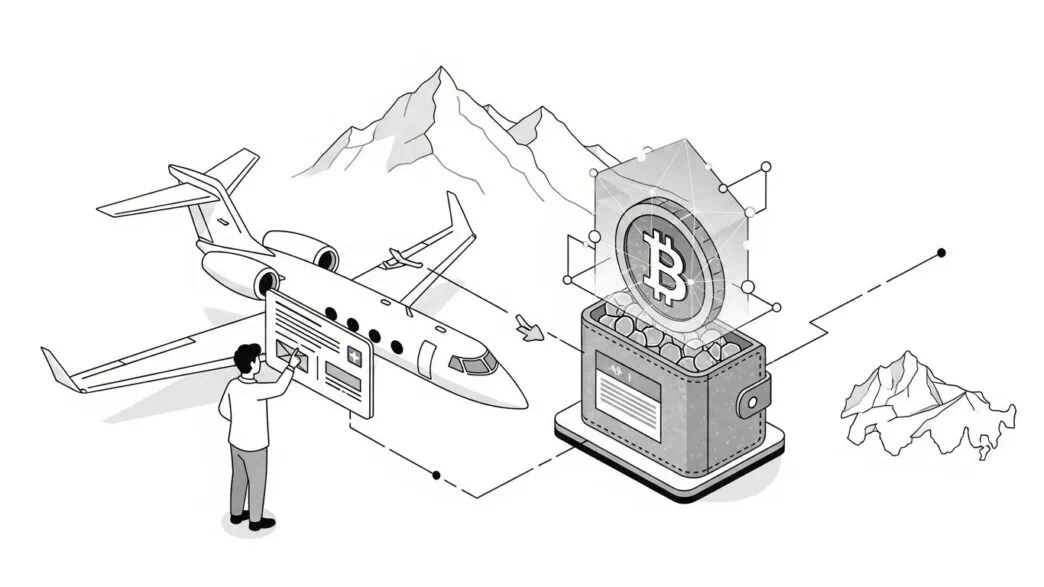

In November 2024, Global Charter completed aviation’s first fully documented Bitcoin-only aircraft transaction—a Gulfstream G200 sold for $5.7 million without third-party exchanges. This milestone proves you can buy private jet with Bitcoin entirely in cryptocurrency, but the process requires infrastructure most buyers lack.

Whether you want to buy private jet with Bitcoin for charter flights starting at $6,000/hour, or purchase aircraft ownership ($5M-$70M range) using cryptocurrency, this guide provides the legal framework, tax implications, and blockchain-secured protocols you need for 2025.

Charter vs. Ownership: How to Buy Private Jet with Bitcoin

When you buy private jet with Bitcoin, two fundamentally different transaction types exist—each with distinct costs, timelines, and regulatory requirements.

Charter Services: Buy Private Jet with Bitcoin by the Hour

To charter private jets using cryptocurrency means paying for temporary aircraft access. Charter costs range $6,000-$20,000+ per flight hour depending on aircraft category. Modern payment infrastructure enables seamless cryptocurrency transactions settling within minutes.

Payment Processing for Cryptocurrency Charter

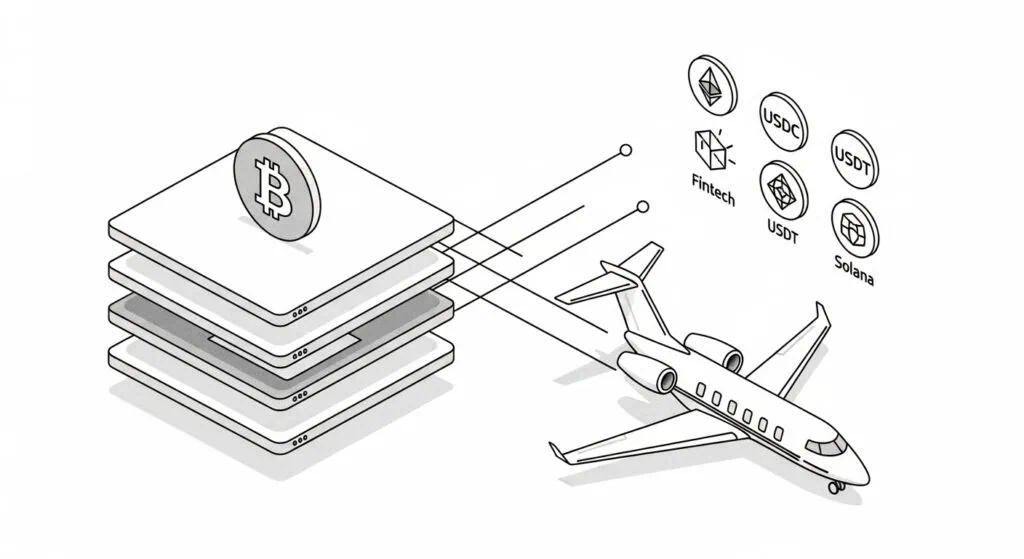

When you buy private jet with Bitcoin charter through modern operators, cryptocurrency payment gateways process 70+ digital currencies including:

Major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH)

Stablecoins: USDC, USDT, DAI, BUSD (optimal for price stability in aviation transactions)

Alternative coins: Solana (SOL), Cardano (ADA), Polkadot (DOT), plus 60+ others

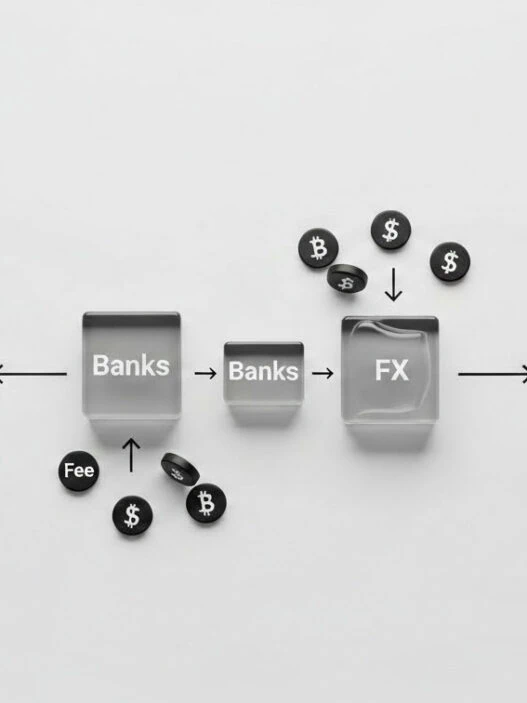

Cost advantage using cryptocurrency charter:

- Cryptocurrency processing: 1.0% merchant fee + 1.8% customer fee = 2.8% total cost

- Traditional fiat payments: 3.6% average credit card processing fees

- Savings: 22% lower transaction costs using crypto vs traditional payments

For customers who charter regularly with cryptocurrency, this represents significant savings. A $50,000 charter flight costs $1,400 in crypto fees versus $1,800 in traditional credit card fees—a $400 savings per transaction.

Leading Operators Accepting Cryptocurrency

PrivateCharterX -First web3-based charter company where you can buy private jet with Bitcoin using 70+ cryptocurrencies via integrated payment gateway. Blockchain escrow services available for high-value bookings.

JetFinder – Toronto-based broker accepting BTC, ETH, SOL, USDT, USDC. Transaction confirmation time: 10 minutes after blockchain verification.

Mercury Jets – Transparent cryptocurrency pricing: 0.035-0.18 BTC per flight hour depending on aircraft type and route.

Global Charter – Pioneered the first Bitcoin-only jet sale. Now accepts 15+ cryptocurrencies including Bitcoin, Ethereum, Solana, and major stablecoins.

Haute Jets – Charges minimal 1% transaction fee for cryptocurrency payments. Features real-time exchange rate conversion for price stability.

Stratos Jets – BitPay partnership accepting 99 different cryptocurrencies. ARGUS Certified for safety standards.

PrivateFly – Industry pioneer (first global operator to accept Bitcoin, January 2014). Secure BitPay processor integration.

LunaJets – European specialist. Successfully processed weekend emergency charter at 2 AM Saturday when traditional banks were closed—demonstrating cryptocurrency payment advantages.

When chartering through these operators using cryptocurrency, payment processing completes within 10-30 minutes after blockchain confirmation, significantly faster than traditional wire transfers requiring 1-3 business days.

Aircraft Ownership: Buy Private Jet with Bitcoin for Full Acquisition

To purchase aircraft using cryptocurrency means acquiring assets valued $5M-$70M through digital currency. Aircraft ownership transactions require 60-120 day closing periods including mandatory pre-purchase inspection ($15K-$150K depending on aircraft class), comprehensive title search, and FAA registration transfer.

Recent documented examples where buyers successfully completed cryptocurrency aircraft purchases:

Global Charter Gulfstream G200 – $5.7M Bitcoin-only sale (November 2024) completed without third-party exchanges or fiat conversion. Three-month transaction timeline from initial offer to delivery. Buyer and seller transacted directly via Bitcoin wallets with professional escrow coordination.

Aviatrade Inc. – New Jersey-based broker offering Gulfstream G650ER ($40M listing) since September 2020. Current inventory includes 13+ aircraft available for cryptocurrency purchase including Bombardier Global 7500s.

Kaizen Aerospace – Chairman Fabrizio Poli publicly announced in June 2020 that buyers can purchase aircraft using cryptocurrency for comprehensive aviation services including sales, leasing, and management.

Critical distinction: Charter using cryptocurrency triggers straightforward capital gains on digital asset disposal. Ownership involves crypto disposal taxes plus complex aircraft depreciation schedules requiring specialized CPA guidance.

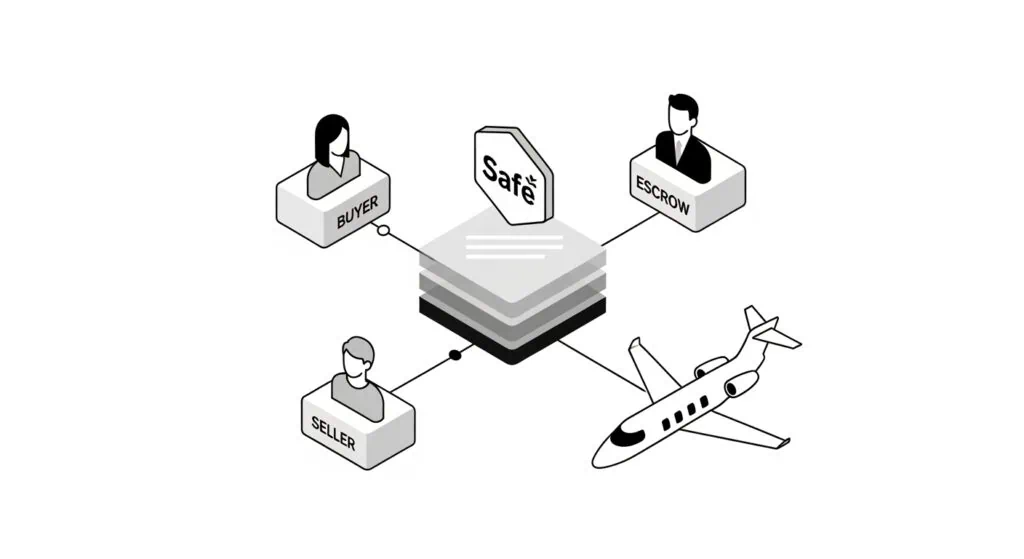

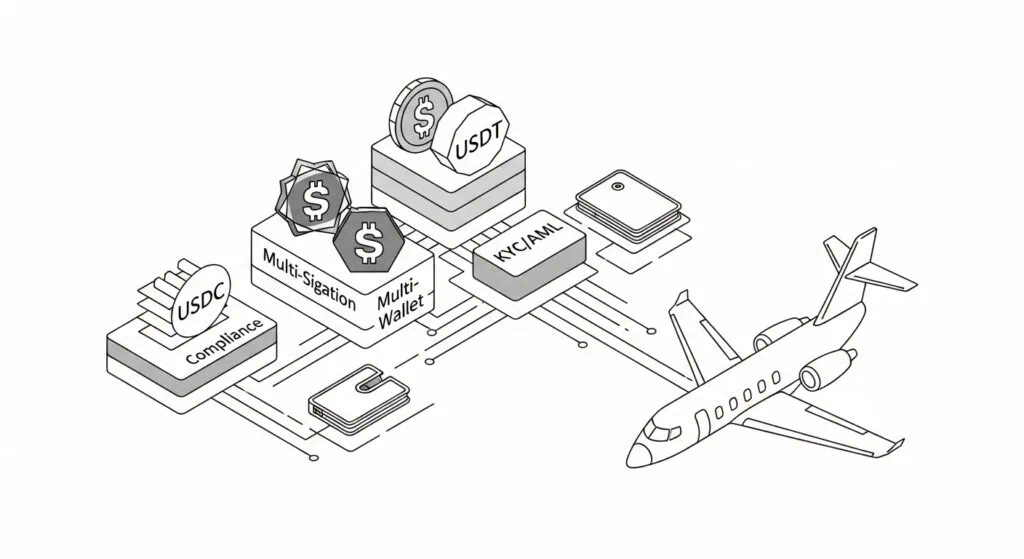

Blockchain Escrow: Multi-Signature Security When You Buy Private Jet with Bitcoin

When purchasing aircraft with cryptocurrency exceeding $1M, blockchain-based escrow services using multi-signature smart contracts provide superior security compared to traditional escrow. Never complete high-value cryptocurrency aircraft transactions without professional escrow—the risks far exceed the costs.

Why Multi-Sig Escrow is Critical for Cryptocurrency Aviation Transactions

Volatility protection: Bitcoin price experienced 20%+ monthly swings multiple times during 2023-2024. When buying aircraft for $10M during typical 90-day closing periods, unprotected cryptocurrency could swing $2M+ in value—creating disputes about who bears losses.

Blockchain escrow services solve this by converting crypto to USD-pegged stablecoins immediately upon receipt, freezing value until closing conditions satisfied.

Fraud prevention: Direct peer-to-peer cryptocurrency transactions expose both parties. Buyer risks sending digital currency before receiving valid aircraft title. Seller risks transferring aircraft before confirming irreversible blockchain payment. Both parties lack recourse if counterparty acts dishonestly—blockchain transactions cannot be reversed like credit cards.

Multi-signature smart contracts eliminate single points of failure. Through multi-sig escrow, funds release only when M-of-N parties authorize (example: 2-of-3 signatures from buyer, seller, and escrow agent).

Dispute resolution: Smart contract escrow acts as neutral arbitrator. When pre-purchase inspection reveals undisclosed airworthiness issues, escrow holds cryptocurrency pending resolution. If closing conditions aren’t met, escrow returns digital assets (minus fees) without protracted legal battles.

Multi-Sig Smart Contract Technology

Modern blockchain escrow leverages Safe (formerly Gnosis Safe) protocol multi-signature wallet technology. Technical architecture:

M-of-N signature requirement: Escrow wallet configured to require M signatures from N authorized parties before funds transfer. Standard configuration: 2-of-3 (buyer, seller, escrow agent). High-value transactions: 3-of-5 (adding aviation attorney, CPA).

On-chain transparency: All parties verify transaction status in real-time via blockchain explorer. Complete audit trail shows: Initial cryptocurrency deposit timestamp, conversion to stablecoin (if elected), hold period duration, signature authorizations, final fund release.

Automated settlement: Smart contracts execute transfers automatically upon condition satisfaction. When all parties digitally sign release authorization, funds transfer within minutes—no manual processing delays.

Security advantages over traditional escrow:

- Eliminates bank account hacking risk (funds secured by cryptographic keys, not passwords)

- Prevents unauthorized access (requires multiple signatures, not single escrow officer)

- Provides immutable audit trail (blockchain records cannot be altered retroactively)

- Enables 24/7 global settlement (no business hours limitations)

Blockchain Escrow Fee Structure

Simple Escrow Service: 1.5% of transaction value for basic multi-party security. Includes: Multi-sig smart contract setup, cryptocurrency-to-stablecoin conversion (if elected), secure fund holding during inspection period, automated settlement upon condition satisfaction.

Comprehensive Escrow with Valuation: 2.5% of transaction value including professional asset appraisal services. Additional services: Independent third-party aircraft valuation, market comparables analysis, negotiation support based on inspection findings, price adjustment recommendations.

Cost comparison for cryptocurrency transactions:

| Service Type | Blockchain Escrow | Traditional Escrow |

|---|---|---|

| Simple Escrow | 1.5% | 0.89-1.5% |

| With Valuation | 2.5% | 2.0-3.0% |

| Security Model | Multi-sig smart contract | Bank account + officer |

| Transparency | On-chain audit trail | Private records |

| Settlement Speed | Minutes (automated) | 1-3 days (manual) |

| Global Availability | 24/7 | Business hours only |

On $10M cryptocurrency transaction:

- Simple blockchain escrow: $150,000 (1.5%)

- Comprehensive with valuation: $250,000 (2.5%)

Premium justified by superior security, transparency, and settlement speed compared to traditional escrow services.

Stablecoin Conversion Strategy

Immediate conversion to stablecoins protects both parties from volatility:

Upon cryptocurrency deposit: Escrow smart contract automatically swaps Bitcoin/Ethereum to USDC or USDT stablecoin within minutes. Conversion executed via decentralized exchange (DEX) protocols ensuring optimal exchange rates.

During holding period: Stablecoin value remains pegged to $1.00 USD throughout 60-120 day closing period. Both parties protected from cryptocurrency price swings during pre-purchase inspection and negotiation phases.

At closing: If transaction completes successfully, stablecoin converts to fiat currency via payment processor, wire transfers to seller’s bank account. If transaction terminates, stablecoin converts back to buyer’s original cryptocurrency, returns to buyer’s wallet minus escrow fees.

Tax optimization consideration: Delaying cryptocurrency-to-stablecoin conversion until closing week may defer capital gains recognition to following tax year. Consult cryptocurrency-knowledgeable CPA regarding optimal conversion timing for your specific situation.

Alternative Licensed Escrow Services

While blockchain-based multi-sig escrow offers superior security, traditional licensed escrow services remain available for cryptocurrency transactions:

Guaranty Escrow – Only licensed escrow company approved by BitGo institutional custody (processes 20% of global Bitcoin transaction volume). Licensed in all 50 US states. Documented transaction: $3.55M crypto escrow successfully completed. Fee structure: 1.5-2.0% of transaction value.

Propy Crypto Escrow – Coinbase Prime institutional integration. Funds secured by Coinbase custody ($25B+ crypto assets under management). Unique advantage: Delays crypto-to-fiat conversion until final transaction stages.

Recommendation: For transactions exceeding $5M, blockchain-based multi-sig escrow provides optimal security through elimination of single points of failure and on-chain transparency.

Tax Implications When You Buy Private Jet with Bitcoin

The IRS treats cryptocurrency as property, not currency—a classification with profound tax implications. Using cryptocurrency for aviation purchases triggers taxable events requiring careful documentation. This section provides factual IRS guidance as of 2025. This is not tax advice—consult qualified CPA before making cryptocurrency aviation purchases.

Capital Gains Tax: Charter Services

Using digital currency for charter constitutes disposal of digital assets. Capital gains are calculated as follows:

Formula: Fair market value (USD paid for charter) minus cost basis (original cryptocurrency purchase price) equals capital gain.

Tax rates for cryptocurrency charter:

- Held less than 1 year: Short-term gains taxed 10-37% (ordinary income rates)

- Held more than 1 year: Long-term gains taxed 0-20% (preferential capital gains rates)

Example scenario: Charter cost $20,000 paid in Bitcoin. Your Bitcoin cost basis was $8,000 (original purchase price). Capital gain equals $12,000. If held more than 1 year, tax at 15% rate (most taxpayers) equals $1,800 tax liability. IRS Form 8949 reports this disposition.

Stablecoin advantage: Using USDC or USDT stablecoins for charter payments typically generates minimal or zero capital gain. If purchased stablecoin at $1.00 and used at $1.00, no gain realized. Simplifies tax reporting significantly compared to volatile cryptocurrencies.

Dual Tax Events: Aircraft Ownership

When purchasing aircraft using cryptocurrency, two separate taxable events occur simultaneously:

Event 1: Cryptocurrency Disposal

To purchase aircraft for $10M using Bitcoin, capital gain calculation works identically to charter. If your BTC cost basis was $3M (original purchase price), capital gain equals $7M. Tax liability: $1.4M at 20% long-term rate, or $2.59M at 37% short-term rate—a $1.19M difference based solely on holding period.

IRS Form 8949 and Schedule D report crypto disposal.

Strategic tax planning: If cryptocurrency held less than 1 year, consider delaying purchase until long-term holding period satisfied. Saving $1.19M in taxes (difference between short-term 37% and long-term 20% rates on $7M gain) far exceeds any aircraft price appreciation during waiting period.

Event 2: Aircraft Depreciation

If business use exceeds 50% of total flight hours, you qualify for bonus depreciation under IRS regulations. Current 2025 rates: 40% first-year write-off (declining to 20% in 2026, expiring completely 2027).

Example calculation: After aircraft purchase for $10M using cryptocurrency with documented 75% business use:

- Qualified basis: $10M × 75% = $7.5M

- First-year bonus depreciation: $7.5M × 40% = $3M tax deduction

- Regular MACRS depreciation applies to remaining basis over subsequent years

Form 4562 claims depreciation deductions. Maintain meticulous flight logs documenting business versus personal use—IRS audits scrutinize this heavily when large deductions claimed.

Combined tax impact for cryptocurrency aircraft purchase:

Assuming 37% marginal tax rate, $7M crypto capital gain (short-term), and $3M first-year depreciation:

- Crypto disposal tax liability: $7M × 37% = $2.59M tax owed

- Depreciation tax benefit: $3M × 37% = $1.11M tax saved

- Net first-year tax impact: $1.48M tax liability

Subsequent years benefit from ongoing depreciation deductions without additional crypto disposal taxes.

New 2025 IRS Reporting Requirements

Form 1099-DA (effective January 1, 2025) mandates brokers report cryptocurrency transactions. Custodial digital asset trading platforms, hosted wallet providers, and payment processors must report gross proceeds from cryptocurrency disposals.

When purchasing aviation services through operators using payment processors, expect 1099-DA forms documenting your transactions. IRS enforcement has intensified dramatically—non-compliance carries penalties from 20% (negligence) to 75% (fraud) of tax underpayment, plus potential criminal prosecution.

What gets reported on Form 1099-DA:

- Gross proceeds: Total USD value of cryptocurrency disposed

- Date of transaction: When blockchain confirmation occurred

- Cryptocurrency type: BTC, ETH, USDC, etc.

- Quantity transacted: Amount of crypto disposed

- Broker/exchange information: Payment processor details

What does NOT get reported: Cost basis (original purchase price) reporting required starting January 1, 2026 for new cryptocurrency acquisitions. Transactions before 2026 require self-calculated basis.

Professional recommendation: Engage cryptocurrency-knowledgeable CPA before making aviation purchases, not after. Proactive tax planning can legally minimize liability through optimal holding periods, entity structuring, and depreciation strategies. Post-transaction planning offers significantly fewer options.

State Sales Tax Considerations

Beyond federal income tax, most states impose sales tax on aircraft purchases:

State sales tax rates (2025):

- California: 7.25% base rate = $725,000 on $10M aircraft

- New York: 4.0% = $400,000 on $10M aircraft

- Florida: 6.0% = $600,000 on $10M aircraft

- Texas: 6.25% = $625,000 on $10M aircraft

- Montana: 0% (no sales tax) = $0 on $10M aircraft

Sales tax avoidance strategies for cryptocurrency purchases:

- Register aircraft in no-sales-tax states (Montana, Delaware, New Hampshire)

- Utilize “fly-away” exemptions (immediate departure from purchase state)

- Lease structures instead of direct purchase (lease payments may avoid sales tax)

- Form aircraft holding LLC in favorable jurisdiction

Consult aviation tax specialist before cryptocurrency aircraft purchase—sales tax mitigation strategies require careful structuring but can save $400K-$700K+ on typical $10M purchase.

Regulatory Compliance When You Buy Private Jet with Bitcoin

FinCEN classifies cryptocurrency businesses as Money Services Businesses (MSBs). When aircraft brokers enable cryptocurrency transactions, they must implement comprehensive Anti-Money Laundering and Know Your Customer programs. Understanding compliance requirements prevents transaction delays and legal complications.

Know Your Customer (KYC) Protocols

When using cryptocurrency for aviation transactions, expect identity verification requests from brokers and payment processors. KYC requirements include:

Basic verification: Government-issued photo ID (passport, driver’s license). Address confirmation (utility bill, bank statement within 90 days). Date of birth and Social Security Number (US residents) or Tax Identification Number (international).

Sanctions screening: All parties checked against OFAC Specially Designated Nationals lists. Transactions with sanctioned individuals/entities prohibited under federal law. Violations carry civil penalties $250,000+ per transaction and potential criminal prosecution.

Enhanced Due Diligence (EDD): For high-value cryptocurrency transactions exceeding $1M, brokers may request digital asset source documentation. Blockchain analytics services like Chainalysis, Elliptic, TRM Labs verify wallet addresses aren’t linked to:

- Sanctioned entities or high-risk jurisdictions

- Dark web marketplaces or illicit activities

- Mixing/tumbling services (cryptocurrency anonymization tools)

- Known ransomware or hacking incidents

Beneficial ownership identification: If buying through corporate entity (LLC, corporation), brokers require documentation identifying ultimate beneficial owners controlling 25%+ equity.

Suspicious Activity Reporting (SAR)

If brokers detect red flags in cryptocurrency transactions, they must file Suspicious Activity Reports with FinCEN within 30 days:

Red flag indicators triggering SAR requirements:

- Cryptocurrency recently passed through mixing/tumbling services

- Funds originating from sanctioned jurisdictions (Iran, North Korea, Syria, Russian-occupied regions)

- Buyer unwilling to provide identity documentation despite legal requirements

- Attempts to structure payments below $10K reporting thresholds (structuring itself is federal crime)

- Unusual urgency completing transaction without proper due diligence

- Inconsistency between buyer’s stated income/business and transaction size

- Multiple small transactions instead of single large transaction (potential structuring)

Penalties for SAR violations: Civil penalties up to $250,000 per violation. Criminal prosecution possible for willful violations (up to 5 years imprisonment). Banking license revocation for chronic non-compliance.

Currency Transaction Reports (CTR)

While cryptocurrency technically isn’t “currency” under Bank Secrecy Act, CTR filing may be required when:

Transaction involves cash equivalent exceeding $10,000 in single day or related transactions. Some payment processors treat cryptocurrency-to-fiat conversions as cash equivalents requiring CTR filing.

What CTR reports for cryptocurrency transactions:

- Personal identifying information (name, address, SSN)

- Transaction date and amount (USD value)

- Account information if applicable

- Payment method and recipient details

CTRs are informational, not necessarily indicating suspicious activity. However, structuring transactions to avoid CTR filing (multiple $9,500 transactions instead of single $30,000 transaction) constitutes federal crime punishable by 5+ years imprisonment.

Travel Rule Compliance (International Transactions)

FATF Recommendation 16 requires Virtual Asset Service Providers share sender/recipient information for cryptocurrency transfers exceeding approximately $1,000 (€1,000/USD equivalent).

For international cryptocurrency aviation transactions (buyer and seller in different countries), Travel Rule compliance mandates transmission of:

- Sender full name and cryptocurrency wallet address

- Recipient full name and cryptocurrency wallet address

- Transaction amount and timestamp

- Purpose of transfer (aircraft purchase, charter payment)

Cross-border complexity: US buyer purchasing from European seller using Bitcoin faces multiple regulatory frameworks:

United States: FinCEN AML/KYC applies to any US-based payment processor or cryptocurrency exchange. MSB registration required for businesses facilitating crypto-to-fiat conversions. State money transmitter licenses may apply (varies by state).

Europe: MiCA (Markets in Crypto-Assets) regulation requires EU-based exchanges, custodians, and service providers obtain authorization. Comprehensive disclosure requirements and consumer protection mandates.

Both jurisdictions: FATF Travel Rule for cross-border crypto transfers. Dual reporting requirements (US Form 1099-DA plus EU equivalent). Tax treaties may provide relief from double taxation.

Switzerland: FINMA crypto regulations classify Virtual Asset Service Providers as financial intermediaries requiring AML compliance. Switzerland’s favorable regulatory framework makes it attractive jurisdiction for cryptocurrency aviation transactions.

Compliance Best Practices for Cryptocurrency Aviation Transactions

1. Work with regulated entities

Choose aircraft brokers with documented cryptocurrency transaction histories and regulatory compliance infrastructure. Operators like PrivateCharterX with integrated payment gateway have established AML/KYC protocols.

2. Maintain comprehensive documentation

Save everything for 7+ years minimum:

- Exchange purchase confirmations showing original cryptocurrency acquisition

- Complete blockchain transaction IDs (TXIDs) for audit trail

- Email correspondence with broker, seller, escrow agent

- Pre-purchase inspection reports and discrepancy lists

- Aircraft title documentation and FAA registration

- Purchase agreement and executed bill of sale

- Insurance binders and active policies

- All records retained 7+ years for IRS audit protection

3. Prepare for Enhanced Due Diligence

Expect identity verification for cryptocurrency transactions. Be prepared to explain digital asset source if amounts exceed $1M. Professional relationships (attorney, CPA) enhance credibility. Corporate entity documentation if buying through LLC/corporation (operating agreements, formation documents, tax returns).

4. Avoid compliance red flags

Do NOT for cryptocurrency aviation transactions:

- Use mixing/tumbling services (CoinJoin, Tornado Cash, Wasabi Wallet)

- Structure payments to avoid $10K reporting thresholds

- Rush transactions without proper due diligence periods

- Resist reasonable KYC requests from licensed brokers

- Transact with parties in sanctioned jurisdictions

- Provide false or misleading information on documentation

5. Engage professional advisors

Aviation attorney with aircraft transaction specialty. Cryptocurrency-knowledgeable CPA familiar with IRS digital asset reporting. Compliance consultant if cryptocurrency transaction exceeds $10M (ensures full regulatory adherence across jurisdictions).

US cryptocurrency regulations require businesses accepting crypto to register as MSBs, implement AML programs, file SARs and CTRs, and conduct ongoing transaction monitoring. Verify broker’s regulatory compliance to protect yourself from enforcement actions.

Pre-Purchase Inspection When You Buy Private Jet with Bitcoin

Never purchase aircraft using cryptocurrency without comprehensive third-party inspection. PPIs are mandatory for aviation lenders financing purchases and insurance underwriters providing hull coverage. Skipping inspection to complete cryptocurrency transaction faster frequently costs $50K-$500K+ in unexpected post-purchase repairs.

Inspection Costs by Aircraft Category

Budget appropriately for inspection based on aircraft class:

| Aircraft Class | Inspection Duration | Cost Range | Focus Areas |

|---|---|---|---|

| Light Jets (Citation Mustang, Phenom 100) | 5-7 business days | $15,000-$25,000 | Basic airframe integrity, engine compression, avionics functionality |

| Midsize Jets (Citation XLS, Hawker 800) | 7-10 business days | $25,000-$40,000 | Corrosion detection, engine borescope, logbook compliance audits |

| Super Midsize (Challenger 350, Citation Sovereign) | 10-14 business days | $40,000-$60,000 | Pressurization cycle cracks, structural fatigue, comprehensive systems testing |

| Heavy Jets (Challenger 650, Falcon 900, Gulfstream G450) | 14-21 business days | $60,000-$100,000 | Full Phase 1-4 inspections covering all aircraft sections |

| Ultra-Long-Range (Gulfstream G650, Global 7500, Falcon 8X) | 21+ business days | $100,000-$150,000+ | Complete teardown, detailed systems analysis, forensic records audit |

Critical Inspection Components

Airframe structural integrity: Inspectors examine for structural cracks, corrosion (especially in belly skin, stringers, tail section where moisture accumulates), pressurization cycle-induced fatigue, and damage history verification. Hidden corrosion discovered post-purchase can cost $100,000+ to remediate, making thorough inspection essential for cryptocurrency transactions.

Engine assessment: Borescope inspection is non-negotiable—a single bad engine start can destroy turbine blades ($500K-$2M+ repair). Comprehensive engine checks include:

- Cylinder compression across all cylinders

- Oil analysis for metal contamination indicating internal wear

- Time to overhaul (TBO) remaining on engines and auxiliary power unit

- Hot section inspection status and cost to next required maintenance

- Power assurance run verifying thrust output meets specifications

Avionics and systems: Modern business aircraft contain $1M-$5M+ in avionics. Verify:

- Flight instruments functionality and software currency

- GPS/FMS navigation systems (software versions, database subscriptions)

- Communication radios meeting current regulatory requirements

- Autopilot certification status and operational testing

- Emergency systems (oxygen, fire suppression) serviceability

- Environmental controls (pressurization, air conditioning) functionality

Logbook and records forensic audit: Complete maintenance history without gaps. Airworthiness Directive (AD) compliance verification (federal mandates requiring specific inspections/modifications). Service Bulletin (SB) incorporation status (manufacturer recommendations). Major modification/alteration documentation with proper FAA approval. Previous ownership chain establishing clear title.

Test flight (if negotiated): Some sellers permit test flights for cryptocurrency purchases. Verifies:

- All systems operation under actual flight conditions

- Performance verification against manufacturer specifications (cruise speed, fuel consumption, climb rates)

- Autopilot engagement and functionality throughout flight envelope

- Pressurization system effectiveness at altitude

- Handling characteristics and control responsiveness

Inspection Outcomes and Negotiation

Detailed discrepancy list categorizes findings:

Airworthiness-limiting defects: Must be corrected for legal flight. Federal aviation regulations prohibit operation with outstanding airworthiness defects. Standard practice: Seller corrects at their expense before closing, or price reduced by repair cost plus reasonable margin (typically 10-20% markup).

Non-airworthiness discrepancies: Cosmetic issues, optional upgrades, preventive maintenance approaching due dates. Negotiation basis for price adjustments. Buyer and seller negotiate who pays or whether price reduced.

Common undisclosed issues discovered in PPIs:

- Undocumented damage history (previous accidents, hard landings not disclosed)

- Non-compliant repairs using inappropriate hardware (hardware-store bolts instead of aviation-grade fasteners)

- Corrosion in hidden areas (wheel wells, belly skin underneath insulation)

- Incomplete Airworthiness Directive compliance (federal mandates not addressed)

- Engine condition requiring immediate expensive overhaul ($500K-$2M cost)

- Avionics software obsolescence requiring $50K-$200K+ upgrades for regulatory compliance

Cost of skipping PPI: Industry data shows buyers frequently face $50,000-$500,000+ unexpected post-purchase repairs. Aviation experts universally advise never purchase aircraft without thorough third-party inspection performed at neutral facility (not seller’s maintenance shop).

Cryptocurrency payment enables faster closing timelines (minutes vs. days for wire transfers), but inspection requirements remain unchanged. Never sacrifice due diligence for transaction speed—consequences far exceed time savings.

Risk Mitigation When You Buy Private Jet with Bitcoin

When purchasing aviation services using cryptocurrency, multiple unique risks require proactive mitigation strategies beyond traditional aircraft purchases.

Volatility Risk Management

The problem: Bitcoin price experienced dramatic swings—$69,000 (November 2021) to $16,000 (November 2022) to $100,000+ (December 2024). For aircraft purchase at $10M during typical 90-day closing periods, unprotected cryptocurrency value could swing $2M+ creating disputes about loss allocation.

Mitigation strategies:

1. Stablecoin payment: Use USDC/USDT instead of BTC/ETH (completely eliminates volatility risk—pegged to $1.00 USD). Modern payment gateways support instant stablecoin-to-fiat conversion with minimal fees.

2. Immediate escrow conversion: Blockchain escrow service converts cryptocurrency to stablecoin (USDC/USDT) within minutes of receipt. Both parties protected from volatility during entire 60-120 day closing period.

3. Price lock agreements: Purchase agreement specifies USD amount as primary price, cryptocurrency amount adjusts to current exchange rate at closing. Protects both parties from market swings during negotiation phase.

4. Futures hedging: Advanced strategy for sophisticated buyers—purchase Bitcoin futures contracts to hedge against price decline during closing period. Requires commodity trading account and derivatives expertise.

5. Compressed timeline: Negotiate 30-45 day closing instead of standard 60-90 days (reduces volatility exposure window by 50%). Possible only with expedited PPI and seller cooperation.

Counterparty Fraud Protection

The problem: Direct peer-to-peer cryptocurrency transactions expose both parties. Buyer risks sending digital currency before receiving valid aircraft title and delivery. Seller risks transferring aircraft before confirming irreversible blockchain payment receipt. Neither party has recourse after transfer—blockchain transactions cannot be reversed like credit cards or wire transfers.

Mitigation strategies:

1. Blockchain escrow mandatory: For all transactions exceeding $1M. Multi-signature smart contracts eliminate single points of failure requiring M-of-N parties (typically 2-of-3) authorize fund release.

2. Established operators only: Work exclusively with brokers having documented cryptocurrency transaction histories—Global Charter ($5.7M Bitcoin-only sale), Aviatrade (13+ aircraft), PrivateCharterX (70+ cryptocurrency integration) have proven track records.

3. Comprehensive PPI required: Independent third-party inspection at neutral maintenance facility discovers hidden defects before funds released. Never skip inspection regardless of seller reputation.

4. Title insurance purchase: Protects against undiscovered liens, ownership disputes, forged documentation. Premium $2K-$10K provides coverage exceeding $10M+ losses.

5. Aviation attorney review: Specialized attorney reviews all contracts, conducts due diligence, protects interests before signing. Cost $10K-$50K prevents $100K-$1M+ losses from contract deficiencies.

Regulatory Compliance Risk

The problem: Rapidly evolving cryptocurrency regulations could impact transaction legality, tax treatment, or enforcement. Non-compliance carries severe penalties including civil fines ($250K+ per violation), criminal prosecution (5+ years imprisonment), asset seizure.

Mitigation strategies:

1. Proactive compliance: Follow all AML/KYC requirements even if perceived as burdensome. Cooperate fully with identity verification, source-of-funds documentation, sanctions screening.

2. Comprehensive documentation: Maintain complete transaction records for 7+ years minimum (exceeds IRS audit statute of limitations):

- Exchange purchase confirmations showing original crypto acquisition

- Complete blockchain transaction IDs (TXIDs)

- All email correspondence with broker, seller, escrow

- PPI reports and discrepancy lists

- Purchase agreements and bills of sale

- Title documentation and FAA registration

- Insurance policies and premium payments

- Tax returns reporting crypto disposal and depreciation deductions

3. Professional guidance: Engage cryptocurrency-knowledgeable CPA and aviation attorney BEFORE initiating transaction. Proactive planning legally minimizes tax liability and ensures regulatory compliance.

4. Avoid gray areas: Never use mixing/tumbling services (CoinJoin, Tornado Cash). Never structure payments to avoid reporting thresholds. Never transact with parties in sanctioned jurisdictions. Never provide false documentation.

5. Stay informed: Subscribe to IRS digital assets guidance updates. Monitor FinCEN cryptocurrency enforcement actions. Follow SEC crypto regulation developments. Regulatory landscape evolves rapidly—continuous education essential.

Technical Transaction Risk

The problem: Blockchain transactions are irreversible. Sending cryptocurrency to wrong address results in permanent, unrecoverable loss. No “cancel transaction” or “chargeback” options exist unlike credit cards or wire transfers.

Mitigation strategies:

1. Test transactions: Before sending full amount, send small test transaction ($100-$500) to verify address accuracy. Confirm receipt before transferring remaining funds.

2. Address verification: Triple-check cryptocurrency address character-by-character. Copy-paste from secure source, never manually type. Verify first 6 and last 6 characters minimum before sending funds.

3. Whitelist addresses: If your cryptocurrency exchange/wallet supports address whitelisting, add escrow/broker addresses 24 hours before transaction (many exchanges enforce 24-hour security delay for new addresses).

4. Hardware wallet security: Store cryptocurrency exceeding $100K on hardware wallet (Ledger, Trezor) rather than exchange-hosted wallet. Multi-factor authentication mandatory for all accounts.

5. Escrow reduces risk: Licensed escrow service provides secure intermediary. Even if transaction goes wrong, escrow holds funds pending dispute resolution rather than irreversible direct transfer.

Future of Aviation & Cryptocurrency Integration

When using cryptocurrency for aviation today, you participate in the industry’s digital transformation. Emerging technologies promise to further streamline transactions, reduce costs, and expand access.

Tokenization: Fractional Aircraft Ownership

Blockchain tokenization enables fractional ownership. Technologies like ERC-3643 T-REX standard and institutional platforms create regulated security tokens representing aircraft ownership shares:

How tokenization works:

$10M aircraft divided into 10,000 tokens ($1,000 per token). Investors purchase tokens representing fractional ownership (100 tokens = 1% ownership = $100K investment). Blockchain records ownership, automates dividend distributions from charter revenue, enables secondary market trading.

Regulatory compliance built-in:

- Automated investor accreditation verification (KYC/AML at token purchase)

- Transfer restrictions enforcing securities regulations (lockup periods, jurisdiction limits)

- Real-time regulatory reporting to authorities

- Permissioned framework preventing non-compliant transfers

Benefits of tokenized fractional ownership:

- Lower capital requirement ($10K-$100K vs $10M full ownership)

- Automated revenue distribution (smart contracts pay charter income proportionally)

- Liquidity via secondary markets (sell tokens without selling entire aircraft)

- Diversification (own fractions of multiple aircraft vs single plane)

Challenges: Regulatory uncertainty around security tokens. Limited secondary market liquidity currently. Complexity managing multi-owner aircraft operations. Still emerging technology for fractional ownership.

Smart Contract Automation

Using Ethereum-based smart contracts, automated settlement eliminates manual processes:

Automated escrow release: Smart contract programmed with closing conditions (PPI satisfactory, title clear, insurance bound). When all conditions satisfied and parties digitally sign, funds automatically transfer—no manual escrow officer intervention required.

Charter payment automation: Payment releases automatically upon flight completion verification. GPS data confirms aircraft arrived at destination, smart contract releases payment to operator—eliminates billing disputes and delayed payments.

Maintenance reserve accounts: Smart contracts can automate maintenance reserve contributions. After each flight hour, smart contract calculates maintenance reserve due (typically $500-$2,000 per flight hour depending on aircraft), automatically deducts from charter payment, deposits in maintenance reserve account.

Cost savings through automation: Eliminates manual processing fees, reduces transaction settlement time from days to minutes, prevents payment disputes through transparent on-chain verification.

Decentralized Finance (DeFi) Aircraft Financing

Emerging DeFi protocols could enable cryptocurrency-collateralized aircraft loans:

Traditional aircraft financing: 20-30% down payment required ($2M-$3M on $10M aircraft), 5-10 year loan term, 4-8% interest rates, extensive credit checks and financial documentation, 30-90 day approval timeline.

Potential DeFi alternative: Cryptocurrency collateral (overcollateralized 150% typical—deposit $15M crypto to borrow $10M for aircraft purchase), instant approval via smart contract, no credit checks required, automated liquidation if collateral value drops below threshold.

Benefits: Retain cryptocurrency holdings (potential appreciation) while accessing aircraft. No personal guarantee required. Global access regardless of citizenship. Near-instant approval.

Risks: Liquidation risk if crypto drops 33%+ (your $15M collateral worth less than $10M loan triggers automatic sale). Interest rates potentially higher than traditional financing. Regulatory uncertainty around DeFi lending. Technology still immature.

Central Bank Digital Currencies (CBDCs)

As governments develop digital currencies, future aviation transactions may utilize CBDCs:

Advantages over current crypto: Government-backed stability (no volatility). Legal tender status (universal acceptance). Integrated regulatory compliance (AML/KYC built into CBDC infrastructure). Instant settlement like cryptocurrency without conversion complexity.

Timeline: Major economies (US, EU, China, Switzerland) actively developing CBDCs with 2026-2030 potential deployment. Future aviation transactions may offer optimal combination of cryptocurrency speed with fiat currency stability.

Recommended Approach for 2025

Focus on proven technologies today:

For charter: Use stablecoins (USDC/USDT) via established payment gateways for instant settlement and zero volatility risk.

For ownership: Use Bitcoin (BTC) via licensed blockchain escrow with immediate stablecoin conversion protecting both parties during closing period.

Future innovations: Monitor tokenization developments for fractional ownership opportunities, but participate only after regulatory clarity established and secondary markets proven liquid.

The future promises increased efficiency, reduced costs, and expanded access. Technology available today already provides substantial advantages over traditional payment methods—44% lower transaction costs, minutes versus days settlement, global 24/7 availability. Future innovations will further transform aviation cryptocurrency integration.

Conclusion: Key Takeaways

Aviation’s first Bitcoin-only aircraft sale ($5.7M Gulfstream G200, November 2024) proves you can successfully buy private jet with Bitcoin for complete aircraft ownership. Modern infrastructure—cryptocurrency payment gateways, blockchain escrow, smart contract security—makes the process increasingly accessible.

Critical success factors:

1.Charter vs. Ownership distinction: Charter (hourly rates $6K-$20K, instant settlement, no tax complexity) dramatically simpler than ownership ($5M-$70M purchases, 60-120 day closings, dual tax events requiring professional guidance).

2.Payment infrastructure matters: Integrated payment gateway supporting 70+ cryptocurrencies provides 44% cost savings ($1,400 vs $1,800 in fees on $50K charter). Stablecoins (USDC/USDT) eliminate volatility risk entirely.

3.Blockchain escrow is mandatory: Multi-signature smart contracts (1.5-2.5% fees) eliminate counterparty fraud risk for ownership transactions. Never transact directly peer-to-peer for amounts exceeding $1M.

4.Tax implications are significant: Cryptocurrency disposal triggers capital gains (0-37% rates). Aircraft ownership adds bonus depreciation benefits (40% in 2025 declining thereafter). Professional CPA guidance prevents $100K-$1M+ tax mistakes.

5.Regulatory compliance is non-negotiable: AML/KYC requirements, sanctions screening, suspicious activity reporting all apply. Documentation retained 7+ years minimum. Penalties for violations include $250K+ fines and criminal prosecution.

6.Pre-purchase inspection never optional: $15K-$150K inspection cost prevents $50K-$500K+ unexpected repairs. Neutral facility mandatory—never use seller’s maintenance shop.

Cost-benefit analysis:

Charter using cryptocurrency: 2.8% total transaction costs versus 3.6% traditional payments saves $400+ per $50,000 flight. Frequent flyers realize $4,000+ annual savings.

Aircraft ownership: Blockchain escrow (1.5-2.5%) comparable to traditional escrow but provides superior security through multi-signature smart contracts and on-chain transparency.

Getting started:

For charter bookings: Contact PrivateCharterX supporting 70+ cryptocurrencies, or established operators like JetFinder, Mercury Jets, Global Charter, Stratos Jets. Payment settles within 10-30 minutes after blockchain confirmation.

For aircraft ownership: Engage cryptocurrency-knowledgeable aviation attorney and CPA before initial offer. Select blockchain escrow service supporting multi-sig smart contracts. Budget 10-16 weeks closing timeline plus 5-10% beyond purchase price for transaction costs.

For cost estimation: Use PrivateCharterX cost calculator to compare charter versus ownership economics. Consider helicopter alternatives for shorter routes (Zürich-St. Moritz: 40 minutes by helicopter vs positioning time + fees for jet).

For market comparisons: Review private jet membership programs as traditional alternatives for fractional access rather than full ownership.

The aviation industry embraces cryptocurrency payments, blockchain escrow, and smart contract automation. When you buy private jet with Bitcoin in 2025, proven infrastructure provides security, cost savings, and transaction speed impossible just five years ago. Whether chartering from $6,000/hour or acquiring ultra-long-range jets approaching $70M, cryptocurrency payment options expand access to private aviation for digital-native wealth holders.

The question isn’t whether cryptocurrency transforms aviation—it already has. The question is whether you’ll experience the advantages.

Contact PrivateCharterX for Bitcoin charter services

Sources & References

Charter Operators & Payment Processing:

Aircraft Sales & Brokers: 10. https://news.bitcoin.com/us-company-accepts-bitcoin-payments-for-luxury-planes-as-40m-gulfstream-jet-goes-on-sale/

IRS Tax Guidance: 11. https://www.irs.gov/filing/digital-assets 12. https://www.irs.gov/newsroom/irs-releases-final-regulations-requiring-custodial-brokers-to-report-sales-and-exchanges-of-digital-assets-including-cryptocurrency 13. https://www.irs.gov/forms-pubs/about-form-8949 14. https://www.irs.gov/forms-pubs/about-schedule-d-form-1040 15. https://www.irs.gov/forms-pubs/about-form-4562 16. https://turbotax.intuit.com/tax-tips/investments-and-taxes/your-cryptocurrency-tax-guide/L4k3xiFjB 17. https://www.schwab.com/learn/story/cryptocurrencies-and-taxes-what-you-should-know 18. https://theflyingengineer.com/private-jet-tax-benefits-and-regulations/ 19. https://www.cnbc.com/2025/11/22/new-irs-requirements-crypto-tax-cheat-risky-this-year-filing.html 20. https://tehcpa.net/crypto-tax-guide-2025-updated-tax-rates-and-irs-regulations/

FinCEN & AML/KYC Compliance: 21. https://www.innreg.com/blog/fincen-cryptocurrency-regulation 22. https://kyc-chain.com/kyc-and-aml-compliance-a-guide-for-crypto-exchanges/ 23. https://home.treasury.gov/policy-issues/financial-sanctions/specially-designated-nationals-and-blocked-persons-list-sdn-human-readable-lists 24. https://financialcrimeacademy.org/cryptocurrency-aml-compliance/ 25. https://blog.amlbot.com/crypto-regulations-in-the-us-2025-complete-aml-compliance-guide/ 26. https://www.kychub.com/blog/cryptocurrency-regulation-in-the-us/ 27. https://kyc-chain.com/maintaining-kyc-aml-amp-ctf-compliance-across-multiple-jurisdictions-for-crypto-firms/ 28. https://www.fincen.gov 29. https://www.ecb.europa.eu 30. https://www.finma.ch 31. https://www.fincen.gov/resources/statutes-regulations/guidance/administrative-ruling-application-definition-currency

Pre-Purchase Inspection: 38. https://www.avbuyer.com/articles/aircraft-ownership/pre-purchase-inspections-who-pays-how-much-113970 39. https://www.flyingmag.com/what-you-need-to-know-about-pre-buy-inspections-for-aircraft/ 40. https://www.faa.gov/regulations_policies/airworthiness_directives/ 41. https://www.faa.gov 42. https://eagle-aviation.com/aircraft-sales-acquisitions/what-to-look-for-during-a-pre-purchase-inspection

Hardware Wallets & Security: 43. https://www.ledger.com 44. https://trezor.io

Legal & Aviation Services: 47. https://www.hargeraviationlaw.com 48. https://gordonlaw.com/learn/crypto-taxes-how-to-report/