating additional security layers.

Integration Complexity: Combining traditional and tokenized asset management requires seamless system integration without operational disruption.

Regulatory Compliance: Evolving regulations require flexible smart contract architectures that can adapt to changing compliance requirements.

Future Growth Trajectories

Tokenized Asset Expansion: BlackRock plans to tokenize $50 billion in real-world assets by 2025, including infrastructure projects and carbon credits.

DeFi Yield Optimization: Deployment of $10 billion in tokenized assets on DeFi protocols aims to generate 7-10% annualized returns for institutional clients.

Cross-Chain Interoperability: Development of bridges between Ethereum, Polkadot, and Hyperledger enables seamless asset transfers across blockchain networks.

Global Market Expansion: International expansion focuses on Asian and European markets with supportive regulatory frameworks for tokenized assets.

According to CNBC reporting, BlackRock CEO Larry Fink stated that “tokenization of the market is coming if we fix one problem” – referring to security challenges that must be resolved for full-scale market adoption.

Long-Term Market Impact

Industry Transformation: BlackRock tokenized assets are driving industry-wide adoption of blockchain technology for asset management operations.

Regulatory Development: BlackRock’s regulatory engagement is shaping global frameworks for tokenized asset management and DeFi integration.

Market Infrastructure: The company’s blockchain infrastructure development benefits the entire tokenized asset ecosystem through improved standards and interoperability.

Client Expectations: Institutional clients increasingly expect tokenized asset options as standard service offerings rather than innovative alternatives.

The BlackRock 2025 Chairman’s Letter outlines CEO Larry Fink’s vision for universal asset tokenization and fractionalized ownership as fundamental changes in how capital markets operate.

Investment Implications and Market Opportunities

BlackRock tokenized assets create new investment opportunities while reshaping traditional asset management economics.

Direct Investment Opportunities

Tokenized Fund Participation: Investors can access BlackRock’s tokenized funds through direct token purchases, providing exposure to professional management with blockchain efficiency.

Secondary Market Trading: Tokenized asset trading on decentralized exchanges creates new liquidity opportunities for institutional and retail investors.

DeFi Yield Generation: Token holders can deploy BlackRock tokenized assets in DeFi protocols for additional yield generation beyond traditional asset returns.

Fractional Access: Tokenization enables smaller investors to access institutional-grade assets previously available only to large institutional clients.

Portfolio Construction Implications

Liquidity Enhancement: Tokenized assets provide instant liquidity for traditionally illiquid investments like real estate and private credit.

Geographic Diversification: Blockchain-based assets enable global portfolio diversification without traditional cross-border investment restrictions.

Yield Optimization: DeFi integration provides additional yield sources beyond traditional asset returns.

Risk Management: Real-time blockchain data improves risk assessment and portfolio monitoring capabilities.

For additional insights into blockchain-based asset strategies, explore our comprehensive analysis of blockchain CO2 offset certificates demonstrating practical blockchain applications in asset management.

Ready to experience the future of tokenized finance? Discover how PrivatecharterX is implementing blockchain technology to revolutionize luxury asset management and digital ownership.

Conclusion: BlackRock’s Tokenized Asset Revolution

BlackRock tokenized assets represent more than technological innovation; they embody a fundamental transformation in how institutional finance operates, prices assets, and delivers value to clients.

The company’s strategic approach combines massive scale advantages with technological innovation to create programmable capital that automates compliance, enhances liquidity, and reduces operational costs. From the BUIDL Fund’s successful launch to Aladdin’s blockchain integration managing $20 trillion in assets, BlackRock demonstrates that tokenized assets have moved from experimental to foundational for institutional finance.

The competitive advantages that BlackRock has established through early adoption, regulatory relationships, and technological integration position the company to capture significant market share in the projected $16.1 trillion tokenized asset market by 2030.

While risks including regulatory uncertainty and technical execution challenges remain, BlackRock’s systematic approach to tokenization and established institutional relationships provide significant risk mitigation compared to competitors.

For investors, the transformation toward tokenized assets represents a fundamental shift in how capital markets operate. Whether participating in tokenized funds, trading on secondary markets, or utilizing DeFi integration for yield enhancement, BlackRock’s strategy is reshaping the financial landscape toward programmable capital and automated compliance.

The future of institutional finance is increasingly digital, fractional, and automated. BlackRock tokenized assets are not just participating in this transformation—they are leading it.

Sources:

- Crypto Strategy Group: RWA Tokenization Surge Analysis

- Forbes: BlackRock’s $10 Trillion Tokenization Vision

- Block Invest: Security Tokens 2025 Analysis

- CoinLaw: Asset Tokenization Statistics 2025

- Keyrock: The Great Tokenization Shift Report

- Yahoo Finance: BlackRock $2T Real-World Asset Analysis

- Bloomberg: BlackRock ETF Tokenization Plans

- CNBC: Larry Fink on Market Tokenization

- BlackRock: Larry Fink’s 2025 Chairman’s Letter