Blockchain luxury travel represents the most significant disruption in premium transportation since commercial aviation began. Traditional booking platforms struggle with opaque fee structures, limited transparency, and rigid cancellation policies, while blockchain technology offers solutions that address decades-old inefficiencies in high-end travel services.

This transformation extends beyond simple payment processing. According to Deloitte’s 2024 Travel Industry Report, blockchain luxury travel platforms are already processing over $2.1 billion in annual bookings.

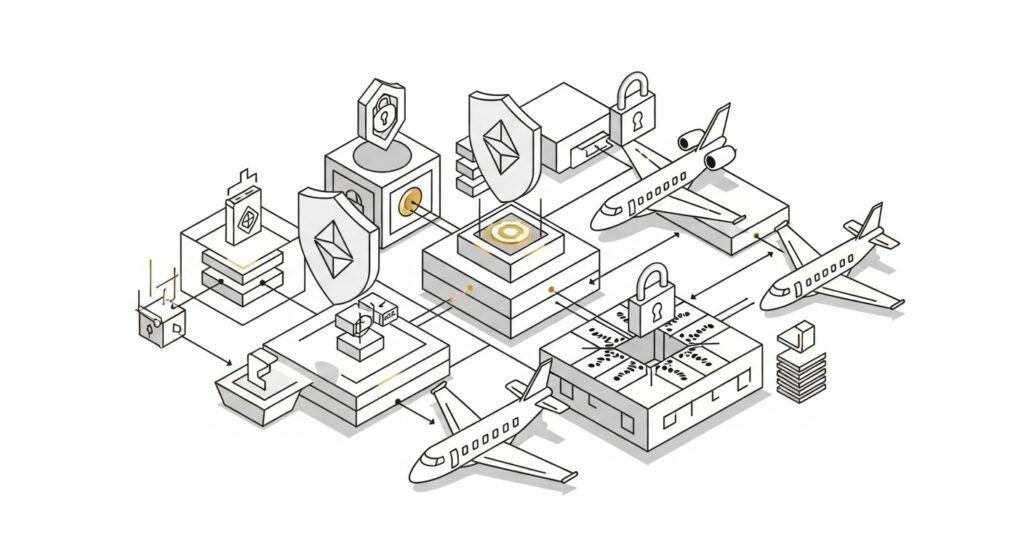

Blockchain fundamentals are reshaping how luxury travelers book private jets, secure yacht charters, and access exclusive experiences through transparent, immutable smart contracts and decentralized ownership models.

For comprehensive coverage of Web3 innovations in travel, explore our complete Web3 category featuring the latest developments in blockchain travel technology.

Current State of Luxury Travel Technology Problems

Traditional luxury travel booking relies on intermediary-heavy systems. These create multiple pain points for high-net-worth travelers.

Opacity in Pricing: Multiple intermediaries add layers of fees. A $50,000 private jet charter often includes broker fees, handling charges, and administrative costs that aren’t disclosed upfront.

Limited Flexibility: Traditional contracts require complex renegotiation for changes. Cancellations involve lengthy processes through multiple parties. This often results in significant financial penalties.

Trust Dependencies: Travelers must rely on individual brokers and companies. There’s no transparent verification of aircraft quality, safety records, or operational history.

Liquidity Constraints: Luxury asset ownership traditionally requires substantial capital commitments. Exit strategies are limited. A private jet owner cannot easily liquidate partial ownership or access immediate liquidity.

Research from McKinsey Global Institute shows that 73% of high-net-worth travelers express frustration with traditional booking transparency issues.

Traditional luxury travel booking relies on intermediary-heavy systems that create multiple pain points for high-net-worth travelers:

Opacity in Pricing: Multiple intermediaries add layers of fees that remain hidden until final billing. A $50,000 private jet charter often includes broker fees, handling charges, and administrative costs that aren’t disclosed upfront.

Limited Flexibility: Traditional contracts require complex renegotiation for changes. Cancellations involve lengthy processes through multiple parties, often resulting in significant financial penalties.

Trust Dependencies: Travelers must rely on individual brokers and companies without transparent verification of aircraft quality, safety records, or operational history.

Liquidity Constraints: Luxury asset ownership traditionally requires substantial capital commitments with limited exit strategies. A private jet owner cannot easily liquidate partial ownership or access immediate liquidity.

How Blockchain Technology Solves Luxury Travel Issues

Blockchain luxury travel platforms address these structural inefficiencies through three core mechanisms.

Transparency Through Immutable Records

Smart contracts eliminate hidden fee structures. They program all costs directly into the blockchain. When booking a private jet charter, every component becomes visible and immutable before confirmation:

- Base charter rate

- Fuel surcharges

- Airport handling fees

- Crew expenses

- Insurance costs

- Platform fees

This transparency extends to asset history. Aircraft maintenance records, safety inspections, and operational data become permanently recorded on-chain. This provides travelers with comprehensive verification of aircraft quality and safety standards.

According to PwC’s Blockchain Analysis Report, companies implementing blockchain technology see 67% improvement in transparency metrics.

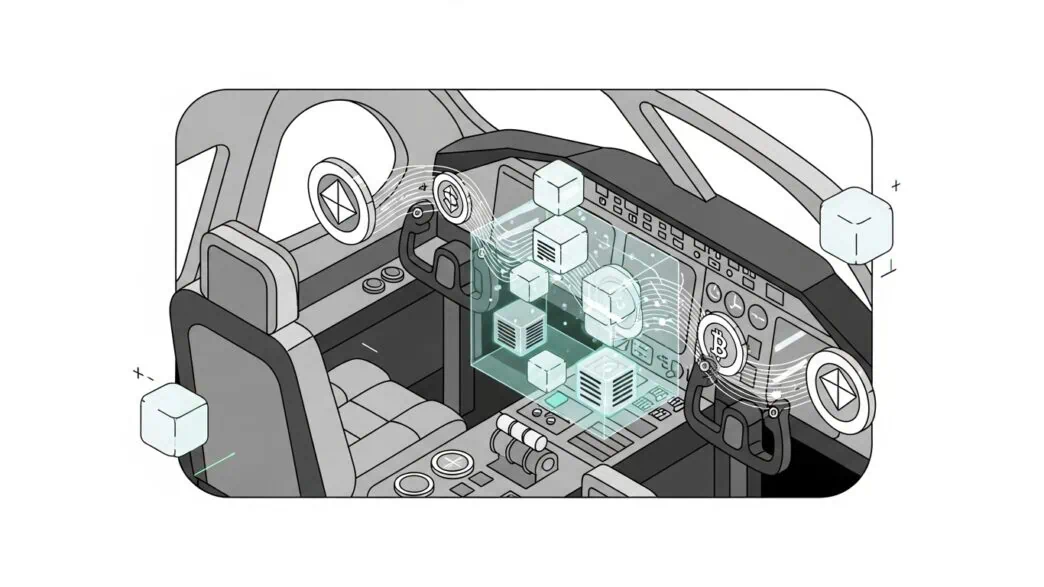

Enhanced Security Through Decentralization

Traditional luxury travel platforms store customer data and payment information on centralized servers. This creates single points of failure vulnerable to data breaches.

Blockchain luxury travel systems distribute this information across decentralized networks. This eliminates central attack vectors.

Customer booking data becomes encrypted and distributed across multiple nodes. Payment processing occurs through smart contracts that execute automatically when predetermined conditions are met. This reduces fraud risk and eliminates the need for customers to share sensitive financial information with multiple intermediaries.

Operational Efficiency Through Automation

Smart contracts automate complex processes that traditionally require manual intervention:

Automatic Payments: Charter fees release automatically upon flight completion verification through GPS and flight tracking data.

Dynamic Pricing: Real-time market conditions adjust pricing automatically based on demand, availability, and external factors like weather or airport congestion.

Instant Refunds: Cancellation policies execute automatically based on predefined parameters. This eliminates lengthy dispute resolution processes.

Real-World Blockchain Applications in Luxury Travel

Private Aviation Revolution

Private jet operators are implementing blockchain luxury travel solutions to address industry-specific challenges:

Aircraft Fractional Ownership: Blockchain enables precise fractional ownership through tokenization. A $50 million Gulfstream G650 can be divided into tokens representing specific ownership percentages. Multiple investors share costs and usage rights through transparent smart contracts.

Empty Leg Distribution: Operators use blockchain to distribute empty leg flights fairly among members. Smart contracts automatically notify qualified members based on route preferences and membership tier. This eliminates favoritism and ensures transparent allocation.

Maintenance Verification: Aircraft maintenance records stored on blockchain provide immutable proof of airworthiness. Travelers can verify maintenance history, inspector certifications, and compliance with aviation regulations before booking.

NetJets recently announced they are exploring blockchain luxury travel solutions for their fractional ownership programs.

Marine Charter Innovation

Superyacht charter operations leverage blockchain for enhanced transparency and efficiency:

Dynamic Availability: Real-time blockchain updates show yacht availability. This eliminates double bookings and provides accurate scheduling information.

Transparent Pricing: All charter costs program into smart contracts before booking confirmation. This includes crew fees, fuel, provisioning, and port charges.

Insurance Claims: Blockchain records provide immutable evidence for insurance claims. This reduces dispute resolution time and ensures fair settlements.

Luxury Accommodation Transformation

High-end hotels and private residences use blockchain luxury travel technology for:

Verified Reviews: Guest reviews stored on blockchain cannot be manipulated or deleted. This provides authentic feedback for future travelers.

Loyalty Programs: Blockchain-based loyalty points transfer between properties and partners. No expiration dates or arbitrary policy changes occur.

Exclusive Access: Smart contracts manage access to exclusive amenities, events, and experiences based on verifiable membership criteria.

According to Hospitality Technology Magazine, 34% of luxury hotel chains are actively testing blockchain solutions.

Tokenization Revolution in Luxury Assets

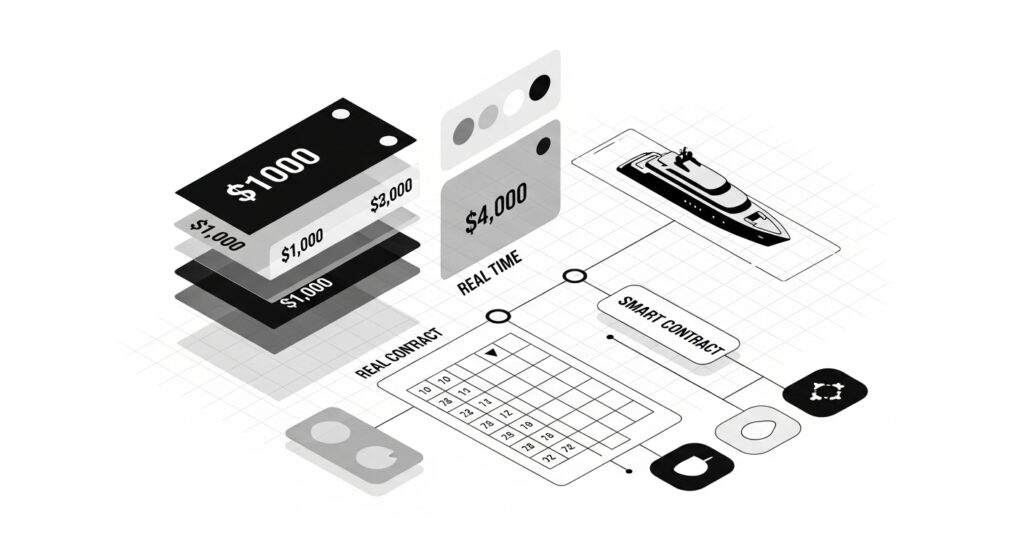

Tokenization represents the most significant blockchain innovation for luxury travel. This process converts real-world assets into digital tokens that represent fractional ownership or usage rights.

How Tokenization Works

Asset Evaluation: Professional appraisers determine the fair market value of luxury assets like private jets, yachts, or exclusive properties.

Token Creation: Smart contracts divide assets into tokens representing specific ownership percentages or usage rights. A $100 million superyacht might become 100,000 tokens at $1,000 each.

Governance Structure: Token holders participate in asset management decisions through decentralized autonomous organizations (DAOs). Voting power corresponds to token ownership percentage.

Revenue Distribution: Charter revenues and appreciation gains are automatically distributed to token holders based on their ownership percentage through smart contracts.

Research from Boston Consulting Group indicates that tokenized asset markets will reach $16 trillion by 2030.

Benefits of Tokenized Luxury Assets

Democratized Access: High-net-worth individuals can access luxury assets without full ownership requirements. Instead of purchasing a $50 million private jet, investors can buy tokens representing partial ownership for significantly lower capital requirements.

Enhanced Liquidity: Tokens trade on secondary markets, providing immediate liquidity that traditional luxury asset ownership lacks. Token holders can exit positions within days rather than months or years required for selling physical assets.

Professional Management: Specialized operators manage day-to-day operations while token holders retain ownership rights. This combines professional expertise with democratic governance.

Global Accessibility: Blockchain enables international investors to participate in luxury asset ownership without geographical restrictions or complex cross-border legal structures.

For practical implementation of these concepts, explore our NFT membership program which demonstrates real-world blockchain luxury travel applications.

Smart Contracts for Travel Excellence

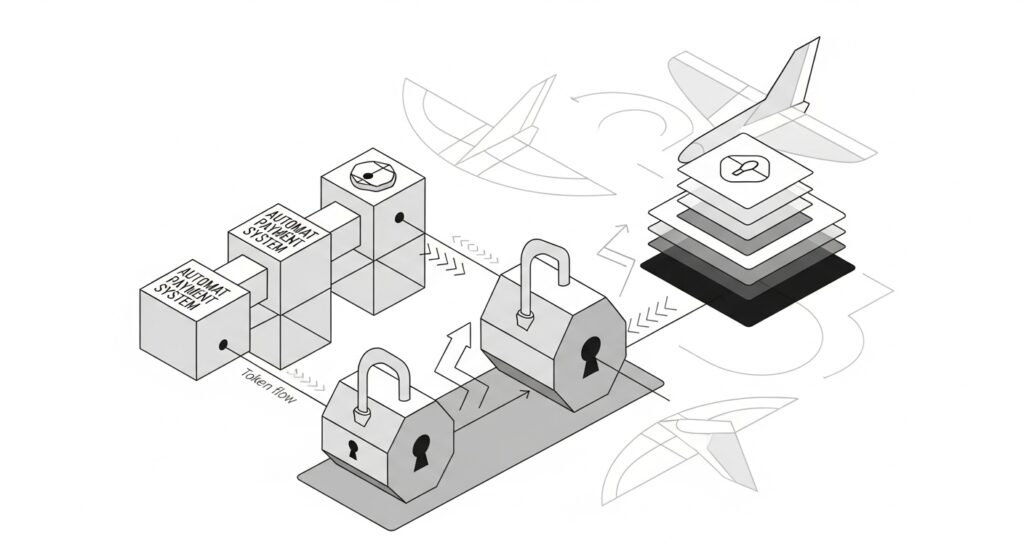

Smart contracts automate complex agreement execution in blockchain luxury travel scenarios:

Automatic Charter Execution

A private jet charter smart contract might include:

IF flight completes on schedule

AND passenger confirms satisfaction

AND no damage occurs to aircraft

THEN release payment to operator

AND distribute loyalty tokens to passenger

AND update aircraft utilization records

Dynamic Pricing Mechanisms

Smart contracts adjust pricing based on multiple variables:

- Real-time demand data

- Weather conditions

- Airport congestion

- Fuel price fluctuations

- Seasonal demand patterns

Escrow Services

Smart contracts hold payments in escrow until service completion. This protects both travelers and service providers. Funds release automatically when predetermined conditions are met. This eliminates disputes over payment timing.

Ready to explore cutting-edge Web3 travel innovations? Browse our comprehensive Web3 content hub covering blockchain technology, tokenization strategies, and digital transformation in luxury transportation.

Investment Opportunities in Blockchain Travel

Platform Investment Categories

Investment opportunities exist across multiple categories:

Early-Stage Platforms: Pre-revenue companies developing blockchain luxury travel solutions.

Growth-Stage Companies: Established platforms with proven traction seeking expansion capital.

Tokenized Assets: Direct investment in tokenized luxury assets through fractional ownership.

Market Size and Projections

The tokenized luxury asset market shows significant growth potential:

- Current market size: $15.4 billion (2024)

- Projected growth rate: 80% year-over-year

- 2030 projection: $240 billion market size

- Adoption rate: Currently 0.03% of total luxury asset market

Goldman Sachs Research projects blockchain luxury travel platforms will capture 15% of the premium travel market by 2030.

Getting Started with Blockchain Travel

Platform Selection Criteria

Choosing the right blockchain luxury travel platform requires evaluation of multiple factors:

Regulatory Compliance: Verify proper licensing and regulatory adherence in relevant jurisdictions.

Security Measures: Review smart contract audits and security protocols.

Asset Quality: Evaluate the quality and maintenance standards of available assets.

Management Team: Assess the experience and track record of platform operators.

Technology Infrastructure: Understand the underlying blockchain technology and scalability.

Initial Investment Approach

New participants should consider a graduated approach:

Education Phase: Understand blockchain fundamentals and platform-specific features.

Small Initial Investment: Start with modest amounts to learn platform mechanics.

Due Diligence: Research specific assets and management teams thoroughly.

Portfolio Building: Gradually increase investments across different asset categories.

For additional insights on Web3 innovation in travel, read our comprehensive tokenization strategies guide.

Conclusion: The Future of Blockchain Luxury Travel

Blockchain luxury travel fundamentally changes how premium transportation operates by introducing transparency, efficiency, and democratized access to exclusive experiences. The shift from intermediary-dependent systems to decentralized, automated platforms benefits both travelers and service providers through reduced costs, enhanced security, and improved operational efficiency.

The tokenization of luxury assets represents a paradigm shift that makes exclusive experiences accessible to a broader range of high-net-worth individuals while providing new liquidity options for asset owners. Smart contracts eliminate many friction points in luxury travel booking and management, creating seamless experiences that rival or exceed traditional service levels.

Early adopters of blockchain luxury travel platforms position themselves advantageously as the technology matures and mainstream adoption accelerates. The combination of proven technology, supportive regulatory frameworks, and growing market demand creates favorable conditions for continued growth and innovation in this sector.

Sources: