A New Era of Institutional Blockchain Adoption

The Canton Network represents a watershed moment in institutional blockchain adoption, as major financial institutions including Goldman Sachs and BNP Paribas pioneer the tokenization of bonds, gold, and sovereign assets. These Canton Network tokenized bonds initiatives mark the transition from experimental blockchain projects to enterprise-grade financial infrastructure, offering unprecedented settlement speed, enhanced liquidity, and institutional-grade security for high-net-worth individuals and sophisticated investors.

Understanding the Canton Network Framework

The Canton Network operates as a permissioned blockchain platform specifically engineered for institutional finance and large-scale asset tokenization, distinguishing itself from public blockchains through regulatory compliance and enterprise security.

Core Network Capabilities

Institutional-Grade Infrastructure:

- Permissioned Access: Central bank oversight ensuring regulatory compliance

- Enterprise Security: Multi-signature protocols and hardware security modules

- Scalable Architecture: Processing thousands of transactions per second

- Privacy Protection: Zero-knowledge proofs for confidential transactions

- Regulatory Integration: FOCA, EASA, and Basel III compliance frameworks

Asset Tokenization Features:

- Real-World Asset (RWA) Representation: Digital twins of physical and financial assets

- Fractional Ownership: Divisible asset tokens for enhanced accessibility

- Instant Settlement: Sub-second transaction confirmation and finality

- Cross-Border Compatibility: Multi-jurisdiction operational capability

- Audit Trail Immutability: Permanent blockchain record keeping

Strategic Institutional Partnerships

The Canton Network’s credibility stems from partnerships with leading global financial institutions committed to blockchain-based asset management innovation.

| Institution | Contribution | Impact on Tokenization |

|---|---|---|

| Goldman Sachs | Trading infrastructure and compliance expertise | Enhanced market liquidity for tokenized assets |

| BNP Paribas | Custody services and settlement capabilities | Institutional-grade security and risk management |

| Swiss National Bank | Gold tokenization pilot participation | Central bank legitimacy and regulatory framework |

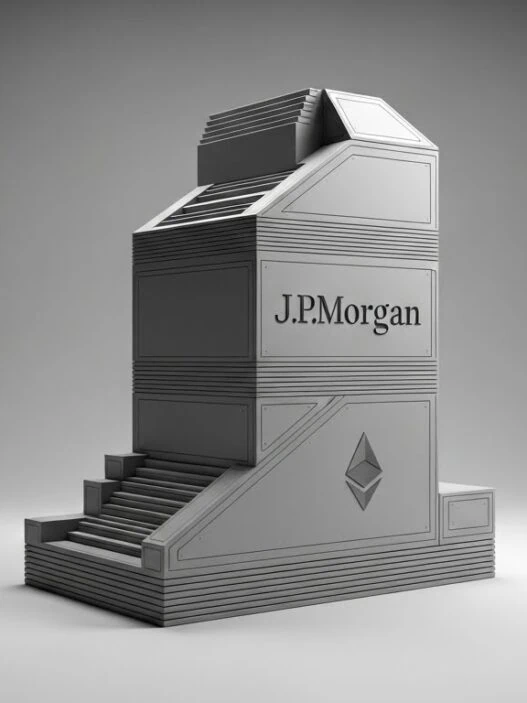

| JPMorgan | Cross-border payment infrastructure | Global accessibility for tokenized instruments |

| Deutsche Bank | European regulatory compliance expertise | Multi-jurisdiction operational capability |

Canton Network Tokenized Bonds Revolution

The tokenization of government and corporate bonds through the Canton Network represents a fundamental shift in fixed-income securities trading and settlement.

Tokenized Bond Advantages

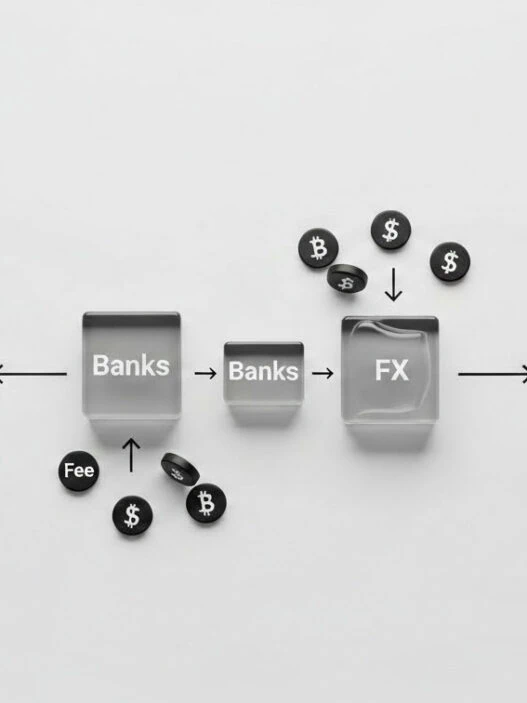

Settlement Efficiency:

- Traditional Bonds: 2-3 business days settlement period

- Canton Network Tokenized Bonds: Instant settlement within seconds

- Cost Reduction: 70-90% reduction in settlement and custody fees

- 24/7 Trading: Continuous market access regardless of traditional hours

- Global Accessibility: Cross-border transactions without currency conversion delays

Enhanced Liquidity Features:

- Fractional Ownership: Access to high-value bonds with smaller investments

- Secondary Market Trading: Instant peer-to-peer bond transfers

- Collateralization: Use tokenized bonds as instant collateral for loans

- Portfolio Diversification: Granular allocation across multiple bond issues

- Risk Management: Real-time mark-to-market valuation and exposure monitoring

Real-World Implementation Example

Scenario: Swiss-based family office utilizing Canton Network tokenized bonds for private aviation financing.

Traditional Process:

- Bond purchase requires 3-day settlement

- Collateral verification takes 48-72 hours

- Credit facility approval requires 5-7 business days

- Total time: 10-14 days for private jet charter financing

Canton Network Process:

- Tokenized bond purchase settles instantly

- Smart contract collateralization occurs within minutes

- Automated credit facility approval within hours

- Total time: Same-day private jet charter financing

Financial Impact: $2.5 million credit facility using tokenized Swiss government bonds as collateral, enabling immediate $500,000 private aviation expenditure with 15% cost reduction through blockchain efficiency.

Tokenized Gold: Digital Precious Metals Innovation

The Canton Network’s tokenized gold initiative bridges physical precious metals with digital asset accessibility, offering institutional investors unprecedented flexibility in gold exposure and utilization.

Tokenized Gold Infrastructure

Physical Asset Backing:

- Vault Storage: Regulated precious metals facilities across Switzerland and London

- Audit Verification: Monthly third-party assay and inventory confirmation

- Insurance Coverage: Lloyd’s of London comprehensive precious metals protection

- Regulatory Compliance: London Bullion Market Association (LBMA) standards

- Chain of Custody: Immutable blockchain tracking from mint to tokenization

Digital Asset Features:

- Fractional Ownership: Access to gold holdings from 0.001 troy ounce minimum

- Real-Time Pricing: LBMA spot price integration with automatic valuation updates

- Instant Liquidity: Convert tokenized gold to fiat or cryptocurrency within minutes

- Cross-Border Transfers: Global gold ownership transfers without physical movement

- Smart Contract Integration: Automated gold-backed lending and collateralization

Tokenized Gold Use Cases

High-Net-Worth Applications:

- Portfolio Hedging: Instant gold allocation adjustments during market volatility

- Collateral Management: Use tokenized gold as loan collateral for luxury purchases

- Estate Planning: Fractional gold distribution to beneficiaries through blockchain

- Tax Optimization: Strategic gold holdings across multiple jurisdictions

- Privacy Protection: Confidential precious metals ownership through zero-knowledge proofs

Luxury Service Integration:

- Private Aviation: Pay for jet charters using gold-backed tokens

- Yacht Charters: Instant settlement using tokenized precious metals

- Real Estate: Gold-backed deposits for luxury property acquisitions

- Art Purchases: Tokenized gold payments for auction house transactions

- Concierge Services: Premium lifestyle payments through digital gold

Sovereign Asset Tokenization: Government-Backed Innovation

The Canton Network’s most ambitious initiative involves tokenizing sovereign assets, including government infrastructure projects and national reserve holdings.

Government-Backed Tokenization

Infrastructure Project Tokens:

- Transportation Networks: Tokenized ownership in high-speed rail and airport projects

- Energy Infrastructure: Fractional ownership in renewable energy installations

- Digital Infrastructure: 5G networks and fiber optic system tokenization

- Real Estate Holdings: Government property portfolios represented digitally

- Strategic Reserves: Partial tokenization of national commodity stockpiles

Benefits for Institutional Investors:

- Sovereign Credit Rating: Government-backed asset quality and stability

- Diversification: Access to infrastructure investments typically unavailable

- Yield Generation: Steady returns from essential infrastructure operations

- Inflation Protection: Real asset backing providing inflation hedge characteristics

- ESG Compliance: Sustainable infrastructure investment opportunities

Regulatory Framework

Government Oversight:

- Central Bank Supervision: National monetary authorities oversee tokenization programs

- Securities Regulation: Compliance with national and international securities laws

- Tax Treatment: Clear guidance on tokenized sovereign asset taxation

- Investor Protection: Regulatory safeguards for institutional and qualified investors

- International Coordination: Cross-border recognition and enforcement mechanisms

Technology Infrastructure and Security

The Canton Network’s technical architecture ensures institutional-grade security and operational reliability for high-value asset tokenization.

Advanced Security Protocols

Multi-Layer Protection:

- Hardware Security Modules: Tamper-resistant cryptographic key storage

- Multi-Signature Authorization: Multiple approval requirements for large transactions

- Zero-Knowledge Proofs: Transaction validation without revealing sensitive data

- Quantum-Resistant Cryptography: Future-proof security against quantum computing threats

- Real-Time Monitoring: AI-powered threat detection and response systems

Operational Security:

- Air-Gapped Systems: Critical infrastructure isolated from internet connectivity

- Biometric Access Controls: Multi-factor authentication for system access

- Encrypted Communications: End-to-end protection for all network communications

- Disaster Recovery: Geographically distributed backup and recovery systems

- Penetration Testing: Regular security assessments and vulnerability analysis

Smart Contract Architecture

Automated Asset Management:

- Conditional Transfers: Programmable asset movement based on predetermined criteria

- Yield Distribution: Automatic income distribution to token holders

- Compliance Monitoring: Built-in regulatory requirement enforcement

- Risk Management: Automated exposure limits and portfolio rebalancing

- Audit Trail Generation: Immutable transaction and ownership records

Market Impact and Adoption Trends

The Canton Network’s institutional adoption represents a broader shift toward blockchain-based financial infrastructure across traditional finance.

Institutional Adoption Metrics

Market Penetration Data:

- Asset Under Management: $50+ billion in tokenized assets across pilot programs

- Transaction Volume: 10,000+ daily transactions averaging $2.5 million each

- Institutional Participants: 150+ global banks and asset managers

- Geographic Coverage: 25 countries with regulatory approval for operations

- Settlement Efficiency: 99.97% of transactions settle within 30 seconds

Growth Projections:

- 2025 Target: $500 billion in tokenized institutional assets

- Cost Savings: 40-60% reduction in settlement and custody expenses

- Market Expansion: Integration with additional central banks and regulators

- Technology Enhancement: Lightning Network integration for instant micropayments

- Service Expansion: Tokenization of additional asset classes including private equity

Industry Transformation

Traditional Finance Evolution:

- Settlement Infrastructure: Blockchain replacing legacy clearing and settlement systems

- Custody Services: Digital asset custody becoming standard offering

- Regulatory Framework: Government agencies developing comprehensive blockchain regulations

- Risk Management: New models for tokenized asset risk assessment and monitoring

- Client Services: Wealth management platforms integrating blockchain-based holdings

Practical Implementation for Wealth Management

High-net-worth individuals and family offices can leverage Canton Network tokenized assets for enhanced portfolio management and lifestyle financing.

Portfolio Integration Strategies

Asset Allocation Optimization:

- Dynamic Rebalancing: Real-time portfolio adjustments using tokenized assets

- Liquidity Management: Instant access to traditionally illiquid investments

- Tax Efficiency: Strategic tokenized asset placement across jurisdictions

- Risk Mitigation: Diversified exposure through fractional asset ownership

- Yield Enhancement: Staking and lending opportunities with tokenized holdings

Lifestyle Integration:

- Luxury Purchases: Private aviation and yacht charters using tokenized collateral

- Real Estate Transactions: Property acquisitions with blockchain-based financing

- Art and Collectibles: Auction payments through tokenized precious metals

- Concierge Services: Premium lifestyle services with instant digital settlement

- Estate Planning: Efficient wealth transfer through programmable asset distribution

Frequently Asked Questions

What are Canton Network tokenized bonds and how do they work? Canton Network tokenized bonds are digital representations of traditional government and corporate bonds that settle instantly on blockchain infrastructure. Unlike traditional bonds requiring 2-3 days for settlement, tokenized bonds enable immediate ownership transfer and can be used as instant collateral for loans or luxury purchases.

Which major financial institutions support the Canton Network? Goldman Sachs, BNP Paribas, JPMorgan, Deutsche Bank, and the Swiss National Bank are key participants in Canton Network pilot programs. These institutions provide trading infrastructure, custody services, and regulatory compliance expertise to ensure institutional-grade asset tokenization.

How secure are tokenized gold holdings on the Canton Network? Tokenized gold on the Canton Network is backed by physical bullion stored in LBMA-approved vaults with Lloyd’s of London insurance coverage. The blockchain infrastructure uses hardware security modules, multi-signature protocols, and quantum-resistant cryptography to protect digital ownership records.

Can I use tokenized assets for private aviation and luxury services? Yes, Canton Network tokenized bonds and gold can be used as collateral for private jet charters, yacht bookings, and luxury purchases. The instant settlement capability enables same-day financing for high-value lifestyle expenses that traditionally required weeks of approval processes.

What regulatory oversight exists for Canton Network operations? The Canton Network operates under central bank supervision with compliance frameworks including FOCA (Switzerland), EASA (Europe), and Basel III international standards. All tokenized assets maintain regulatory approval for institutional investment and cross-border transactions.

How do tokenized sovereign assets differ from traditional government bonds? Tokenized sovereign assets include infrastructure projects and national reserves beyond traditional bonds, offering fractional ownership in government-backed real assets. These provide exposure to essential infrastructure generating steady yields while maintaining sovereign credit quality and inflation protection characteristics.

Strategic Implementation for Institutional Clients

For Family Offices

Wealth Management Enhancement:

- Portfolio Diversification: Access to previously unavailable asset classes through tokenization

- Liquidity Optimization: Convert illiquid holdings to liquid tokens for flexible allocation

- Tax Efficiency: Strategic asset placement across favorable jurisdictions

- Succession Planning: Programmable inheritance through smart contract automation

- Privacy Protection: Confidential wealth management through zero-knowledge protocols

For Private Banks

Client Service Innovation:

- Enhanced Custody: Digital asset custody alongside traditional portfolio management

- Instant Settlement: Real-time trade execution and settlement for client transactions

- Collateral Management: Tokenized assets as collateral for credit facilities

- Global Accessibility: 24/7 asset management regardless of traditional banking hours

- Regulatory Compliance: Built-in AML/KYC protocols for institutional requirements

The Future of Institutional Blockchain Finance

The Canton Network’s success with tokenized bonds, gold, and sovereign assets signals the beginning of comprehensive blockchain integration across institutional finance.

Emerging Developments

Technology Evolution:

- Central Bank Digital Currencies: Integration with government-issued digital currencies

- AI-Powered Analytics: Machine learning for tokenized asset risk assessment

- Cross-Chain Interoperability: Seamless asset transfers across blockchain networks

- Quantum Computing Integration: Advanced cryptographic security enhancements

- Internet of Things: Real-world asset monitoring through IoT sensor networks

Market Expansion:

- Asset Class Diversification: Tokenization of private equity, venture capital, and alternative investments

- Geographic Growth: Expansion to emerging markets with developing regulatory frameworks

- Retail Integration: Qualified investor access to institutional tokenized assets

- DeFi Integration: Decentralized finance protocols for tokenized asset lending and yield generation

- ESG Integration: Sustainability-focused tokenized asset offerings and impact measurement

Conclusion: Blockchain’s Institutional Breakthrough

The Canton Network’s pilot projects with tokenized bonds, gold, and sovereign assets represent a pivotal moment in institutional blockchain adoption. As Goldman Sachs, BNP Paribas, and other major financial institutions embrace blockchain-based asset management, we’re witnessing the transformation of traditional finance toward digital infrastructure that offers superior speed, efficiency, and accessibility.

For sophisticated investors, wealth managers, and luxury service providers, the Canton Network enables unprecedented flexibility in asset management and lifestyle financing. Whether utilizing tokenized bonds for private aviation purchases, leveraging gold tokens for yacht charters, or accessing sovereign assets for portfolio diversification, blockchain technology is becoming essential infrastructure for modern wealth management.

The future of institutional finance is being built on blockchain foundations, and the Canton Network stands at the forefront of this revolutionary transformation.

Related Blockchain Resources

For comprehensive cryptocurrency payment solutions in luxury aviation, explore our USDT payment methods covering institutional-grade blockchain transactions for private jet charters and high-value travel services.

Discover advanced tokenization strategies through our BlackRock blockchain analysis examining institutional crypto adoption and tokenized luxury Web3 solutions for premium asset management and exclusive access rights.

For foundational cryptocurrency knowledge, our Tether beginner’s guide provides essential stablecoin understanding, while our comprehensive luxury travel cryptocurrency guide covers Bitcoin, Ethereum, and digital asset integration across premium travel services.

Additional blockchain integration resources include crypto private jet booking services and Web3 aviation solutions for comprehensive digital asset management in luxury transportation.

External Compliance Resources

For current blockchain regulations and institutional compliance, consult the Bank for International Settlements (BIS) guidelines and Financial Stability Board (FSB) recommendations for institutional digital asset adoption.

This Canton Network analysis represents current market developments and institutional blockchain adoption trends as of 2025. Blockchain regulations and tokenization capabilities continue evolving rapidly. Always verify current compliance requirements and institutional capabilities with certified blockchain financial advisors.

![Apple Vision Pro Complete Review: Ultimate 2025 Guide - Is It Worth $3,500? 25 Apple Vision Pro headset displayed on modern desk with soft lighting fashion magazine style photography"]](https://privatecharterx.blog/wp-content/uploads/2025/08/romeo-a-TGQQbDoG2C4-unsplash-scaled-95x95.jpg)