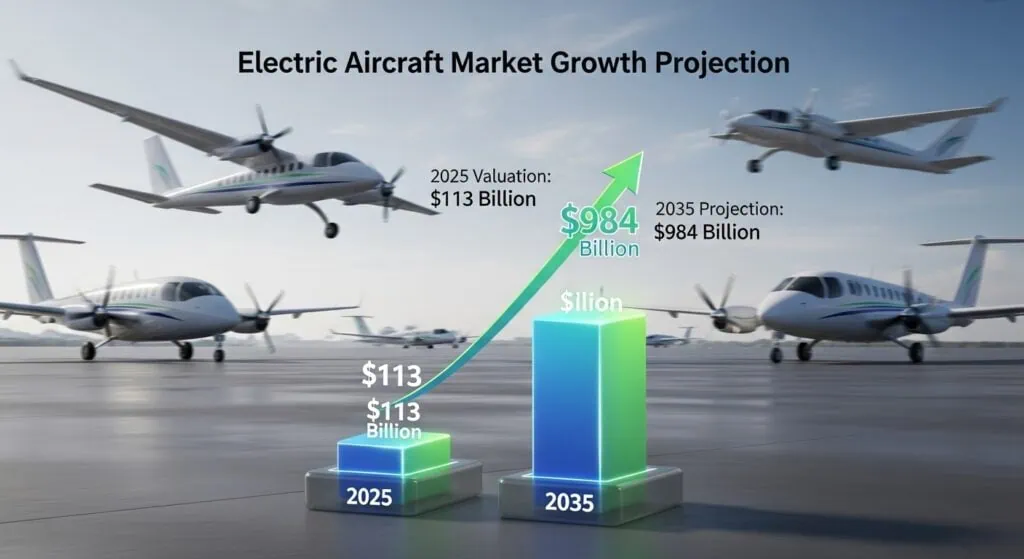

The electric aircraft market 2025 has reached an unprecedented milestone, achieving $113 billion in total market valuation while projecting explosive growth toward $984 billion by 2035. This transformative industry represents the most significant aviation breakthrough since jet propulsion, fundamentally reshaping how passengers and cargo move through the skies.

As battery technology advances and environmental regulations tighten globally, electric aviation has evolved from experimental concepts to commercially viable transportation solutions. Leading manufacturers like Joby Aviation and Archer Aviation are nearing certification milestones, with the first commercial electric aircraft operations targeting early 2026 launches.

Electric Aircraft Market Size and Growth Projections

The electric aircraft market 2025 demonstrates remarkable momentum across multiple segments. Market analysts project the industry will maintain a compound annual growth rate (CAGR) of 21.67% through 2035, representing one of the fastest-growing transportation sectors globally.

Market Segment Breakdown

eVTOL (Electric Vertical Takeoff and Landing) aircraft capture over 60% of total market activity, driven by urban air mobility applications and short-distance passenger transport. These revolutionary aircraft eliminate the need for traditional runways, opening previously inaccessible routes in congested metropolitan areas.

Light and ultralight electric aircraft generate 47.58% of current revenue streams, primarily serving training, recreational, and short-haul commercial applications. This segment benefits from simpler certification requirements and lower operational complexity compared to larger aircraft.

Regional electric aircraft represent the highest growth potential, targeting routes between 100-500 miles where conventional aircraft economics become challenging. Airlines recognize these routes offer substantial cost savings through electric propulsion systems.

The commercial aviation sector specifically shows exceptional promise, with passenger demand for sustainable travel options driving airline investment in electric aircraft fleets. Major carriers including United Airlines and Delta Air Lines have committed hundreds of millions in strategic investments.

Leading Electric Aircraft Manufacturers Rankings 2025

The electric aircraft manufacturers ranking 2025 reveals intense competition among established players and emerging startups racing toward commercial certification.

Joby Aviation: Certification Leader

Joby Aviation maintains the most advanced certification progress, completing 70% of Stage 4 FAA requirements for their flagship eVTOL aircraft. The company’s methodical approach prioritizes safety validation over speed, building regulatory confidence through extensive testing protocols.

Toyota’s $1 billion investment provides manufacturing expertise and quality control systems essential for scaling production. Joby’s partnership strategy focuses on operational readiness, securing agreements with airports and establishing pilot training programs.

The company projects commercial operations beginning in select markets during early 2026, targeting premium passengers willing to pay higher fares for time savings and environmental benefits.

Archer Aviation: Manufacturing Scale Focus

Archer Aviation pursues aggressive manufacturing scaling through strategic partnerships with Stellantis, leveraging automotive production expertise to achieve cost-competitive aircraft manufacturing. Their approach emphasizes rapid deployment over certification timing.

United Airlines’ $150 million investment includes commitments for aircraft purchases and route planning integration. Archer’s business model targets airline partnerships rather than direct passenger services, reducing operational complexity.

The company’s Midnight aircraft demonstrates impressive performance specifications, achieving 60-mile range with 1,000-pound payload capacity. Commercial launches target late 2026 following certification completion.

Emerging Competitors

Lilium focuses on regional electric aircraft with longer range capabilities, targeting 155-mile routes that conventional helicopters cannot serve economically. Their unique ducted fan design offers noise reduction advantages in urban environments.

Volocopter emphasizes cargo applications alongside passenger transport, recognizing that freight operations provide revenue diversification and regulatory pathway development opportunities.

Beta Technologies pursues military contracts and cargo operations, building operational experience before entering passenger markets. Their approach reduces regulatory complexity while generating revenue during certification processes.

Technology Breakthrough: Battery vs Hybrid Systems

Electric aircraft technology advancement centers on energy storage solutions, with manufacturers choosing between pure battery systems, hybrid configurations, and emerging hydrogen fuel cell technologies.

Battery Electric Advantages

Pure battery systems offer operational simplicity with minimal moving parts, reducing maintenance requirements and pilot training complexity. Current lithium-ion technology supports routes up to 100 miles with commercial payload requirements.

Battery costs continue declining at 8-10% annually, improving aircraft economics while increasing energy density. Industry projections suggest 400 Wh/kg battery performance by 2027, enabling 200-mile commercial routes.

Electric motors provide instant torque and precise control, enhancing safety during critical flight phases. The technology eliminates engine failure scenarios that challenge conventional aircraft operations.

Hybrid System Benefits

Hybrid electric configurations combine battery power with conventional engines, extending range capabilities while maintaining electric efficiency for noise-sensitive operations near airports.

These systems enable operators to utilize electric power during takeoff and landing phases, minimizing community noise impact while using conventional power for cruise efficiency on longer routes.

Hybrid technology provides transition pathway for operators hesitant to adopt pure electric systems, offering familiar operational procedures while introducing electric benefits gradually.

Hydrogen Fuel Cell Potential

Hydrogen fuel cells represent long-term technology solutions for regional and intercity electric aviation, potentially supporting 500+ mile routes with commercial payload requirements.

Current hydrogen systems face infrastructure challenges requiring specialized ground equipment and storage facilities. However, energy density advantages make hydrogen attractive for larger aircraft applications.

Several manufacturers including ZeroAvia and Universal Hydrogen are developing hydrogen-powered aircraft targeting 2028-2030 commercial operations, focusing on regional airline applications.

Investment Analysis: Strategic Funding and Partnerships

The electric aircraft investment analysis reveals sophisticated capital deployment strategies combining traditional venture funding with strategic corporate partnerships and government support.

Private Investment Flows

Total private investment in electric aviation infrastructure exceeded $8 billion between 2024 and 2025, demonstrating institutional confidence in market viability. Venture capital firms including Kleiner Perkins and Bessemer Venture Partners lead funding rounds.

Strategic investments focus on manufacturing partnerships rather than pure technology development, recognizing that certification and scaling represent the primary challenges facing successful companies.

Corporate venture arms from aerospace giants including Boeing, Airbus, and Lockheed Martin provide technical expertise alongside financial capital, accelerating development timelines through industry knowledge transfer.

Airline Strategic Partnerships

United Airlines committed $150 million toward Archer Aviation while securing aircraft purchase agreements and route planning collaboration. These partnerships provide market validation essential for regulatory approval and customer confidence.

Delta Air Lines invested in Joby Aviation alongside operational agreements for airport infrastructure and passenger service integration. Airline partnerships offer distribution channels and operational expertise impossible to replicate independently.

These strategic relationships extend beyond financial investment, including pilot training programs, maintenance facility planning, and passenger experience optimization critical for commercial success.

Government Support Programs

Federal aviation authorities worldwide provide certification pathway development and infrastructure grant programs supporting electric aircraft deployment. The FAA’s Innovation Center actively collaborates with manufacturers on safety standards development.

Research and development tax incentives reduce manufacturer costs while accelerating technology advancement. Government procurement programs for military and emergency services applications provide revenue diversification opportunities.

International cooperation agreements facilitate cross-border certification recognition, reducing regulatory complexity for manufacturers targeting global markets.

Regional Market Performance and Expansion

Regional electric aircraft market analysis reveals significant geographic variation in adoption rates, regulatory support, and infrastructure development.

North American Leadership

North America captured 44.70% of global electric aircraft market revenue in 2024, with the United States specifically reaching $3.69 billion and projecting $23.58 billion by 2034.

Regulatory leadership through FAA certification programs provides manufacturers with clear development pathways and investor confidence. American companies benefit from domestic aviation expertise and established aerospace supply chains.

Urban centers including Los Angeles, New York, and Miami offer ideal markets for initial eVTOL operations, combining traffic congestion problems with affluent passenger demographics willing to pay premium prices for time savings.

European Expansion

European markets emphasize environmental sustainability and urban noise reduction, creating favorable regulatory environments for electric aircraft adoption. The European Union Aviation Safety Agency (EASA) coordinates certification standards across member nations.

Cities including London, Paris, and Frankfurt face severe air traffic congestion and environmental pressure, making electric aircraft attractive for short-distance connections and urban mobility applications.

Government incentives supporting sustainable transportation accelerate infrastructure investment and operational subsidy programs that improve early-stage economics for electric aircraft operators.

Asia-Pacific Growth

Asia-Pacific regions show exceptional growth potential driven by rapid urbanization and infrastructure development. Countries including Japan, Singapore, and South Korea actively develop electric aircraft regulatory frameworks.

Dense urban populations and severe traffic congestion create compelling use cases for electric vertical aircraft serving airport connections and intercity routes. Government investment in smart city initiatives includes electric aviation infrastructure planning.

Manufacturing partnerships with regional aerospace companies provide cost advantages and local market access essential for competing with established international manufacturers.

Cost Economics: Why Electric Aircraft Win

Electric aircraft cost economics demonstrate compelling advantages over conventional aviation across multiple operational categories, driving rapid industry adoption.

Fuel Cost Advantages

Electric aircraft deliver 75-90% lower fuel costs compared to conventional aircraft on equivalent routes. Electricity pricing remains stable and predictable, eliminating fuel price volatility that challenges airline profitability.

Regional electricity rates average $0.08-0.12 per kWh, providing cost certainty impossible with volatile jet fuel markets. Electric aircraft operators can hedge energy costs through renewable energy contracts and on-site solar installations.

Battery charging during off-peak hours reduces operational costs while supporting grid stability through demand response programs. These operational efficiencies become increasingly important as flight frequencies increase.

Maintenance Savings

Electric propulsion systems require 50-60% lower maintenance expenses due to dramatically fewer moving parts compared to conventional engines. Electric motors contain no oil systems, fuel injection components, or complex mechanical linkages requiring regular service.

Scheduled maintenance intervals extend significantly, reducing aircraft downtime and increasing revenue-generating flight hours. Predictive maintenance using electric system monitoring prevents unexpected failures while optimizing component replacement timing.

Insurance costs decrease substantially due to reduced fire risk and improved safety records from electric propulsion system reliability. These savings compound over aircraft operational lifespans.

Operational Efficiency

Electric aircraft achieve superior operational efficiency through instant torque delivery, precise power control, and reduced noise footprint enabling extended operating hours at noise-sensitive airports.

Simplified pre-flight procedures reduce turnaround times between flights, increasing daily flight frequency and revenue potential. Electric systems eliminate complex engine warm-up and cool-down requirements.

Noise reduction capabilities allow operations during restricted hours and in noise-sensitive areas, expanding market opportunities unavailable to conventional aircraft operators.

Infrastructure Development and Charging Networks

Electric aircraft infrastructure development accelerates rapidly as airports, manufacturers, and energy companies collaborate on charging network deployment essential for commercial operations.

Airport Infrastructure Investment

Over 150 airports have installed electric aircraft charging stations in preparation for commercial operations beginning in 2026. These installations range from basic Level 2 charging for light aircraft to high-power DC fast charging for commercial eVTOL operations.

Major airports including Los Angeles International (LAX), Dallas-Fort Worth (DFW), and John F. Kennedy (JFK) develop dedicated electric aircraft terminals with integrated charging infrastructure and passenger amenities.

Airport authorities recognize electric aircraft operations generate higher revenue per flight through premium pricing while requiring less infrastructure investment compared to expanding conventional terminal capacity.

Charging Technology Standards

Industry standardization efforts focus on establishing universal charging protocols enabling interoperability between different aircraft manufacturers and charging infrastructure providers.

Fast-charging technology development targets 15-20 minute charging times for commercial operations, balancing battery longevity with operational efficiency requirements. Liquid-cooled charging systems prevent thermal degradation during rapid charging cycles.

Smart charging management systems optimize power distribution across multiple aircraft while managing peak demand charges and grid stability requirements essential for cost-effective operations.

Distributed Energy Integration

Renewable energy integration through on-site solar installations and battery storage systems reduces operational costs while supporting sustainability marketing messages important for passenger acceptance.

Microgrids connecting airports with local renewable energy sources provide cost stability and environmental benefits that differentiate electric aircraft operators from conventional alternatives.

Vehicle-to-grid technology enables parked electric aircraft to provide grid services during peak demand periods, generating additional revenue streams while supporting electrical grid stability.

Certification Timeline and Regulatory Progress

Electric aircraft certification timeline shows accelerating progress as manufacturers complete testing requirements and regulatory authorities establish operational standards.

FAA Certification Progress

Federal Aviation Administration (FAA) type certification requires completion of comprehensive testing protocols validating aircraft safety, performance, and operational procedures under various conditions.

Joby Aviation leads certification progress with 70% of Stage 4 requirements completed, including flight testing, systems validation, and pilot training program development. Certification completion targets late 2025 for early 2026 commercial operations.

Archer Aviation follows closely with 60% of certification requirements completed, benefiting from shared industry knowledge and established testing protocols developed through earlier certification attempts.

International Certification Coordination

European Union Aviation Safety Agency (EASA) coordinates with FAA on certification standards development, facilitating international operations and reducing duplicate testing requirements for manufacturers targeting global markets.

Bilateral aviation safety agreements enable certification recognition across multiple jurisdictions, reducing regulatory complexity and accelerating international market entry for successful manufacturers.

Transport Canada, Civil Aviation Authority (UK), and other international regulators participate in working groups establishing global standards for electric aircraft operations and pilot training requirements.

Commercial Operations Timeline

First commercial operations target early 2026 launches in select markets with favorable regulatory environments and strong passenger demand. Initial routes focus on premium airport connections and urban mobility applications.

Middle Eastern operators including Dubai and Abu Dhabi pursue accelerated certification pathways targeting late 2025 commercial launches, leveraging favorable regulatory environments and strong government support.

Commercial airline integration follows initial operations, with major carriers planning electric aircraft service launches throughout 2026-2027 as fleet delivery schedules and route planning integration mature.

Risk Factors and Market Challenges

Electric aircraft market risks encompass technological, financial, and operational challenges that could impact industry growth projections and individual company success.

Technology Risks

Battery technology advancement remains critical for achieving commercial viability on longer routes. Current lithium-ion limitations require breakthrough developments in energy density and charging speed for broad market adoption.

Thermal management challenges during rapid charging and high-power operations require sophisticated cooling systems that add weight and complexity to aircraft designs. Battery degradation over operational lifecycles impacts economics through replacement costs.

Electric motor reliability in aviation applications requires extensive validation across various operating conditions including extreme temperatures, humidity, and electromagnetic interference scenarios common in commercial aviation.

Financial Challenges

Leading manufacturers remain pre-revenue with substantial cash burn rates requiring continued investment access for survival. Joby Aviation burns $1.3 billion annually with breakeven not expected until 2028.

Capital requirements for manufacturing scaling exceed initial projections as companies discover complex supply chain development and quality control requirements essential for aviation certification.

Insurance and liability frameworks for electric aircraft operations remain underdeveloped, creating uncertainty around operational costs and coverage availability for commercial operators.

Market Adoption Risks

Public acceptance requires successful demonstration of safety and reliability through initial commercial operations. Single high-profile accidents could devastate market confidence and regulatory support.

Pilot training and certification programs must develop alongside aircraft certification, creating potential bottlenecks for operational scaling as qualified pilot supply may limit growth rates.

Competition from improving conventional aircraft efficiency and sustainable aviation fuels could reduce electric aircraft advantages, particularly for longer routes where battery limitations remain significant.

Economic Sensitivity

Economic recession could reduce capital availability and delay infrastructure deployment essential for commercial operations. Consumer discretionary spending impacts premium-priced early electric aircraft services.

Energy cost volatility affects operational economics, particularly if electricity prices rise substantially or battery replacement costs exceed projections through supply chain disruptions.

Interest rate changes impact financing costs for aircraft purchases and infrastructure development, potentially delaying deployment schedules and increasing operational break-even requirements.

Future Outlook: What’s Next for Electric Aviation

The electric aircraft market 2025 outlook shows accelerating momentum across technology development, regulatory approval, and commercial deployment as the industry transitions from experimental to operational status.

Technology Evolution

Next-generation battery technology promises energy densities exceeding 400 Wh/kg by 2027, enabling electric aircraft operations on 200+ mile routes with commercial payload requirements. Solid-state batteries offer improved safety and faster charging capabilities.

Autonomous flight systems development accelerates through partnerships with artificial intelligence companies, potentially reducing operational costs while improving safety through enhanced situational awareness and decision-making capabilities.

Hybrid-electric systems mature as bridge technology for longer routes, combining electric efficiency for noise-sensitive operations with conventional power for extended range requirements.

Market Expansion

Urban air mobility networks develop rapidly in major metropolitan areas as infrastructure deployment and regulatory approval enable regular passenger services. Route networks expand from airport connections to comprehensive urban transportation systems.

Regional airline applications grow as aircraft capabilities improve and operational costs decrease through scale economies. Electric aircraft enable profitable service on routes too small for conventional aircraft operations.

Cargo applications accelerate adoption through reduced regulatory complexity and immediate operational benefits for time-sensitive deliveries in urban environments where conventional aircraft access remains limited.

Industry Transformation

Traditional aerospace companies increase electric aircraft investment and development programs as market viability becomes apparent. Boeing, Airbus, and other established manufacturers accelerate electric propulsion research and partnership development.

Supply chain development matures as battery manufacturers, electric motor companies, and charging infrastructure providers establish aviation-specific product lines and quality standards.

Pilot training programs expand through partnerships between manufacturers, airlines, and flight training organizations, developing the qualified workforce essential for operational scaling.

The transformation represents more than technological advancement—it signifies fundamental changes in aviation economics, environmental impact, and transportation accessibility that will reshape the industry for decades to come.

Key Takeaways: Electric Aircraft Market 2025

Market Leadership: The electric aircraft market reached $113 billion in 2025, projecting $984 billion by 2035 at 21.67% annual growth, representing mainstream aviation transformation.

Technology Frontrunners: Joby Aviation leads certification with 70% of FAA Stage 4 requirements complete, while Archer Aviation emphasizes manufacturing partnerships for rapid scaling.

Investment Momentum: Strategic investors including Toyota ($1 billion in Joby), United Airlines ($150 million in Archer), and Delta Air Lines demonstrate institutional commitment to electric aviation.

Geographic Distribution: North America dominates with 44.70% market share, while the U.S. market reached $3.69 billion, projecting $23.58 billion by 2034.

Economic Advantages: Electric aircraft deliver 75-90% fuel cost savings and 50-60% maintenance reductions compared to conventional aircraft, creating compelling operational economics.

Infrastructure Readiness: Over 150 airports installed charging stations with $8 billion in private infrastructure investment accelerating commercial operation preparation.

Commercial Timeline: First operations target early 2026, with Middle Eastern launches potentially beginning late 2025 through accelerated regulatory pathways.

Financial Reality: Leading manufacturers remain pre-revenue with significant cash requirements—Joby burns $1.3 billion annually with 2028 breakeven projections.

Technology Focus: eVTOL applications capture 60% of market activity, while light aircraft generate 47.58% of current revenue streams.

Success Dependencies: Commercial viability requires achieving certification, scaling manufacturing, building infrastructure, and maintaining adequate capital—all presenting execution risks.

The electric aircraft revolution progresses from experimental to commercial reality, fundamentally transforming aviation through sustainable technology and innovative business models.

About this Analysis: This comprehensive electric aircraft market analysis examines industry trends, manufacturer competition, investment flows, and growth projections based on market data, regulatory filings, and industry reporting through October 2025. For the latest developments in sustainable aviation technology, explore our analysis of eVTOL vs helicopter cost comparison and private jet market trends. Learn how artificial intelligence transforms aviation operations and discover emerging opportunities in institutional blockchain adoption for aviation finance.

Recommended Reading:

- eVTOL Manufacturers Ranking 2025: Complete Market Analysis

- Private Aviation Technology Trends and Innovation

- BlackRock Tokenized Assets: Institutional Investment Evolution

Data Sources – Electric Aircraft Market 2025 Article

Market Research & Analysis

SkyQuest Technology – Electric Aircraft Market Report

- Market size: $10.84B (2023) → $49.57B (2032), CAGR 18.4%

Market Research Future – Electric Aircraft Industry Analysis

- Market value: $14.8B (2023) → $40.3B (2032), CAGR 15.40%

Precedence Research – Global Electric Aircraft Market

- Current size: $13.71B (2025) → $74.25B (2034), CAGR 20.65%

Fortune Business Insights – More Electric Aircraft Market

- Market analysis: $3.99B (2022) → $8.49B (2030), CAGR 11.37%

MarketsandMarkets – Electric Aircraft Market Forecast

- Comprehensive analysis: $8.8B (2022) → $37.2B (2030), CAGR 19.8%

Company Financial Data

Joby Aviation Investor Relations

- SEC filings, quarterly reports, cash burn analysis

- All financial reports, 10-K, 10-Q forms

Alpha Spread – Joby Aviation Analysis

- Financial performance, investor materials, earnings calls

Regulatory & Certification

FAA Advanced Air Mobility Program

- eVTOL certification requirements, operational rules

FAA eVTOL Certification Statement

- Official certification progress updates

Flying Magazine – FAA Powered-Lift Guidance

- Latest certification requirements and timelines

Avionics International – Electric Engine Standards

- Special airworthiness conditions for electric propulsion

Industry Analysis

Vertical Flight Society – eVTOL News

- Industry developments, certification updates

VFS Commentary – FAA Certification Changes

- Regulatory framework analysis

Roots Analysis – Electric Aircraft Market Till 2035

- Long-term market forecasts and industry trends

Technology & Development

Electrek – First FAA-Certified Electric Trainer

- Pipistrel Alpha Electro certification milestone

Future Market Insights – More Electric Aircraft

Technology advancement analysis, growth projections