Hyperliquid DEX—the revolutionary zero-fee perpetual trading platform. Learn about HYPE token, Layer 1 blockchain, security features, and why traders are making the switch in 2025.

Article Overview

What is Hyperliquid? Understanding the Revolutionary DEX

The story of Hyperliquid begins with a simple but powerful observation: despite DeFi’s rapid expansion, most decentralized exchanges still failed to match the speed, liquidity, and user experience of centralized platforms. Traders faced high gas fees, lagging interfaces, and inefficient capital allocation — all issues that contradicted the original promise of blockchain innovation.

In 2022, a small collective of engineers, quantitative traders, and blockchain researchers came together to address these limitations. Their mission was clear: to build a decentralized exchange that could perform like a centralized one, without sacrificing transparency or user custody.

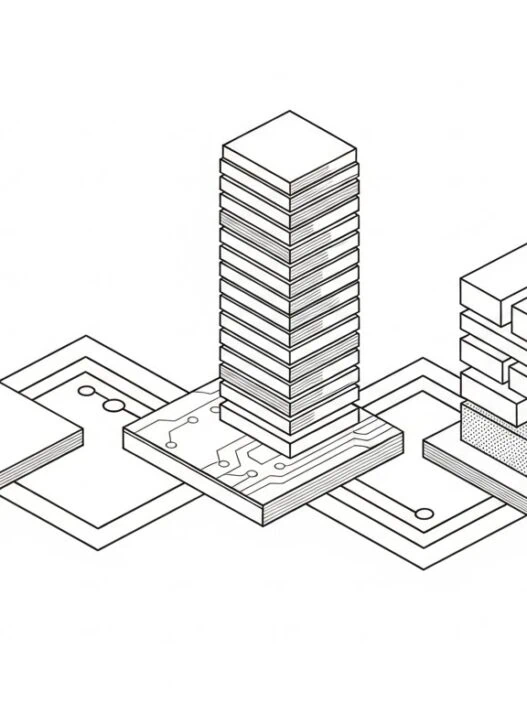

Unlike most decentralized exchanges that attempt to operate on existing Layer 1 networks such as Ethereum or Solana — which are not optimized for high-frequency trading — Hyperliquid was built entirely from scratch as a custom Layer 1 blockchain.

Its architecture was designed specifically for high-performance perpetual futures trading, delivering ultra-fast execution, near-zero latency, and a zero-gas trading environment.

This foundation created a key differentiator in the market: speed and scalability without compromise on decentralization. By removing the technical bottlenecks of general-purpose blockchains, Hyperliquid established a new paradigm for how decentralized trading infrastructure should function.

The project’s long-term vision quickly resonated with traders and developers alike. When the team launched the HYPE token in November 2024, it marked a pivotal milestone in the platform’s evolution.

Starting at $3.57, HYPE’s value reflected growing community confidence, soaring to an all-time high of $59.40 by June 2025. As of October 2025, HYPE trades around $48.67, with a market capitalization of $16.38 billion, positioning Hyperliquid among the top 15 cryptocurrencies globally.

By combining technical precision, community ownership, and a focus on sustainable growth, Hyperliquid has evolved from a niche experiment into one of the most advanced and trusted decentralized exchanges in existence — a true testament to what’s possible when blockchain infrastructure is purpose-built for performance.

How It Works: The Zero-Fee Trading Mechanism Behind Hyperliquid

The Zero-Fee Promise: Understanding the Reality

Many platforms advertise “low fee” or “zero gas” trading, but often conceal hidden costs. Hyperliquid’s approach, however, is structurally different. When Hyperliquid discusses zero gas fees for trading, it’s not a marketing gimmick—it’s a result of its unique blockchain design.

Hyperliquid operates on its custom-built Layer 1 blockchain, engineered exclusively for trading. With a 0.07-second block time, transactions are processed nearly instantly. Unlike Ethereum or other Layer 1 networks where trading competes for block space with NFT minting, lending, or other DeFi activities, Hyperliquid’s chain isolates trading activity.

This means every transaction is optimized for performance, ensuring trades are finalized rapidly and without gas feeseating into profits.

The Economic Model: Maker and Taker Dynamics

Even though traders pay no gas fees, the exchange still maintains a transparent, exchange-style fee model designed to reward liquidity providers and maintain market balance:

- Maker rebates: When you provide liquidity (limit orders), you actually earn 0.02%. This incentive encourages deeper order books and tighter spreads.

- Taker fees: When you take liquidity (market orders), you pay around 0.025%–0.035%.

For context, Uniswap charges between 1%–3%, and centralized exchanges typically charge 0.1% or more per trade.

This makes Hyperliquid’s structure not only cost-efficient but also capital-friendly for active traders.

The Core Engine: Matching and Settlement

At the heart of Hyperliquid’s performance is its centralized matching engine architecture — but deployed on a decentralized Layer 1.

Unlike AMMs that depend on liquidity pools, Hyperliquid uses an on-chain order book that synchronizes directly with its validator network.

This hybrid approach combines the speed of centralized exchanges with the transparency and self-custody of DeFi.

- Matching Engine: Continuously matches orders at sub-second speeds with near-zero latency.

- Settlement Layer: Finalizes transactions directly on the Layer 1 blockchain, guaranteeing security and verifiability.

- Scalability: The network’s trading-only design eliminates congestion and ensures throughput even under heavy trading volume.

Why It Matters

This architecture allows Hyperliquid to deliver an experience similar to CEX performance—but without the custodial risk.

Traders benefit from:

- Instant confirmations (0.07s block time)

- No gas fees per transaction

- Transparent, predictable costs

- Full on-chain security and auditability

In effect, Hyperliquid merges the precision of traditional finance with the decentralization of DeFi, offering a new trading paradigm built around efficiency, fairness, and accessibility

For detailed technical specifications on how Hyperliquid’s Layer 1 blockchain and on-chain order book are structured, refer to the official Hyperliquid documentation.

Is Hyperliquid Legit? Platform Legitimacy and Transparency

Evaluating Hyperliquid’s legitimacy requires examining multiple factors. The platform demonstrates strong fundamentals: audited by reputable firms like Zellic, open-source code available for verification, and impressive trading volume exceeding $515M daily. With a #11 market cap ranking and active development, the technical credentials are solid.

However, considerations exist. Hyperliquid is relatively new, launching in late 2024. US restrictions limit the addressable market, and there’s high concentration of whale positions—though this remains transparent and verifiable on-chain.

What sets Hyperliquid apart is its complete on-chain operation. Every trade, liquidation, and order records on the blockchain, eliminating uncertainty about front-running or hidden manipulation. This verifiable trading data allows independent audits and ensures fair liquidation mechanisms without suspicious market movements.

The governance structure reinforces this transparency. By excluding VCs and private investors, Hyperliquid created authentic community governance where HYPE token holders possess real authority—voting on protocol upgrades, proposing features, deciding fee structures, and allocating treasury funds. These aren’t marketing claims but protocol-integrated mechanisms. Users own platform equity rather than simply accessing services.

This alignment of incentives creates mutual benefit. When users are owners, platform success becomes shared success. While no platform is risk-free, Hyperliquid’s fundamentals—transparency, community ownership, and verifiable operations—represent DeFi’s intended purpose in practice.

For a deeper understanding of how decentralized governance empowers communities and redefines ownership in the digital era, explore our article on What Is a DAO? A Powerful Guide.

Live on-chain statistics such as Total Value Locked (TVL), daily volume, and performance metrics can be verified via DeFiLlama’s Hyperliquid dashboard.

Hyperliquid vs. Centralized Exchanges: The Key Differences

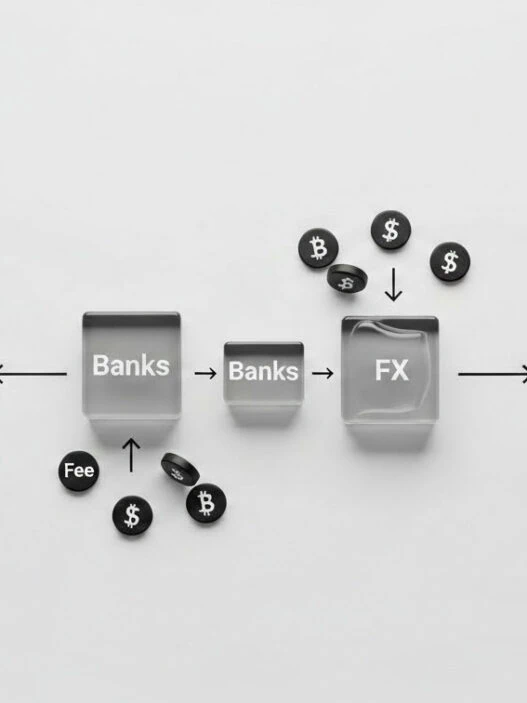

Centralized exchanges like Binance and Coinbase have dominated crypto trading for years. They’re familiar and liquid, but come with fundamental trade-offs that Hyperliquid addresses directly.

Custody: Your Keys, Your Crypto

The biggest difference is control. When you trade on a centralized exchange, you deposit funds into their custody. You’re trusting them to keep your crypto safe, allow withdrawals, and stay solvent. FTX and Mt. Gox showed how badly this can go wrong.

Hyperliquid works differently. You connect your wallet and trade directly from it. No deposits to exchange wallets. No waiting for withdrawal approvals. Your crypto stays in your control, always.

Performance Without Compromise

Centralized exchanges traditionally won on speed—instant execution, deep liquidity, minimal slippage. That performance advantage kept traders accepting the custody risk.

Hyperliquid’s Layer 1 blockchain eliminates this trade-off. With 0.07-second block times and zero gas fees, you get CEX-level performance with DEX-level security. You’re not sacrificing speed for decentralization anymore.

Transparency vs. Black Box

Centralized exchanges operate behind closed doors. You can’t verify their reserves, confirm they’re not trading against customers, or audit how liquidations work.

Hyperliquid operates entirely on-chain. Every trade, liquidation, and order is publicly verifiable. Want to check if the platform is manipulating markets? The blockchain data is there. This transparency level is impossible with centralized platforms

Fee Structure Reality

Centralized exchanges hide costs everywhere—trading fees (typically 0.1%+), withdrawal fees, hidden spreads, and deposit charges.

Hyperliquid’s structure is straightforward:

- No gas fees

- Maker rebates: earn 0.02% for providing liquidity

- Taker fees: pay just 0.025%–0.035%

- No hidden costs

For active traders, these differences compound significantly.

The Bottom Line

Centralized exchanges require trust—trust they’re solvent, honest, and acting in your interest. Hyperliquid replaces trust with verification. You’re not asking permission to access your funds or hoping the exchange processes your withdrawal.

You’re trading on infrastructure designed around one premise: traders should have both performance and control. Not one or the other—both.

How to Trade Perpetual Futures on Hyperliquid: Step-by-Step Guide

Trading on Hyperliquid requires understanding the platform’s structure. The process involves several key steps for new traders.

Step 1: Connect a Wallet

A compatible wallet is required for platform access. MetaMask is commonly used, though alternatives exist. The connection process includes:

- Navigate to hyperliquid.xyz

- Click “Connect Wallet” in the top-right corner

- Select the preferred wallet (MetaMask, WalletConnect, etc.)

- Approve the connection

- Access granted

Security Note: For long-term HYPE token holdings, hardware wallets like Ledger provide enhanced security layers. This adds an extra step but significantly improves asset protection.

Step 2: Fund the Account

Assets must be bridged to Hyperliquid’s Layer 1. The platform supports:

- USDC (primary trading pair)

- HYPE (native token)

- ETH and other major cryptocurrencies

The bridging process is secure—audited by Zellic—and typically takes just a few minutes.

Step 3: Start Trading

Once funded, traders can:

- Go long or short on hundreds of perpetual contracts

- Use leverage up to 50x (though maximum leverage carries significant risk)

- Set limit orders, stop losses, and take profits

- Access spot trading alongside perpetuals

The interface balances clarity with functionality, suitable for both beginners and experienced traders.

HYPE Token: Beyond Standard Governance

The HYPE token serves multiple functions within the Hyperliquid ecosystem, distinguishing it from simple governance tokens.

What Does the HYPE Token Do?

HYPE provides essential functionality across the Hyperliquid platform:

- Gas token for HyperEVM: Powers all transactions on Hyperliquid’s EVM-compatible layer

- Staking rewards: Lock up your HYPE and earn yields

- Governance rights: Vote on protocol upgrades and treasury decisions

- Fee discounts: Reduced trading fees for HYPE holders

HYPE Token Staking Guide

Hyperliquid offers staking opportunities for HYPE token holders. Staking involves more than locking tokens—it represents active participation in network security and governance.

How to Stake HYPE:

- Acquire HYPE tokens through the DEX or supported exchanges

- Navigate to the staking section on app.hyperliquid.xyz

- Choose staking duration (longer periods typically offer better rewards)

- Lock tokens and begin earning

Current staking rewards vary based on network activity and total staked supply. Early participants report attractive yields, with additional governance voting rights included.

Final Thoughts: Is Hyperliquid Worth It?

Hyperliquid isn’t perfect—no platform is. It’s relatively new, which means less battle-tested than decade-old exchanges. Smart contract risks exist despite audits. And if you’re unfamiliar with DeFi, the learning curve requires patience.

But for traders who understand these considerations, Hyperliquid offers something rare: a platform that doesn’t ask you to choose between performance and principles. You get both the speed of centralized exchanges and the security of self-custody. You get transparency without sacrificing functionality.

The crypto space has long needed infrastructure that treats users like owners rather than customers. Hyperliquid delivers that vision—not through marketing promises, but through technical execution and community governance.

Whether Hyperliquid becomes the dominant trading platform or simply pushes the entire industry toward better standards, it’s already proven something important: decentralized exchanges don’t have to be second-rate alternatives. They can compete directly with—and often surpass—their centralized counterparts.

For traders ready to experience what purpose-built DeFi infrastructure can deliver, Hyperliquid is worth exploring. Just start small, understand the risks, and see if the platform’s approach aligns with your trading needs.

The revolution won’t be centralized. And platforms like Hyperliquid are showing exactly what that means in practice.

Hyperliquid is ideal for:

- Active perpetual futures traders seeking lower fees and faster execution

- Traders burned by centralized exchange collapses who want self-custody

- DeFi users frustrated with slow, expensive DEXs

- Crypto natives who value transparency and on-chain verification

- International traders looking for no-KYC access

Frequently Asked Questions

Is Hyperliquid available in the US?

No. Hyperliquid is not available to US residents, US citizens, or US-incorporated entities. This restriction is outlined in their Terms of Use and enforced at the platform level.

Do I need KYC to use Hyperliquid?

Currently, no KYC (Know Your Customer) verification is required to trade on Hyperliquid. You can access the platform using just your wallet connection or email address.

What’s the minimum deposit amount?

Minimum deposits vary by asset:

- USDC: No strict minimum

- BTC: 0.002 BTC minimum

- ETH and other assets: Check platform documentation for specific requirements

There are no deposit limits—you can deposit as much as needed.

Is Hyperliquid safe? Has it been audited?

Yes. Hyperliquid has undergone multiple security audits by Zellic, a reputable blockchain security firm. The platform’s code is open-source and verifiable. All operations occur on-chain, providing transparency that centralized exchanges cannot match.

However, remember: no platform is entirely risk-free. Always practice proper security hygiene and never invest more than you can afford to lose.

What happens if Hyperliquid goes down?

Because Hyperliquid operates on a decentralized Layer 1 blockchain, there’s no single point of failure. The network continues functioning as long as validators remain operational. Unlike centralized exchanges, no CEO or company can unilaterally shut down the platform.

Can I trade spot markets or only perpetuals?

Hyperliquid supports both perpetual futures and spot trading. The platform launched with perpetuals but has expanded to include spot markets for major cryptocurrencies.

Ready to Explore More?

For deeper exploration of decentralized trading:

- Best Crypto Wallets in 2025 – Comprehensive wallet security guide

- What is DAO? Powerful Guide – Understanding decentralized governance structures

- Web3 Wallet Guide – Advanced wallet management techniques

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency trading carries significant risk. Hyperliquid is not available to US residents. Always conduct your own research and consult with financial professionals before making investment decisions.