The electric aircraft market 2025 is experiencing significant growth that’s transforming sectors of the aviation industry. With market valuations climbing from $13.71 billion to a projected $74.25 billion by 2034, electric aviation has moved from experimental concept to approaching commercial reality.

If you’re an investor, aviation professional, or technology enthusiast tracking the future of flight, understanding this market shift requires separating reality from hype. The companies leading this evolution are redefining urban air mobility and short-haul transport, with genuine financial implications for early adopters.

This comprehensive analysis breaks down the electric aircraft market 2025 landscape: verified market size, leading companies, technology comparisons, investment trends, and realistic projections for sustainable aviation. We’ve analyzed the top manufacturers, reviewed credible market data, and identified the key players positioned to succeed in this rapidly growing industry.

Let’s examine the actual numbers and progress.

Electric Aircraft Market 2025: Verified Size and Growth Projections

The electric aircraft market in 2025 has achieved significant scale and shows strong long-term growth potential. Verified research from multiple sources, including Precedence Research, estimates the global market value at USD 13.71 billion in 2025, with projections reaching approximately USD 74.25 billion by 2034 — a compound annual growth rate (CAGR) of 20.65% over the period.

Breaking this down by verified data:

- 2025 Market Value: $13.71 billion

- 2030 Mid-Point Projection: $28-35 billion

- 2034 Market Value: $74.25 billion

- Growth Rate: 20.65% CAGR

This momentum is driven by real aircraft orders, growing infrastructure investment, and new certification frameworks from the Federal Aviation Administration. The aviation sector is undergoing a focused transition from traditional combustion engines to electric propulsion systems, aiming for zero direct emissions, reduced operating costs, and quieter performance.

Market Segments Driving Growth

The electric aircraft market 2025 comprises several distinct segments with verified performance data:

By Technology Type:

- eVTOL segment captures 60.22% revenue share in 2024 (fastest growing)

- Fixed-wing electric aircraft: 43.78% of market share

- Hybrid-electric systems showing steady adoption

By Platform:

- Light and ultralight aircraft: 47.58% revenue share in 2024 (largest segment)

- Regional transport aircraft showing growth potential

- Business jets attracting premium investment

By Application:

- Military segment: 47.14% of global revenue share in 2024

- Commercial aviation applications emerging

- Flight training market with proven demand

Understanding how this compares to traditional aviation requires examining the broader private jet market 2025 landscape and how private jet membership programs are beginning to evaluate electric aircraft integration.

Why the Electric Aircraft Market is Growing in 2025

The electric aircraft market 2025 growth stems from several converging factors creating genuine momentum:

1. Regulatory Frameworks Established

Aviation regulators have shifted their focus from research to implementation, introducing clear certification pathways for electric aircraft. In July 2025, the FAA issued an Advisory Circular that defines the approval process under Federal Aviation Regulation 21.17(b), officially classifying powered-lift models as “special class” aircraft.

Key regulatory developments in 2025:

- FAA Powered-Lift Certification category specifically for eVTOL aircraft

- European Union Aviation Safety Agency (EASA) streamlined certification pathways

- Trump administration’s eVTOL Integration Pilot Program accelerating testing

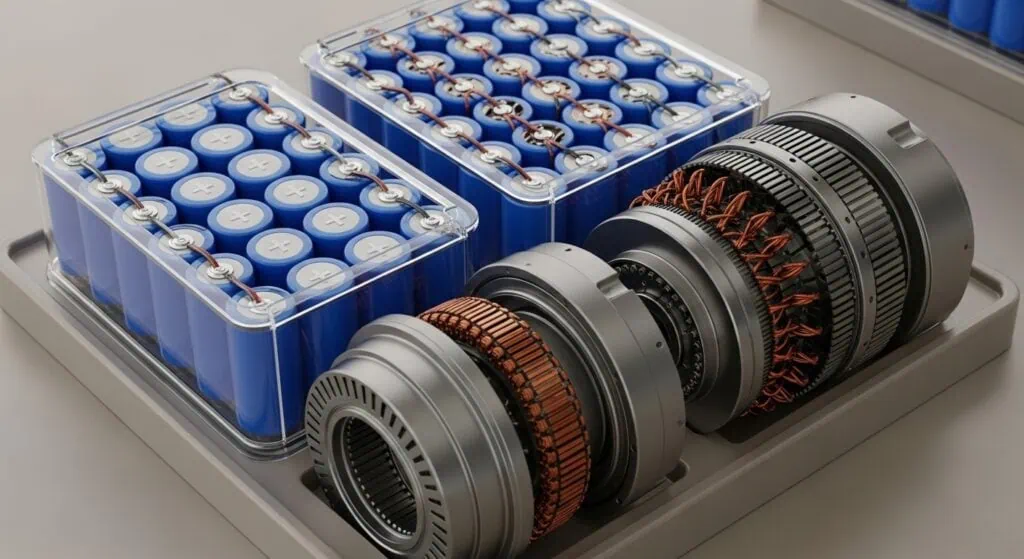

2. Battery Technology Reaching Viability Thresholds

Lithium-ion battery energy density has improved to commercially viable levels. Modern aviation-grade batteries achieve:

- 250-300 Wh/kg energy density (significant improvement from 150 Wh/kg five years ago)

- 30-45 minute rapid charging capability for urban operations

- 2,000+ charge cycles maintaining 80% capacity

- Aviation-certified thermal management systems

These improvements make electric aircraft viable for specific route types under 300 kilometers, though longer ranges remain challenging.

3. Operating Cost Advantages for Specific Applications

Electric aircraft deliver compelling economics for targeted use cases. For detailed cost analysis, see our eVTOL vs helicopter cost comparison:

- 75-90% lower fuel costs (electricity vs. jet fuel) for short routes

- 50-60% lower maintenance costs (fewer moving parts, simplified systems)

- Reduced noise penalties at airports

- Faster crew training and aircraft turnaround times

These advantages are most pronounced on routes under 200 kilometers where battery weight penalties remain manageable.

4. Infrastructure Investment Accelerating

The infrastructure challenge is being addressed through coordinated investment:

- Over 150 airports globally have installed electric aircraft charging stations

- Vertiport construction projects in major urban centers

- Private investment in charging infrastructure exceeded $8 billion between 2024-2025

5. Technology Transfer from Automotive Industry

Electric aviation benefits from automotive EV development scaling. Battery technology, power electronics, and thermal management systems proven in automotive applications transfer to aviation with modifications, reducing development risk and accelerating timelines.

Leading Electric Aircraft Companies by Certification Progress

The electric aircraft industry features a mix of well-funded startups and established aerospace manufacturers. Here’s analysis of the leading companies based on actual certification progress and verified achievements. For comprehensive rankings, see our detailed eVTOL manufacturers ranking 2025.

Ranking Methodology

Companies evaluated across verified criteria:

- FAA/EASA certification progress (stages completed)

- Actual funding raised and financial backing

- Real partnerships and orders

- Flight testing achievements

- Manufacturing capabilities

Joby Aviation: Certification Leader

Headquarters: Santa Clara, California, USA Founded: 2009 Status: Public (NYSE: JOBY) Verified Funding: $2+ billion raised

Aircraft Specifications (S4):

- Passengers: 4 + 1 pilot

- Range: 150 miles with reserves

- Cruise Speed: 200 mph

- Propulsion: 6 electric motors

Why Leading: Joby has completed approximately 70% of Stage 4 FAA certification requirements as of Q3 2025, positioning the company for Type Inspection Authorization testing where FAA pilots will directly evaluate the aircraft. This represents the most advanced certification progress of any eVTOL manufacturer.

Verified Recent Achievements:

- Completed over 40,000 flight miles across multiple aircraft

- Successfully completed static load testing of tail structure for FAA credit

- Started final assembly of first FAA-conforming aircraft at Marina, California facility

- Achieved milestone of flying two aircraft simultaneously

Strategic Partnerships:

- Toyota Motor investment exceeding $1 billion total

- Delta Air Lines partnership for airline integration

- U.S. Air Force Agility Prime contract

For comparison with traditional helicopter services, our eVTOL cost analysis demonstrates the economic case Joby is building.

Archer Aviation: Manufacturing Strategy Focus

Headquarters: San Jose, California, USA Founded: 2018 Status: Public (NYSE: ACHR) Verified Funding: $1+ billion raised

Aircraft Specifications (Midnight):

- Passengers: 4 + 1 pilot

- Range: 100 miles optimized for urban operations

- Cruise Speed: 150 mph

- Propulsion: 12 electric motors with tilt capability

Certification Status: Approximately 15% of Stage 4 FAA certification requirements completed as of Q3 2025. Archer received Part 141 certificate from FAA in February 2025 for pilot training operations.

Manufacturing Approach: Partnership with Stellantis for production scaling, potentially accelerating manufacturing once certification achieved.

Strategic Partnerships:

- United Airlines partnership with aircraft orders

- UAE operations partnerships for international expansion

- Participation in FAA’s eVTOL Integration Pilot Program

Understanding private aviation market context helps evaluate Archer’s strategy – see our NetJets vs VistaJet comparison for insights on how established operators approach new aircraft types.

EHang: First Certified eVTOL (China Market)

Headquarters: Guangzhou, China Founded: 2014 Status: Public (NASDAQ: EH)

Aircraft Specifications (EH216-S):

- Passengers: 2 (autonomous operation)

- Range: 19 miles (limited urban applications)

- Top Speed: 81 mph

- Propulsion: 16 electric rotors

Achievement: First and only eVTOL with Type Certification (China’s CAAC, October 2023) and conducting commercial operations in multiple Chinese cities.

Limitations: Very limited range restricts applications to ultra-short urban routes. International certification remains pending.

Eviation Aircraft: Regional Electric Aviation

Headquarters: Arlington, Washington, USA Founded: 2015 Focus: All-electric commuter aircraft

Aircraft Specifications (Alice):

- Passengers: 9 passengers

- Range: 287 miles

- Cruise Speed: 253 mph

- Propulsion: 2 electric motors

Status: Successfully completed first flight in September 2022. Ongoing FAA certification process with orders from DHL (12 aircraft), Cape Air, and other regional operators.

Market Position: Leading the all-electric fixed-wing regional aircraft segment with different market focus than eVTOL competitors. For context on regional aviation markets, see our guide to private jet travel to Japan.

Heart Aerospace: Hybrid-Electric Approach

Headquarters: Gothenburg, Sweden Founded: 2018 Focus: Hybrid-electric regional aircraft

Aircraft Specifications (ES-30):

- Passengers: 30 passengers

- All-Electric Range: 124 miles

- Hybrid Range: 248 miles

- Propulsion: Electric motors + turbine generators

Strategy: Hybrid approach addresses range limitations of pure electric systems while providing emissions reductions. Over 250 aircraft on order from United Airlines, Air Canada, and other carriers.

Other Notable Companies

Vertical Aerospace (UK): Strong airline partnerships with American Airlines and Virgin Atlantic, though facing execution challenges and funding pressures.

Lilium (Germany): Unique ducted fan design with European focus, but certification timeline extending into 2026-2027.

Beta Technologies (Vermont): Focus on cargo operations first with military contracts, building charging infrastructure network.

Technology Comparison: Battery vs. Hybrid vs. Hydrogen

The electric aircraft market 2025 features three distinct propulsion approaches, each with verified capabilities and limitations:

All-Battery Electric

How it works: Lithium-ion battery packs power electric motors directly.

Verified Advantages:

- Zero direct emissions during operation

- Simplest system architecture

- Lowest operating costs for suitable routes

- Quietest operation profile

- Proven technology base from automotive sector

Current Limitations:

- Range practically limited to 150-300 miles with current technology

- Significant weight penalty from battery systems

- Charging infrastructure requirements

- Charging time typically 30-90 minutes

- Battery replacement costs every 8-12 years

Best Applications: Urban air mobility, short regional routes under 300km, flight training

Leading Examples: Joby Aviation, Archer Aviation, Eviation Aircraft

For economic analysis of these applications, see our charter vs ownership cost comparison.

Hybrid-Electric

How it works: Combines electric motors with conventional turbine or piston engines for extended range capability.

Advantages:

- Extended range (300-500+ miles possible)

- Uses existing fuel infrastructure

- Operational redundancy from multiple power sources

- Transition technology allowing gradual electrification

Trade-offs:

- Still produces emissions (though 50-70% reduction possible)

- More complex systems than pure electric

- Higher maintenance requirements than pure electric

- Weight penalty from dual powertrains

Best Applications: Regional airlines, 300-500 mile routes, transition technology for fleet operators

Leading Examples: Heart Aerospace ES-30, Ampaire Eco Caravan retrofits

Hydrogen Fuel Cell Electric

How it works: Hydrogen fuel cells generate electricity to power electric motors.

Theoretical Advantages:

- Longer range potential (500+ miles)

- Faster refueling similar to conventional aircraft

- Only water vapor as operational byproduct

- Higher energy density than batteries

Current Limitations:

- Hydrogen infrastructure essentially nonexistent for aviation

- Hydrogen storage complexity (high pressure or cryogenic systems)

- Fuel cell system weight and complexity

- Less mature technology for aviation applications

- Hydrogen production methods affect overall carbon footprint

Best Applications: Longer regional routes, airports investing in hydrogen infrastructure

Leading Examples: ZeroAvia (targeting 2027 certification)

The electric aircraft market 2025 accommodates different technologies for different mission requirements rather than a single winning approach.

Investment Analysis: VC Funding and Market Reality

The electric aircraft market 2025 has attracted substantial investment, though with realistic assessment of risks and timelines:

Who’s Investing and Why

Strategic Corporate Investors:

- Airlines: United, Delta, American investing to secure future technology options

- Automotive: Toyota (Joby), Stellantis (Archer) bringing manufacturing expertise

- Aerospace: Boeing, Honeywell, Rolls-Royce positioning for market evolution

Financial Investors:

- Growth venture capital firms betting on category leaders

- Late-stage growth funds: Fidelity, TPG in public companies

- Public markets: Retail and institutional investors in listed companies

Investment Reality Check

Capital Requirements: Electric aircraft development requires $500M-$2B to reach production scale, creating high barriers for new entrants.

Current Cash Positions:

- Joby Aviation: $933 million in cash and equivalents (Q3 2025)

- Archer Aviation: $834 million in cash reserves (year-end 2024)

- Both companies pre-revenue with significant cash burn rates

Investment Risks and Mitigation

High Risk Factors:

- Certification delays extending development timelines

- Technology execution challenges in battery and systems integration

- Market adoption uncertainty for new transportation modes

- Infrastructure development requirements

- Regulatory changes affecting certification requirements

Risk Mitigation Approaches:

- Focus on companies with meaningful certification progress

- Diversify across different technology approaches

- Emphasize strategic corporate backing for execution support

- Realistic timeline expectations (2026-2028 for initial commercial operations)

Emerging Investment Models

The intersection of traditional aviation finance and blockchain technology is creating new investment opportunities. BlackRock’s tokenized assets platform demonstrates how major financial institutions are exploring fractional ownership models for expensive aviation assets.

Tokenized Aircraft Ownership Concept:

- Aircraft ownership structured through special purpose vehicles

- Ownership interests tokenized as digital securities

- Investors purchase fractional shares

- Aircraft operations generate revenue for token holders

- Blockchain provides transparent accounting and distribution

For more on institutional adoption of these models, see our analysis of institutional blockchain infrastructure and advanced trading platforms.

Regional Market Breakdown

Electric aircraft adoption varies significantly by geographic region based on regulatory environment, infrastructure investment, and market characteristics:

North America: Manufacturing and Regulatory Hub

Market Share: 44.70% revenue share in 2024

Advantages:

- FAA establishment of powered-lift certification category

- Trump administration eVTOL Integration Pilot Program

- Strong venture capital ecosystem

- Leading manufacturers (Joby, Archer, Beta Technologies)

Key Markets:

- United States: $3.69 billion in 2024, projected $23.58 billion by 2034

- Canada: Emerging interest with strong aerospace manufacturing base

The broader context of North American luxury aviation is covered in our private jet market analysis and regional trends like Zurich private jet services.

Europe: Regulatory Leadership

Market Performance: Europe was the largest revenue generating market in 2024, with over 36.84% share in the More Electric Aircraft segment.

Strengths:

- EASA leading certification standards development

- Aggressive carbon pricing creating economic incentives

- Strong automotive partnerships (Airbus, Lilium, Volocopter)

- Government support programs

Key Markets:

- Germany: Lilium, Volocopter headquarters with strong industrial ecosystem

- United Kingdom: Vertical Aerospace, supportive regulatory environment

- Nordic Countries: Heart Aerospace targeting regional route applications

For European aviation context, see our guides on luxury travel in Zurich and Swiss helicopter operations.

Asia-Pacific: Emerging Market Leadership

Growth Profile: Fastest growing region with significant government support

Key Developments:

- China: EHang certified and operating commercially; massive manufacturing potential

- Japan: Partnerships with Joby and Archer for urban networks

- Singapore: Smart city infrastructure supporting eVTOL integration

- South Korea: Supernal (Hyundai) developing domestic eVTOL capabilities

For regional aviation insights, see our comprehensive Japan aviation guide and Latin America market analysis.

Middle East: Early Adopter Markets

Characteristics: High-wealth demographics and government innovation support

Key Markets:

- UAE: Joby and Archer planning commercial launches 2025-2026

- Saudi Arabia: Major aircraft orders and infrastructure investment

The integration of advanced financial technology in these markets, including private banking innovations, could accelerate aircraft financing models.

Challenges Facing the Electric Aircraft Market 2025

Despite growth momentum, electric aircraft face significant obstacles requiring realistic assessment:

1. Certification Timeline Reality

The Challenge: Aviation certification remains time-consuming and expensive with unpredictable timelines.

Even leader Joby Aviation has completed only 70% of Stage 4 requirements, while Archer stands at 15% completion. The FAA and EASA require extensive testing including:

- Thousands of test flights under various conditions

- Extreme environment testing (icing, lightning, bird strikes)

- Systems redundancy verification across all components

- Manufacturing process validation

- Comprehensive pilot training program development

Timeline Reality: Most companies now targeting 2026-2027 for initial commercial operations rather than earlier projections.

2. Battery Technology Constraints

The Fundamental Challenge: Physics limitations of current battery technology.

Current Reality:

- Jet fuel: ~12,000 Wh/kg energy density

- Best aviation lithium-ion batteries: ~300 Wh/kg

- 40x energy density difference

This constraint means aircraft would require electric batteries that weigh 30 times more than current fuel loads to achieve equivalent range, practically limiting electric aircraft to routes under 300-500 kilometers.

Progress Timeline: Industry experts indicate that batteries enabling longer commercial flights may not be available until the late 2030s to early 2040s.

3. Infrastructure Development Requirements

The Challenge: Electric aircraft need charging infrastructure that largely doesn’t exist.

Current Status:

- ~150 airports globally have electric aircraft charging (small fraction of commercial airports)

- ~50 vertiports in development worldwide for urban air mobility

- Hydrogen infrastructure essentially nonexistent for aviation

- Investment requirement: $50-100 billion globally over next decade

4. Operating Model Uncertainty

The Challenge: Limited real-world operational experience.

Airlines and operators lack experience with electric aircraft operations including maintenance procedures, pilot training requirements, dispatch reliability, and integration with existing networks. Early operations will likely reveal unforeseen challenges requiring iterative solutions.

5. Market Adoption Risk

The Challenge: Demand validation at commercial price points.

Business models assume market acceptance at prices covering operational costs, but actual consumer and business adoption won’t be validated until commercial service launches. Early adopter markets may not represent broader demand patterns.

For perspective on luxury transportation adoption patterns, see our analysis of luxury travel services and premium travel trends.

Future Outlook: 2025-2034 Projections

Realistic assessment of electric aircraft market development over the next decade:

Near-Term Catalysts (2025-2027)

Certification Milestones: Joby targeting Type Inspection Authorization testing in 2025 with commercial operations possible by early 2026. First certifications will validate technology and regulatory pathways.

Initial Commercial Operations: Multiple companies planning limited commercial launches between 2025-2026, primarily in Middle Eastern markets with supportive regulatory environments.

Infrastructure Development: Charging networks expanding in major urban centers; vertiport construction accelerating based on early operational validation.

Medium-Term Evolution (2027-2030)

Technology Improvements: Battery energy density continuing to improve at 5-8% annually, gradually expanding practical range and reducing costs.

Market Expansion: Successful initial operations leading to route network development and gradual scaling in urban air mobility markets.

Manufacturing Scale-Up: Leading companies transitioning from prototype production to serial manufacturing with typical scaling challenges.

Long-Term Projections (2030-2034)

Market Maturation: The Electric Aircraft market projected to grow from USD 11.68 billion in 2025 to USD 19.42 billion by 2029, representing sustained but measured growth rather than explosive expansion.

Technology Diversification:

- Battery-electric dominating urban and short-haul applications

- Hybrid-electric becoming standard for regional aircraft

- Hydrogen fuel cell aircraft potentially reaching commercialization for specific longer-range applications

Regulatory Evolution: Autonomous flight capabilities beginning to receive approval for cargo operations, potentially extending to passenger applications later in the period.

Key Assumptions and Risks

Growth Assumptions:

- Battery technology continues improving at current rates

- Regulatory frameworks remain supportive

- Infrastructure investment sustained

- No major safety incidents undermining public confidence

- Economic conditions supporting capital-intensive aviation investments

Downside Risks:

- Certification delays extending commercialization

- Battery technology improvement plateaus

- Economic conditions reducing aviation demand

- Safety incidents affecting public acceptance

- Competition from sustainable aviation fuels providing easier transition path

The integration of advanced technologies including AI in aviation operations will be crucial for optimizing electric aircraft networks and operational efficiency.

Key Takeaways: Electric Aircraft Market 2025

Market Reality

Verified Market Size: $13.71 billion in 2025 growing to $74.25 billion by 2034 represents substantial opportunity while remaining grounded in current technological capabilities and market realities.

Growth Drivers: Environmental regulations, technological maturity in specific applications, economic advantages for short routes, and established regulatory frameworks creating genuine momentum.

Technology Status

Current Capabilities:

- eVTOL aircraft approaching commercial viability for urban routes under 150 miles

- Regional electric aircraft viable for specific short-haul applications under 300 miles

- Battery limitations constraining broader applications to shorter ranges

- Hybrid-electric emerging as bridge technology for medium-range flights

Timeline Reality: Commercial electric aviation will initially serve niche applications before potential broader adoption, with longer-range electric aviation requiring technological breakthroughs likely in the 2030s.

Investment Perspective

Opportunity Assessment:

- High-risk, high-reward sector with substantial technical and regulatory challenges

- Leading companies with demonstrated certification progress (Joby, Archer, Eviation) offer best risk-adjusted opportunities

- Strategic corporate backing and airline partnerships reduce execution risk

- Realistic timeline expectations essential for investment success

Innovation in Financing: Emerging blockchain-based ownership models and tokenized asset platforms creating new investment access for aviation infrastructure.

Industry Transformation

Electric aircraft will transform specific aviation segments rather than broadly replacing conventional aircraft in the near term. Urban air mobility and short-haul routes under 300 miles offer the most promising applications, while longer-range electric aviation remains a longer-term prospect requiring significant technological advancement.

Competitive Context: Understanding how electric aircraft fit within broader aviation trends requires examining traditional markets including private jet vs commercial aviation and emerging technologies like AI-powered aviation systems.

The electric aircraft market represents legitimate innovation in aviation technology with genuine commercial potential, but success requires realistic assessment of technological constraints, regulatory timelines, and market adoption patterns. Companies with proven technology, strategic partnerships, and conservative timeline planning are best positioned to capitalize on this emerging opportunity. Electric Aircraft market projected to grow from USD 11.68 billion in 2025 to USD 19.42 billion by 2029, representing sustained but measured growth rather than explosive expansion.

Technology Diversification:

- Battery-electric dominating urban and short-haul applications

- Hybrid-electric becoming standard for regional aircraft

- Hydrogen fuel cell aircraft potentially reaching commercialization for specific longer-range applications

Regulatory Evolution: Autonomous flight capabilities beginning to receive approval for cargo operations, potentially extending to passenger applications later in the period.

Key Assumptions and Risks

Growth Assumptions:

- Battery technology continues improving at current rates

- Regulatory frameworks remain supportive

- Infrastructure investment sustained

- No major safety incidents undermining public confidence

- Economic conditions supporting capital-intensive aviation investments

Downside Risks:

- Certification delays extending commercialization

- Battery technology improvement plateaus

- Economic conditions reducing aviation demand

- Safety incidents affecting public acceptance

- Competition from sustainable aviation fuels providing easier transition path

The integration of advanced technologies, such as AI in aviation operations, will play a key role in optimizing electric aircraft networks and improving overall operational efficiency.

Key Takeaways: Electric Aircraft Market 2025

Market Reality

Verified Market Size: $13.71 billion in 2025 growing to $74.25 billion by 2034 represents substantial opportunity while remaining grounded in current technological capabilities and market realities.

Growth Drivers: Environmental regulations, technological maturity in specific applications, economic advantages for short routes, and established regulatory frameworks creating genuine momentum.

Technology Status

Current Capabilities:

- eVTOL aircraft approaching commercial viability for urban routes under 150 miles

- Regional electric aircraft viable for specific short-haul applications under 300 miles

- Battery limitations constraining broader applications to shorter ranges

- Hybrid-electric emerging as bridge technology for medium-range flights

Timeline Reality: Commercial electric aviation will initially serve niche applications before potential broader adoption, with longer-range electric aviation requiring technological breakthroughs likely in the 2030s.

Investment Perspective

Opportunity Assessment:

- High-risk, high-reward sector with substantial technical and regulatory challenges

- Leading companies with demonstrated certification progress (Joby, Archer, Eviation) offer best risk-adjusted opportunities

- Strategic corporate backing and airline partnerships reduce execution risk

- Realistic timeline expectations essential for investment success

Innovation in Financing: Emerging blockchain-based ownership models and tokenized asset platforms are opening new investment opportunities in aviation infrastructure.

Industry Transformation

Electric aircraft are set to transform targeted segments of aviation rather than replace conventional aircraft across the board in the near future. Urban air mobility and short-haul routes under 300 miles present the strongest commercial potential, while long-range electric aviation remains a future prospect that depends on substantial technological progress.

Competitive Context:

Understanding where electric aircraft fit within the broader aviation landscape requires examining established markets such as private jet vs commercial aviation and emerging innovations like AI-powered aviation systems.

The electric aircraft market represents a credible evolution in aviation technology with real commercial promise. However, achieving success depends on clear recognition of technological limits, regulatory pacing, and realistic market adoption curves. Companies combining proven technology, strategic alliances, and pragmatic development timelines will be best positioned to capture value in this growing sector.