Table of Content

- The Revolutionary Shift in Private Aviation Access

- How Fractional Jet Ownership Transformed Aviation Since 1987

- Understanding Fractional Jet Ownership vs Tokenization Models

- 7 Critical Differences: Fractional Jet Ownership vs Tokenization

- Real-World Cost Comparison Scenarios

- The Technology Behind Aviation Tokenization

- Future of Fractional Jet Ownership and Tokenization

- Decision Framework: Which Model Suits Your Needs?

The Revolutionary Shift in Private Aviation Access

Private aviation has experienced only two truly transformative moments in its history. The first came in 1987 when Richard Santulli launched NetJets, pioneering fractional jet ownership that made luxury aviation accessible beyond full aircraft purchasers. The second is happening right now: blockchain tokenization is dismantling the capital barriers that have defined private aviation for nearly four decades.

The stakes are enormous. According to Aviation Week, the fractional ownership market exceeded $8 billion annually, with NetJets controlling 64% of market share. Yet for all its success, traditional fractional jet ownership vs tokenization reveals fundamental limitations that blockchain technology systematically addresses.

This comprehensive analysis draws from industry data, aviation law expertise, and operational realities to provide the most detailed comparison of fractional jet ownership vs tokenization available.

How Fractional Jet Ownership Transformed Aviation Since 1987

The Birth of Fractional Aircraft Ownership

Before 1987, only two options existed for private flying: purchase a $20-70 million aircraft outright, or book on-demand charter with zero guarantees of availability, safety standards, or pricing consistency.

Richard Santulli revolutionized this binary choice. His fractional jet ownership model allowed corporations and ultra-high-net-worth families to purchase shares in aircraft—typically 1/16th, 1/8th, 1/4, or 1/2 shares—gaining guaranteed access to an entire managed fleet.

Warren Buffett recognized the model’s brilliance, acquiring NetJets for Berkshire Hathaway in 1998 for $725 million. By 2001, Embry-Riddle Aeronautical University research identified the optimal range for fractional ownership at 145-387 annual flight hours.

For a comprehensive overview of how fractional ownership compares to other private aviation models like NetJets and VistaJet, see our detailed comparison of luxury aviation providers.

The Traditional Fractional Jet Ownership Structure

Standard Share Allocations:

Annual Flight HoursAircraft ShareTypical Initial Investment50 hours1/16$1.25M - $4.4M100 hours1/8$2.5M - $8.75M200 hours1/4$5M - $17.5M400 hours1/2$10M - $35M800 hoursFull (1/1)$20M - $70M

Based on aircraft ranging from light jets ($20M) to ultra-long-range ($70M)

Additional Costs in Fractional Jet Ownership:

- Monthly management fees: $8,000 – $50,000

- Hourly flight rates: $2,500 – $8,000

- Fuel surcharges (variable)

- Enhanced catering

- Airport fees and taxes

- Ferry fees outside Primary Service Area

According to Business Jet Traveler, total annual costs for a 1/8 share typically range from $400,000 to $1.2 million depending on aircraft type and utilization.

Key Advantages That Made Fractional Ownership Revolutionary

Privacy & Operational Benefits:

- No publicly trackable tail numbers (critical for executives)

- Zero management burden (pilots, maintenance, regulations handled)

- Backup aircraft availability within hours

- Multi-aircraft simultaneous access (with restrictions)

- Access to diverse aircraft types for different mission profiles

Financial Benefits:

- Depreciation deductions as capital asset

- Predictable costs within Primary Service Area

- Professional flight department without internal staffing

Understanding Fractional Jet Ownership vs Tokenization Models

How Traditional Fractional Jet Ownership Works

The traditional model operates through interconnected legal agreements:

- Purchase Agreement: You buy a physical share in a specific aircraft

- Master Dry Lease Exchange: All owners agree to share aircraft access

- Management Agreement: Provider operates and maintains the fleet

- Guaranteed Access: Booking windows (typically 10-24 hours notice)

- Fixed Costs: Monthly management fees plus hourly rates

- Term Commitment: 3-5 years minimum, often extending to 10 years

- Buyback Provision: Provider repurchases share at market value (no guarantees)

James Butler, CEO of Shaircraft Solutions LLC and aviation attorney, emphasizes: “These documents govern your rights and obligations with respect to what most likely will be a multi-million dollar investment, and they are negotiable.”

How Private Jet Tokenization Works

Tokenization transforms fractional jet ownership vs tokenization from a comparison to a revolution. Instead of purchasing physical aircraft shares through complex legal structures, investors acquire digital tokens representing:

- Fractional ownership units (security tokens)

- Flight hour access rights (utility tokens)

- Revenue participation from charter operations

- Tradeable assets on secondary markets

- Automated profit distribution via smart contracts

For an in-depth exploration of the technology and infrastructure behind this revolution, read our comprehensive Private Jet Tokenization: Blockchain Investment Guide.

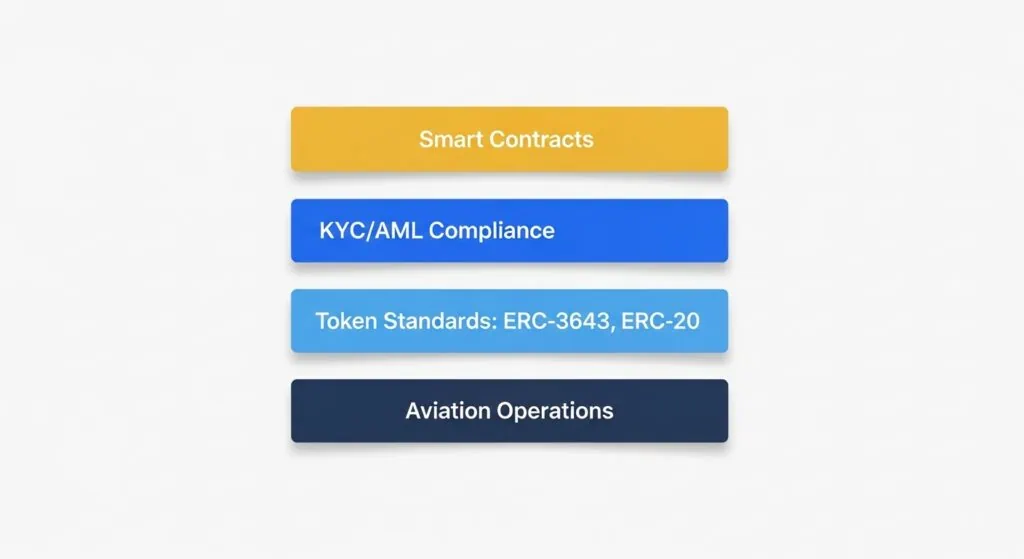

Key Technological Components:

According to Deloitte’s asset tokenization research, tokenization creates unprecedented transparency and liquidity in historically illiquid assets.

7 Critical Differences: Fractional Jet Ownership vs Tokenization

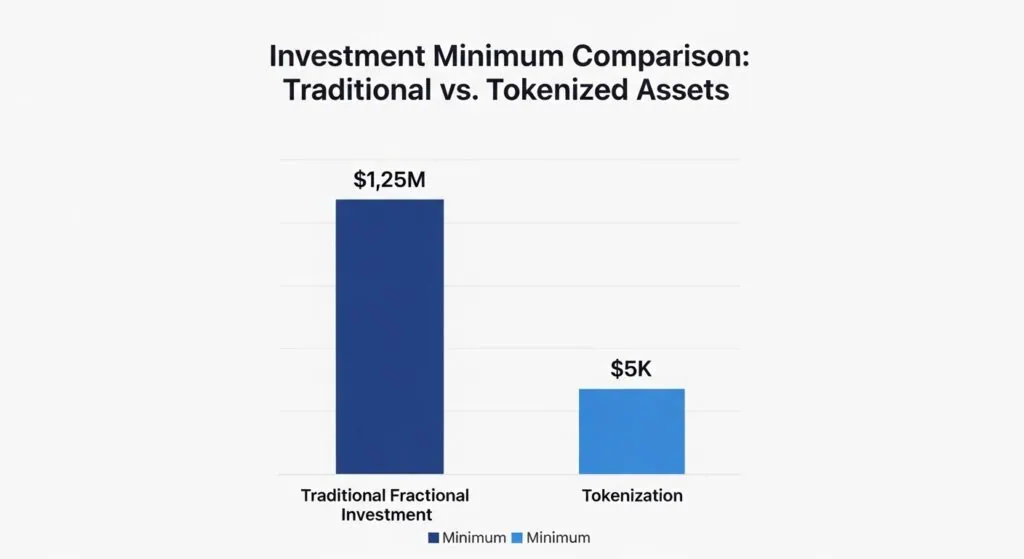

1. Capital Requirements & Entry Barriers

Traditional Fractional Ownership:

- Minimum investment: $1.25M – $4.4M (1/16 share)

- Upfront capital outlay required

- Working with 9 major providers globally (NetJets, Flexjet, PlaneSense, Flight Options, Airshare, Nicholas Air, Northern Jet, Airsprint, Traqpak)

Tokenization:

- Minimum investment: $5,000 – $50,000

- No aircraft purchase required

- Fractional tokens divisible to micro-levels

- 96% lower entry barrier

2. Liquidity & Exit Flexibility

Traditional Fractional Ownership:

- 3-10 year lock-up periods

- Early exit requires aviation attorney negotiation

- Limited internal marketplace (provider-dependent)

- Buyback value tied to aircraft depreciation (typically 9-10% annually per Corporate Jet Investor)

- No guaranteed minimum return

Case Study: A Bombardier Global Express purchased new in 2003 for $44.4M was worth only $13.5M by 2016—a 70% value decline impacting all shareowners.

Tokenization:

- No mandatory hold period

- Secondary market trading 24/7

- Instant liquidity (subject to market demand)

- Price discovery through open markets

- Exit flexibility within days, not years

- 95% faster liquidity compared to traditional models

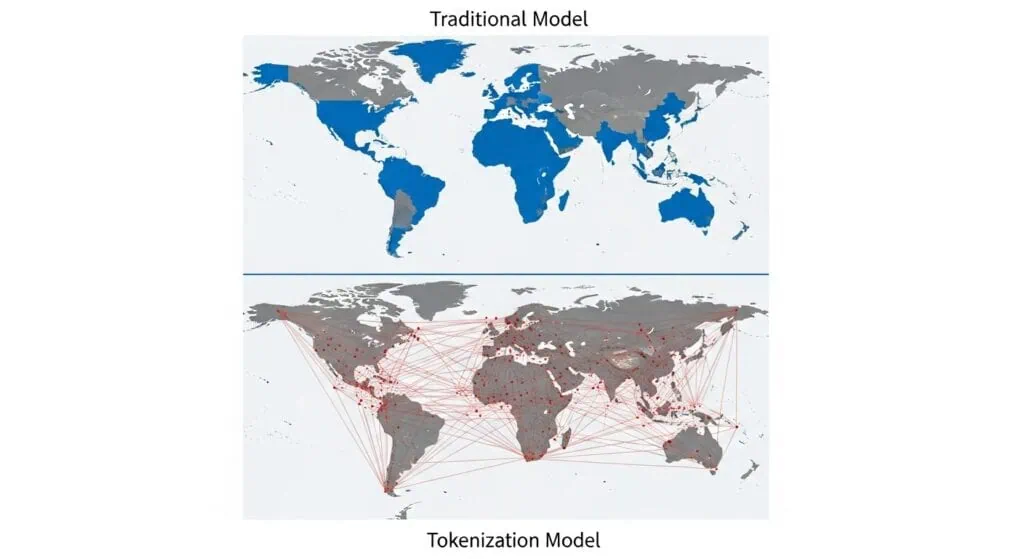

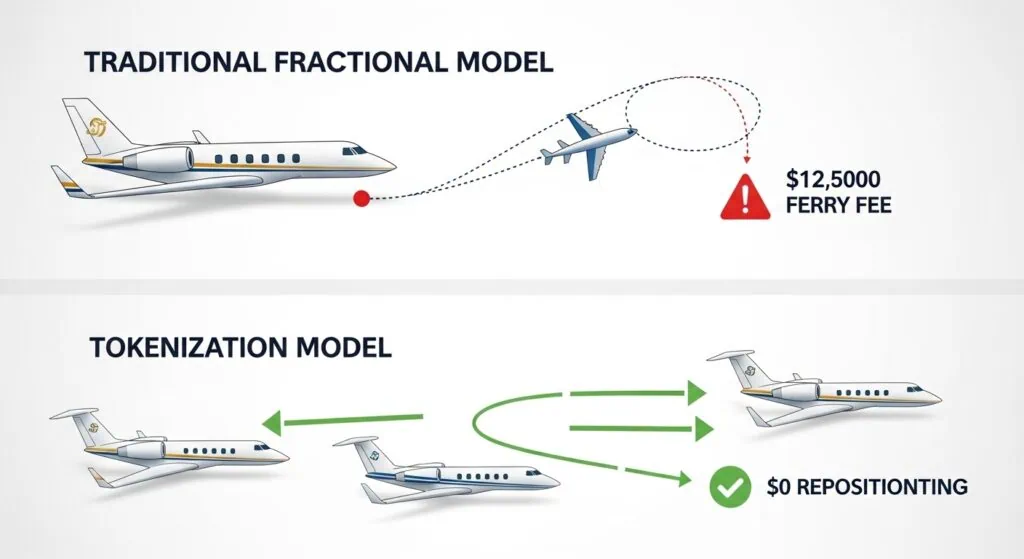

3. Geographic Flexibility & Ferry Fees

Traditional Fractional Ownership:

- Restricted to Primary Service Area (PSA)

- Ferry fees outside PSA: $5,000 – $25,000 per repositioning

- Crew overnight costs and per diems

- Limited international coverage

Example PSA Limitations:

- NetJets North America PSA: Continental US + parts of Caribbean

- European PSA: EU countries + select destinations

- Flying to Asia from US base: Significant ferry and crew costs

Tokenization:

- Global network access without geographic restrictions

- No ferry fees (aircraft positioned optimally via network)

- Dynamic fleet allocation based on demand patterns

- Estimated 20-30% cost reduction on international travel

4. Usage Flexibility & Hour Management

Traditional Fractional Ownership:

- Fixed annual hours (50, 100, 200, 400, 800)

- Excess hours charged at 15-25% premium

- Unused hours often lost (limited rollover/marketplace)

- Minimum flight time: 60 minutes (billed even for 30-minute flights)

- Peak day restrictions (3-hour departure time flexibility imposed)

Real Cost Example:

- Contract: 100 hours annually

- Used: 110 hours (pay premium)

- Next year used: 60 hours (40 hours wasted)

- Effective waste: 30% of contracted capacity

Tokenization:

- Purchase exact hours needed (no fixed brackets)

- Sell unused capacity on secondary markets

- Buy additional capacity at spot rates

- No minimum flight times

- Dynamic pricing based on real-time demand

- Zero hour waste potential

5. Transparency & Cost Predictability

Traditional Fractional Ownership:

- Fuel surcharges (unilateral provider adjustment)

- Opaque fee structures

- Variable catering and service charges

- Surprise repositioning costs

- No visibility into aircraft utilization/revenue

Tokenization:

- Blockchain-immutable transaction records

- Smart contract automated pricing

- Real-time cost visibility

- Transparent revenue sharing

- Maintenance records on-chain

- Every flight hour tracked and verifiable

According to PwC’s blockchain aviation report, blockchain provides “unprecedented transparency in asset utilization and revenue generation.”

6. Residual Value Risk & Depreciation

Traditional Fractional Ownership:

- Full depreciation risk borne by shareowner

- Average 9-10% annual depreciation

- Buyback value uncertain until contract end

- Market timing risk (selling during downturn)

Historical Volatility Example:

- Gulfstream IV (1987): Bought $17.8M, sold 2002 for ~$18M (stable)

- Global Express (2003): Bought $44.4M, worth 2016 $13.5M (-70%)

Tokenization:

- Residual value risk distributed across token holders

- Mark-to-market pricing (daily valuation)

- Portfolio diversification across multiple aircraft

- Exit before depreciation impacts value

- 70% risk mitigation through liquidity and diversification

7. Regulatory Compliance & Operational Standards

Traditional Fractional Ownership:

- FAA Part 91K regulations (fractional specific)

- Or Part 135 (on request, for litigation protection)

- Provider handles all compliance

- Established safety track record (NetJets: 60+ years)

Tokenization:

- Evolving regulatory framework (MiCA in Europe, SEC in US)

- Must comply with securities regulations

- KYC/AML requirements for token holders

- Operational aviation standards identical to traditional

- Additional blockchain/smart contract audits

European Union’s MiCA regulation provides clarity for tokenized assets, with full implementation by December 2024.

Real-World Cost Comparison Scenarios

Scenario 1: The Tech Executive with Variable Usage

Profile: Sarah, CEO of mid-market SaaS company, needs 80-120 hours annually with seasonal spikes.

Traditional Fractional Jet Ownership (1/8 Share Midsize Jet):

- Initial investment: $3.5M (1/8 of $28M aircraft)

- Monthly management: $45,000 ($540K annually)

- Hourly rate: $4,500

- Contract: 100 hours/year, 5 years

Year 1: 110 hours used

- Base cost: $540K management + $450K flight hours = $990K

- Excess 10 hours at 20% premium: $54K

- Total: $1,044,000

Year 2: 60 hours used (merger reduced travel)

- Base cost: $540K management + $270K flight hours = $810K

- 40 hours wasted (no refund): $180K opportunity cost

- Total: $810K effective, $180K wasted

5-Year Total:

- Initial: $3.5M

- Operating: $5.2M (average 90 hours/year utilization)

- Buyback: $2.1M (40% depreciation)

- Net Cost: $6.6M ($1.32M annually)

Tokenization Alternative:

- Year 1: Purchase 90 tokens at $8,500/hour = $765K

- Year 2: Sell 30 unused tokens at $8,000 = $240K recouped, net $525K for 60 hours used

- Year 3-5: Purchase as needed (85, 95, 80 tokens)

- No capital outlay

- No management fees

- 5-Year Total: $3.4M ($680K annually)

Savings: $3.2M (48% reduction) over 5 years

Learn more about how tokenization creates liquidity in aviation assets.

Scenario 2: The Family Office with Seasonal Needs

Profile: Marcus, managing $500M family office, heavy winter Caribbean/Aspen travel (80 hours Q1/Q4), minimal summer use (20 hours Q2/Q3).

Traditional Fractional Problem:

- Forced to purchase 100-hour annual commitment

- 50% utilization waste during off-peak quarters

- Cannot adjust capacity seasonally

Tokenization Solution:

- Q1: Purchase 40 heavy-jet tokens

- Q2: Purchase 10 light-jet tokens

- Q3: Purchase 10 light-jet tokens

- Q4: Purchase 40 heavy-jet tokens

- 40% annual cost reduction through seasonal flexibility

Scenario 3: The Multi-Location Corporation

Profile: Tech company with NYC, LA, Austin offices requiring regional flying.

Traditional Fractional Challenge:

- Single Primary Service Area

- Ferry fees for out-of-position aircraft: $8K-$15K per repositioning

- 30+ repositioning events annually = $240K-$450K added costs

Tokenization Advantage:

- Access regionally-positioned aircraft

- LA-SF: West Coast fleet

- NYC-BOS: Northeast fleet

- Austin-Houston: Southwest fleet

- $300K average annual savings eliminating ferry costs

The Technology Behind Aviation Tokenization

Blockchain Infrastructure for Private Jets

Smart Contract Architecture:

Modern aviation tokenization relies on sophisticated blockchain infrastructure:

Security Tokens (ERC-3643/ERC-1400 Standards):

- Represent actual aircraft ownership stakes

- Comply with securities regulations (MiCA in EU, SEC in US)

- Automated dividend distribution from charter revenue

- Built-in KYC/AML compliance and transfer restrictions

- ERC-3643 is the first permissioned token standard officially merged into Ethereum GitHub

Utility Tokens (ERC-20/ERC-721 Standards):

- Represent flight hour access rights

- Tradeable on secondary markets

- No securities classification (when properly structured)

- Redeemable for actual flights

According to World Economic Forum research, tokenization could unlock $24 trillion in currently illiquid assets globally.

Real-World Implementation: PrivateCharterX Model

PrivateCharterX pioneers the hybrid approach, combining operational charter expertise with blockchain tokenization. Their dual-token model demonstrates how traditional aviation knowledge merges with Web3 technology:

SPV-as-a-Service Infrastructure:

- Regulated custody providers handle compliance

- Institutional-grade security for digital assets

- Multi-jurisdiction SPV structures

- KYC/AML processes meeting banking standards

Learn more about Web3’s disruption of luxury travel.

Current Market Adoption

Tokenization Progress:

- 2023: Proof-of-concept phase

- 2024: First tokenized aircraft operational

- 2025: Multiple platforms launching

- 2026-2027 projection: $2B+ in tokenized aviation assets

According to Boston Consulting Group, tokenized assets will reach $16 trillion by 2030, with aviation representing a significant segment.

Future of Fractional Jet Ownership and Tokenization

The Hybrid Model Emerges

The most likely outcome isn’t wholesale replacement but evolution:

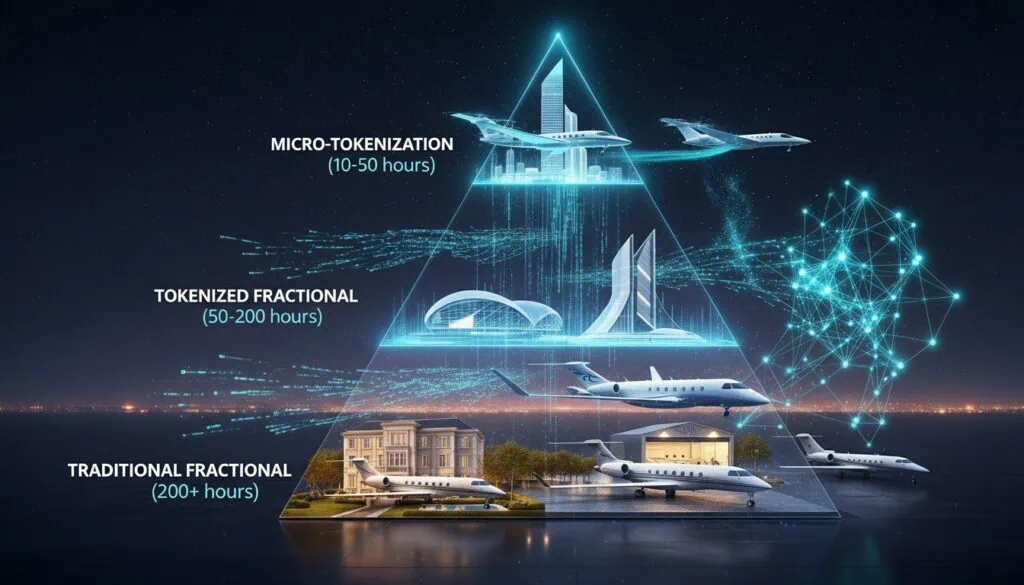

Traditional Fractional Shares (200+ hours):

- Remain optimal for high-volume, predictable fliers

- NetJets, Flexjet maintain premium positioning

- Established safety records and operational excellence

- Depreciation tax benefits for corporations

Tokenized Fractional Access (50-200 hours):

- Mid-tier users wanting flexibility

- Reduced capital requirements

- Secondary market liquidity

- Dynamic capacity adjustment

Micro-Tokenization (10-50 hours):

- Occasional private fliers

- Single-flight token purchases

- No long-term commitments

- Democratized access to private aviation

This hybrid approach is already being pioneered by platforms like PrivateCharterX, which combines operational charter services with blockchain tokenization.

Industry Transformation Timeline

2025-2026: Foundation Phase

- Regulatory clarity (MiCA in EU, SEC guidance in US)

- First major fractional provider integrates tokenization

- Secondary markets launch for aviation tokens

- Industry standards established

2027-2028: Acceleration Phase

- Traditional providers adopt hybrid models

- Token liquidity reaches critical mass

- Insurance and financing products mature

- $5B+ in tokenized aviation assets

2029-2030: Mainstream Phase

- Tokenization becomes standard offering

- Traditional fractional-only models decline

- New entrants without legacy infrastructure dominate growth

- $15B+ tokenized market

Morgan Stanley research projects tokenization will create $2 trillion in new market liquidity by 2030.

Decision Framework: Which Model Suits Your Needs?

Choose Traditional Fractional Jet Ownership If:

- Flight Pattern: 200+ predictable annual hours

- Aircraft Need: Specific aircraft configuration requirements

- Time Horizon: Stable 5+ year usage projections

- Financial Structure: Benefit from depreciation deductions

- Risk Tolerance: Comfortable with residual value uncertainty

- Priority: Established provider reputation (NetJets, Flexjet)

Choose Tokenization If:

- Flight Pattern: 50-150 variable annual hours

- Capital Preference: Avoid multi-million dollar outlays

- Flexibility Need: Seasonal or project-based flying

- Liquidity Priority: Want exit options within months, not years

- Geography: Extensive international travel

- Innovation Comfort: Early adopter of proven technology

Hybrid Strategy: Best of Both Worlds

Sophisticated fliers are implementing combination approaches:

Base Capacity: Traditional fractional share (100 hours) for core predictable travel Flexible Capacity: Tokenized access (50 hours) for variable/seasonal needs Result: 33% cost reduction while maintaining guaranteed availability

Expert Consultation Requirements

James Butler, aviation attorney at Shaircraft Solutions, emphasizes: “Anytime you’re parting with more than $25,000 in exchange for a promise by a jet company to fly you sometime in the future, you should have an experienced attorney review the paperwork.”

Critical Review Areas:

- Purchase/Lease Agreements

- Management Agreements

- Master Dry Lease Exchange

- Token smart contract code audits

- Securities compliance documentation

- Exit provisions and buyback terms

For tokenization specifically, add:

- Blockchain security audits

- Custody arrangements

- KYC/AML procedures

- Secondary market access terms

Challenges Tokenization Must Overcome

Regulatory Uncertainty

Current Gaps:

- FAA Part 91K doesn’t address tokenized ownership

- SEC securities classification varies by token structure

- International jurisdictions have different frameworks

- Insurance underwriting for tokenized assets evolving

Progress:

- EU MiCA provides clarity for crypto-assets

- Swiss FINMA offers crypto-banking licenses

- Singapore MAS active in digital asset regulation

International Air Transport Association (IATA) research indicates regulatory harmonization expected by 2026.

Technology Infrastructure Requirements

Critical Components:

- Aviation scheduling system blockchain integration

- Real-time maintenance tracking on-chain

- Smart contract security (aviation-grade reliability)

- Custody solutions for institutional investors

Market Liquidity Development

Chicken-and-Egg Challenge:

- Liquidity requires trading volume

- Volume requires sufficient token holders

- Token holders want liquidity before committing

Solution Path:

- Market makers provide initial liquidity

- Platform incentives for early adopters

- Cross-platform token compatibility

- Institutional investor participation

Safety and Operational Standards

Tokenization must maintain traditional aviation’s safety record:

Non-Negotiable Requirements:

- Aircraft maintenance to manufacturer specs

- Pilot qualifications and training

- Regulatory compliance (FAA, EASA)

- Insurance coverage

- Operational oversight

According to Flight Safety Foundation, business aviation maintains exceptional safety records with accident rates of 0.93 per 100,000 flight hours. Tokenization cannot compromise this standard.

Key Takeaways: Fractional Jet Ownership vs Tokenization

Revolutionary Evolution: Just as fractional ownership disrupted full ownership in 1987, tokenization is disrupting fractional models by addressing capital intensity, infliquidity, and inflexibility.

Capital Efficiency: Tokenization reduces entry barriers by 96% ($5K vs $1.25M minimum) while eliminating multi-million dollar aircraft purchase requirements.

Liquidity Transformation: Traditional 3-10 year lock-ups become 24/7 tradeable assets with secondary market access, creating 95% faster liquidity.

Geographic Freedom: Primary Service Area restrictions and ferry fees ($5K-$25K per repositioning) eliminated through global tokenized networks.

Cost Reduction: Real-world scenarios demonstrate 30-48% cost savings through usage flexibility, zero hour waste, and optimized capacity matching.

Blockchain Transparency: Smart contracts provide immutable transaction records, automated revenue distribution, and unprecedented operational visibility.

Hybrid Future: The most likely outcome is coexistence—traditional fractional for high-volume users (200+ hours), tokenization for flexible users (50-200 hours), micro-tokenization for occasional fliers (10-50 hours).

Regulatory Maturation: MiCA (EU), SEC guidance (US), and international frameworks providing clarity by 2026, enabling mainstream adoption.

Related Reading: Essential Resources

Deepen your understanding of private aviation’s digital transformation:

PrivateCharterX Insights:

- Private Jet Tokenization: Complete Blockchain Investment Guide – Deep dive into the technology and investment opportunities

- NFT Memberships in Luxury Aviation – How digital ownership is creating new access models

- Blockchain Luxury Travel Guide 2025 – The broader context of Web3 in premium travel

- NetJets vs VistaJet: Comprehensive Comparison – Traditional fractional provider analysis

External Authority Sources:

- Private Jet Card Comparisons: Fractional Ownership Guide – Comprehensive traditional fractional ownership analysis

- Deloitte: Blockchain Tokenization in Asset Management – Professional services perspective on tokenization

- World Economic Forum: Asset Tokenization – Global economic implications

- PwC: Blockchain in Aerospace & Defence – Industry transformation analysis

Conclusion: The 40-Year Cycle Repeats

Richard Santulli’s fractional jet ownership revolution in 1987 democratized private aviation for those who couldn’t justify full aircraft ownership. For nearly four decades, this model served high-net-worth individuals and corporations exceptionally well.

But the same forces that made fractional ownership revolutionary—accessibility, shared resources, professional management—are precisely what tokenization amplifies exponentially through blockchain technology.

The fundamental question isn’t whether tokenization will transform private aviation. It’s whether traditional providers will adapt quickly enough to compete with digital-native platforms unburdened by legacy infrastructure.

For buyers evaluating fractional jet ownership vs tokenization today, the decision requires analyzing flight patterns, capital availability, flexibility needs, and time horizons. Yet increasingly, the answer isn’t binary—it’s hybrid.

The barriers that have defined private aviation access for 40 years are falling. The next decade will determine whether established players like NetJets and Flexjet successfully integrate tokenization, or whether new entrants like PrivateCharterX redefine the industry entirely.

One certainty exists: Private aviation will never return to the pre-tokenization era, just as it never returned to the pre-fractional ownership days of 1987.

The revolution is here. The only question is whether you’re positioned to benefit from it.

Tokenization & RWA Resources:

- Private Jet Tokenization: Complete Blockchain Guide – Technical deep-dive into aviation RWA

- BlackRock BUIDL Fund Guide: Tokenized Treasury Access – How institutional RWA adoption impacts aviation

- First Mobility Tokenization: Aviation RWA Case Study – Real-world implementation example

- PrivateCharterX Platform Launch: Web3 Aviation – How our tokenization platform works

Ready to Explore Tokenized Aviation?

Visit PrivateCharterX.com to learn about our RWA platform and current tokenized aircraft opportunities.