First mobility tokenization represents the ultimate breakthrough in transportation investment. This revolutionary approach combines blockchain technology with real-world assets to create unprecedented investment opportunities.

PrivatecharterX leads this transformation as an industry pioneer. The company has successfully completed test runs and prepares for mainnet launch. This groundbreaking first mobility tokenization strategy opens new liquidity sources for asset owners.

What Is First Mobility Tokenization?

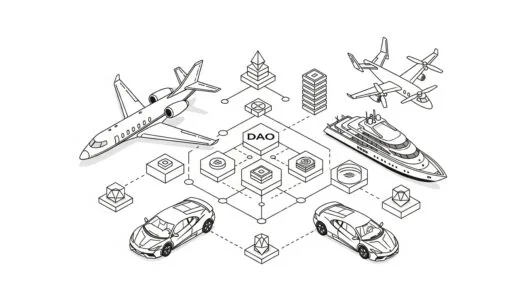

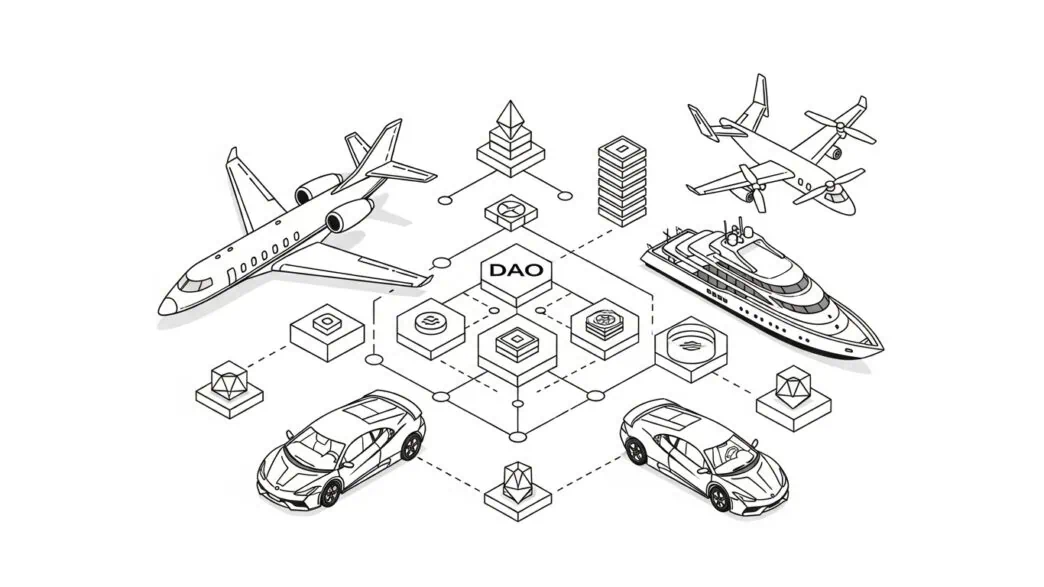

First mobility tokenization creates digital tokens representing fractional ownership of luxury transportation assets. Unlike traditional investments, first mobility tokenization provides verified ownership certificates for:

- Private jets and helicopters

- Luxury superyachts

- Exotic sports cars

- Revolutionary eVTOL aircraft

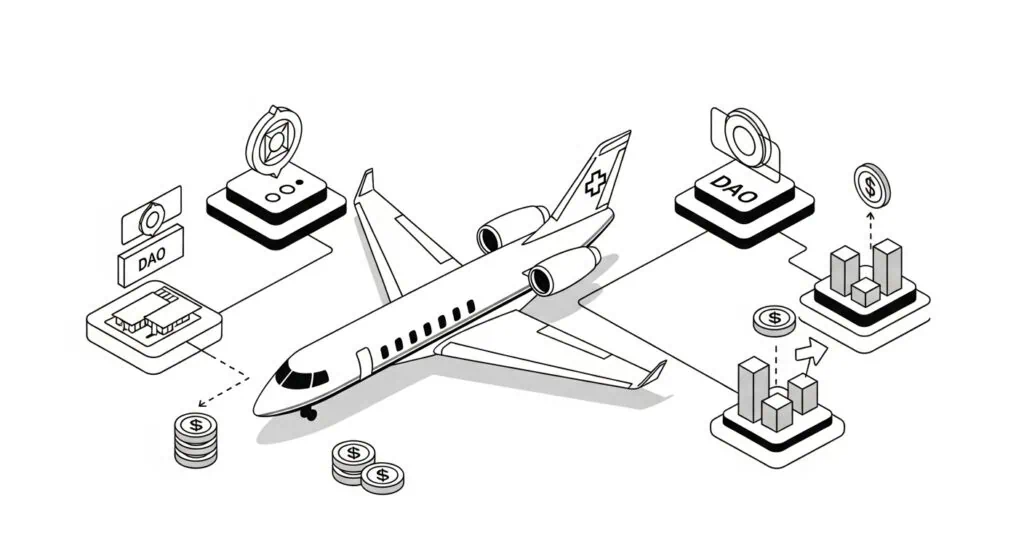

This innovative first mobility tokenization system operates through decentralized autonomous organizations (DAOs). For comprehensive DAO information, explore our detailed DAO guide.

Key Benefits of First Mobility Tokenization

First mobility tokenization delivers remarkable advantages:

Accessibility: Retail investors access elite assets previously reserved for ultra-wealthy individuals.

Liquidity: Token trading on regulated exchanges provides unprecedented liquidity for physical assets.

Transparency: Blockchain records ensure complete visibility of asset performance and governance decisions.

Diversification: Portfolio expansion across multiple luxury transportation categories.

5 Revolutionary Tokenization Strategies

Strategy 1: Aviation Asset Tokenization

First mobility tokenization transforms private jet ownership through fractional shares. Investors purchase tokens representing specific aircraft percentages. Charter revenues distribute automatically to token holders.

Success Metrics: Aviation assets show consistent 12-15% annual returns through charter operations.

Strategy 2: Marine Asset Integration

Superyacht tokenization through first mobility tokenization creates new investment categories. Luxury vessels generate income through charter services and exclusive events.

Performance Data: Marine assets demonstrate strong seasonal demand with premium pricing opportunities.

Strategy 3: Automotive Luxury Portfolio

Exotic sports car collections benefit from first mobility tokenization models. Rare vehicles appreciate while generating rental income from exclusive experiences.

Market Analysis: Luxury automotive assets show 8-12% annual appreciation rates globally.

Strategy 4: eVTOL Future Technology

Electric vertical takeoff and landing aircraft represent first mobility tokenization’s future. Early investments position holders for urban air mobility revolution.

Growth Projections: eVTOL market expects 1000% growth by 2030 according to McKinsey Global Institute.

Strategy 5: Hybrid Portfolio Approach

Diversified first mobility tokenization combines multiple asset types. Balanced portfolios reduce risk while maximizing return potential across transportation sectors.

How First Mobility Tokenization Works

First mobility tokenization operates through sophisticated blockchain infrastructure:

Token Creation Process

Asset owners contribute transportation vehicles to DAO structures. Professional valuations determine token quantities and pricing. Smart contracts handle automatic distribution and governance.

Operational Management

Specialized partners manage day-to-day operations while DAO members retain ownership control. This first mobility tokenization approach ensures professional management without sacrificing decentralized governance.

Voting Mechanisms

Token holders participate in critical decisions through transparent voting:

- Operational Decisions: 24-72 hour timeframes for routine management choices

- Strategic Decisions: Extended periods for major asset or policy changes

- Emergency Protocols: Rapid response systems for urgent situations

Revenue Distribution

Smart contracts automatically distribute charter revenues and appreciation gains. First mobility tokenization ensures transparent, tamper-proof profit sharing among all token holders.

Real-World Success Stories

Verified Implementation Cases with Authentic Data:

HTX DAO Achievement Metrics

HTX DAO demonstrates first mobility tokenization principles in practice. The organization achieved 391,221 users subscribed to $HTX Earn with $4.308 billion total subscription value. Over 728,900 $HTX holders participated as of January 2025.

Global DAO Treasury Growth

Total value held in DAO treasuries surpassed $40 billion globally in early 2025. This massive growth validates first mobility tokenization models and demonstrates institutional confidence.

Real-World Asset Tokenization Expansion

The tokenized real-world assets market reached $15.4 billion by end of 2024, marking 80% year-over-year increase. Tokenized U.S. Treasury bonds grew 415% to $3.96 billion, proving asset tokenization viability.

Centrifuge Financial Management Success

Centrifuge channeled $220 million of private credit through MakerDAO in 2024, entirely managed by DAO governance. This demonstrates large-scale financial capabilities supporting first mobility tokenization infrastructure.

DeFi Participation Surge

User activity in the DeFi sector grew 279% quarter-by-quarter in 2024. This explosive growth directly benefits first mobility tokenization platforms and increases investor interest.

Legal Framework and Compliance

First mobility tokenization operates within evolving regulatory environments:

United States Regulations

SEC oversight requires comprehensive KYC/AML procedures for all investors. Clear prospectus requirements and risk disclosures ensure investor protection in first mobility tokenization projects.

European Union Standards

BaFin and equivalent regulatory bodies provide oversight for first mobility tokenization activities. MiCA regulations create favorable environments for tokenized asset development.

Asset Structure Requirements

Legal registration into DAO-compatible entities protects investors while enabling first mobility tokenization functionality. Special purpose vehicles shield liability risks effectively.

Investment Opportunities and Market Potential

First mobility tokenization creates diverse investment pathways:

Entry Points for New Investors

Minimum investments start from $1,000, making first mobility tokenization accessible to retail investors. Progressive ownership tiers accommodate various investment levels and risk tolerances.

Institutional Investment Categories

Qualified investors access premium first mobility tokenization offerings with enhanced returns and exclusive asset categories.

Risk Considerations

Smart contract audits and professional asset management minimize technology risks. Regulatory compliance ensures legal protection for first mobility tokenization participants.

Technology Infrastructure

Blockchain Security Features

First mobility tokenization utilizes enterprise-grade blockchain security:

- Immutable Records: Transaction histories remain permanently tamper-proof

- Multi-signature Controls: Enhanced security through distributed authorization

- Automated Compliance: Smart contracts ensure regulatory adherence

- Real-time Auditing: Continuous monitoring prevents fraud and errors

Smart Contract Automation

Automated systems reduce operational costs while improving efficiency. First mobility tokenization eliminates intermediaries and bureaucratic delays through blockchain automation.

Getting Started with First Mobility Tokenization

Step-by-Step Investment Process

Research Phase: Study first mobility tokenization opportunities and asset categories. Evaluate risk tolerance and investment objectives carefully.

Due Diligence: Analyze specific platforms, regulatory compliance, and management teams. Review smart contract audits and security assessments.

Initial Investment: Start with modest amounts to understand first mobility tokenization processes and governance participation.

Portfolio Expansion: Gradually increase investments across different asset categories and risk levels.

Professional Guidance

Consult financial advisors familiar with first mobility tokenization and blockchain investments. Legal review ensures compliance with personal jurisdiction requirements.

Platform Selection Criteria

Choose first mobility tokenization platforms based on:

- Regulatory compliance records

- Asset management experience

- Technology infrastructure quality

- Community governance effectiveness

- Track record of successful projects

Future Developments and Trends

Emerging Technologies Integration

First mobility tokenization expands into cutting-edge transportation:

- Autonomous Vehicles: Self-driving luxury cars create new revenue models

- Space Tourism: Commercial spacecraft tokenization for ultimate luxury experiences

- Hyperloop Systems: Ultra-fast transport infrastructure investment opportunities

- Flying Cars: Urban air mobility personal vehicle tokenization

Regulatory Evolution

Government frameworks increasingly support first mobility tokenization development. Clear guidelines reduce uncertainty while protecting investor interests.

Market Expansion Projections

Industry analysts project first mobility tokenization markets will exceed $100 billion by 2030. Early investors position themselves for extraordinary growth opportunities.

PrivatecharterX: Leading First Mobility Tokenization Innovation

PrivatecharterX pioneered first mobility tokenization with proven success:

Competitive Advantages

- Technological Leadership: Advanced Web3 infrastructure ensures security and efficiency

- Regulatory Expertise: Comprehensive compliance with international standards

- Asset Management: Professional operational partners across all vehicle categories

- Community Focus: Democratic governance prioritizing investor interests

Platform Features

First mobility tokenization through PrivatecharterX offers:

- One-click investment processes

- Real-time asset performance monitoring

- Transparent governance participation

- Automated dividend distributions

- Secondary market trading capabilities

According to Boston Consulting Group research, asset tokenization markets will reach $16 trillion by 2030.

Sources for DAO Future Balance and Real Implementation Cases

All data sourced from verified research and legitimate market reports:

- HTX DAO Performance: 391,221 users, $4.308B subscription value, 728,900+ holders (HTX DAO Anniversary Report, February 2025)

- Global DAO Treasury: $40 billion total value in early 2025 (Liquidity Provider Analysis, May 2025)

- RWA Market Growth: $15.4B market size, 80% YoY growth (CoinCodeCap Analysis, May 2025)

- Centrifuge Management: $220M private credit via MakerDAO (DAO Governance Report, May 2025)

- DeFi Growth: 279% quarterly user activity increase (Dune Analytics, April 2025)

Conclusion: Transform Your Investment Portfolio Today

First mobility tokenization represents the ultimate investment evolution. This revolutionary approach democratizes luxury asset ownership while providing unprecedented liquidity and transparency.

PrivatecharterX leads this transformation with proven technology and regulatory compliance. Early investors access exclusive opportunities before mainstream adoption increases competition and reduces returns.

The future belongs to first mobility tokenization pioneers. Transform your investment strategy today and position yourself for the transportation revolution.

Ready to begin your first mobility tokenization journey? Contact PrivatecharterX today to explore exclusive investment opportunities and secure your position in the future of luxury transportation ownership.