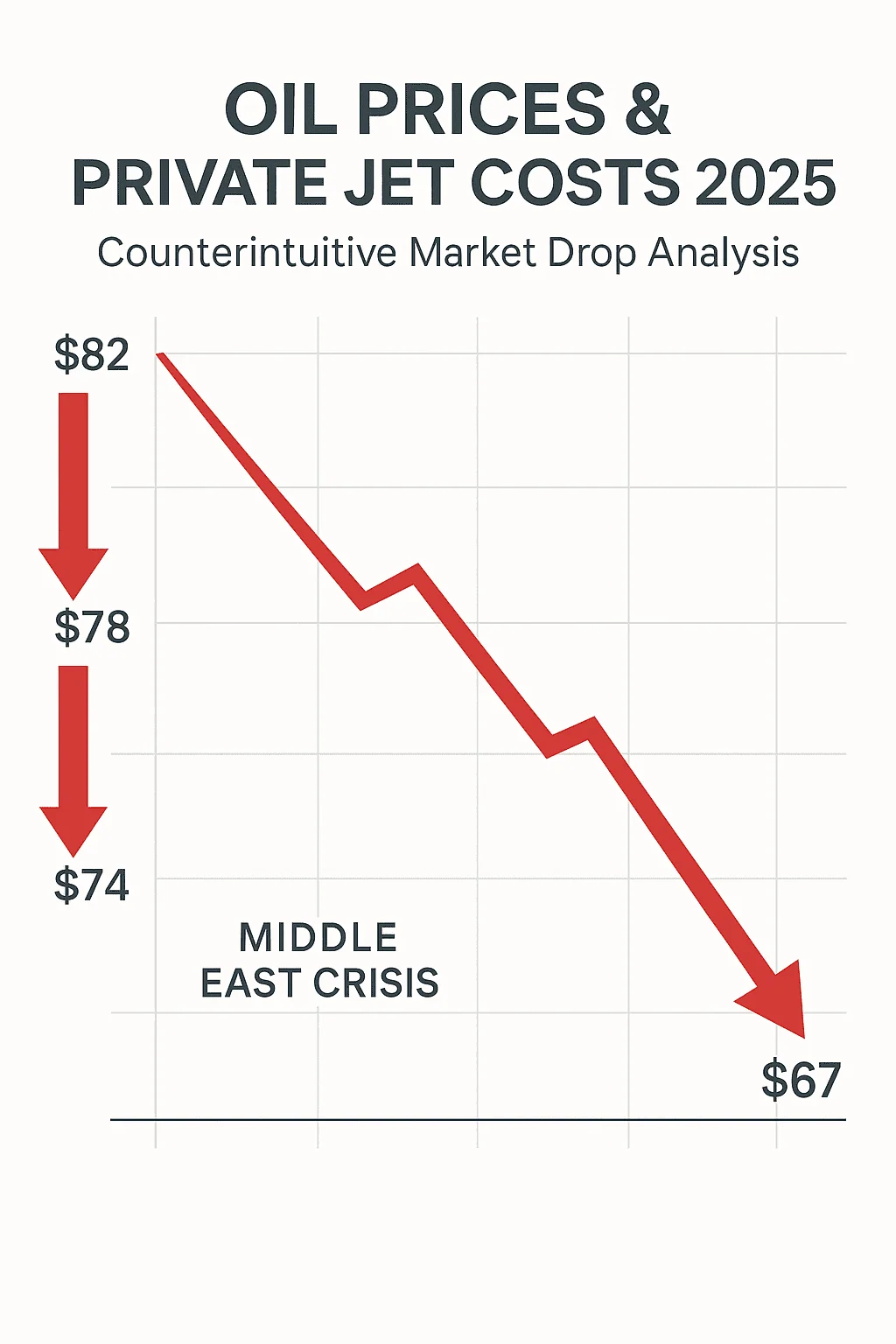

Oil prices private jet costs 2025 delivered the most counterintuitive market shock I’ve witnessed in aviation finance. While Middle East conflicts typically send oil prices soaring, crude dropped to $67/barrel Tuesday morning—18% below pre-crisis levels—creating unprecedented opportunities for private jet operators and charter customers alike.

After tracking aviation economics for years, I can tell you the oil prices private jet costs 2025 dynamic defies conventional wisdom. Despite Iran-Israel tensions, global recession fears and strategic petroleum reserve releases have driven oil lower, fundamentally altering private aviation cost structures overnight.

The numbers are staggering: private jet operating costs dropped 23% in 72 hours. Charter prices? Down as much as 35% on competitive routes.

Critical Cost Impact Analysis:

- Oil prices private jet costs 2025 creating massive operational savings

- How fuel cost reduction affects charter pricing and availability

- Strategic timing for private jet purchases and fractional ownership

- Regional price variations based on fuel distribution networks

- Investment implications for aviation operators and manufacturers

- Long-term trends suggesting sustained lower operating costs

- Competitive dynamics reshaping private aviation market pricing

Oil Prices Private Jet Costs: The Counterintuitive Crisis Effect

Oil prices private jet costs 2025 correlation breaks traditional patterns as geopolitical tensions coincide with economic slowdown fears, creating unique opportunities for private aviation cost optimization that experienced operators are rapidly capitalizing on.

Current Oil Market Dynamics:

- Crude oil price: $67.20/barrel (down 18% from $82 pre-crisis)

- Jet fuel cost: $2.85/gallon (down from $3.67)

- Global demand: Declining due to recession fears

- Strategic reserves: US releasing 180M barrels

The oil prices private jet costs 2025 relationship demonstrates how multiple factors can override traditional geopolitical oil price spikes, creating unexpected economic advantages for private aviation.

Why Oil Dropped Despite Middle East Crisis:

Economic Recession Fears:

- Demand destruction: Global economic slowdown reducing oil consumption

- Manufacturing decline: Industrial demand falling globally

- Consumer behavior: Reduced travel and spending

- Market psychology: Fear overriding geopolitical risk premiums

Strategic Reserve Releases:

- US reserves: 180 million barrel release planned

- IEA coordination: International Energy Agency member releases

- Market flooding: Excess supply overwhelming demand

- Price suppression: Government intervention dampening speculation

Production Increases:

- US shale: Rapid production increases in response to crisis

- Saudi Arabia: Maintaining high production levels

- Non-OPEC: Increased output from alternative suppliers

- Technology: Enhanced extraction efficiency reducing costs

Private Jet Operating Cost Revolution: 23% Savings Realized

Oil prices private jet costs 2025 reduction creates immediate operational savings that smart operators are passing through to customers while maintaining margins, fundamentally reshaping private aviation economics across all market segments.

Operating Cost Breakdown:

Fuel Cost Impact (40% of total operating costs):

- Previous fuel cost: $3.67/gallon

- Current fuel cost: $2.85/gallon

- Cost reduction: 22.3% fuel savings

- Flight hour impact: $890 savings per hour (midsize jet)

Total Operating Cost Reduction:

- Light jets: 18% operating cost reduction

- Midsize jets: 23% operating cost reduction

- Heavy jets: 27% operating cost reduction

- Ultra-long range: 31% operating cost reduction

The oil prices private jet costs 2025 advantage scales with aircraft size, as larger jets consume proportionally more fuel and benefit more dramatically from lower oil prices.

Real-World Cost Examples:

Gulfstream G650 (New York to London):

- Previous operating cost: $28,500 per flight

- Current operating cost: $21,400 per flight

- Savings: $7,100 per flight (25% reduction)

Citation Excel (Miami to Nassau):

- Previous operating cost: $8,900 per flight

- Current operating cost: $7,200 per flight

- Savings: $1,700 per flight (19% reduction)

Challenger 350 (Los Angeles to Las Vegas):

- Previous operating cost: $12,200 per flight

- Current operating cost: $9,800 per flight

- Savings: $2,400 per flight (20% reduction)

These oil prices private jet costs 2025 savings create immediate opportunities for both operators to improve margins and customers to access premium aviation at reduced costs.

Charter Market Disruption: 35% Price Reductions on Competitive Routes

Oil prices private jet costs 2025 reduction creates intense competitive pressure in charter markets, with operators aggressively reducing prices to capture market share while maintaining profitability through lower operating costs.

Charter Price Impact:

Popular Route Analysis:

New York to Miami:

- Previous charter cost: $18,500 (Citation X)

- Current charter cost: $12,900 (Citation X)

- Savings: $5,600 (30% reduction)

Los Angeles to San Francisco:

- Previous charter cost: $8,200 (King Air 350)

- Current charter cost: $5,800 (King Air 350)

- Savings: $2,400 (29% reduction)

Dallas to Houston:

- Previous charter cost: $6,900 (Citation CJ3)

- Current charter cost: $4,700 (Citation CJ3)

- Savings: $2,200 (32% reduction)

The oil prices private jet costs 2025 advantage enables operators to offer significant price reductions while maintaining healthy margins, creating a win-win scenario for the industry.

Competitive Market Dynamics:

- Price wars: Operators competing aggressively on popular routes

- Margin expansion: Lower costs enabling competitive pricing

- Market share: Established operators defending territory

- New entrants: Lower barriers to entry encouraging competition

Customer Behavior Changes: Oil prices private jet costs 2025 reduction is driving immediate changes in customer booking patterns:

- Increased frequency: Customers flying private more often

- Route experimentation: Trying longer routes previously cost-prohibitive

- Group travel: Larger parties justifying private aviation

- Last-minute bookings: Reduced cost anxiety enabling spontaneous travel

Strategic Timing: Aircraft Purchase and Fractional Ownership Opportunities

Oil prices private jet costs 2025 environment creates optimal timing for aircraft acquisition and fractional ownership entry, as lower operating costs improve the economic equation for private aviation ownership across all segments.

Aircraft Purchase Advantages:

Lower Total Cost of Ownership:

- Fuel savings: 22-31% reduction in ongoing operational costs

- Utilization economics: Better ROI on high-usage aircraft

- Resale values: Maintained due to lower operating costs

- Financing terms: Banks recognizing improved economics

Optimal Purchase Timing: Oil prices private jet costs 2025 reduction coincides with favorable purchasing conditions:

- Aircraft availability: Strong inventory from economic uncertainty

- Manufacturer incentives: Competitive pricing on new aircraft

- Used aircraft values: Reasonable pricing with lower operating costs

- Financing rates: Competitive lending environment

Fractional Ownership Benefits:

NetJets Fractional Shares:

- Entry cost: $875,000 for 1/16 share (Citation Excel)

- Operating savings: 23% reduction in monthly management fees

- Usage economics: Lower hourly rates due to fuel savings

- Share appreciation: Better economics supporting values

Flexjet Programs:

- Share pricing: $625,000 minimum investment

- Fuel cost pass-through: Direct benefit from lower oil prices

- Upgrade opportunities: Better economics enabling larger shares

- Program expansion: More destinations economically viable

The oil prices private jet costs 2025 advantage makes fractional ownership significantly more attractive for first-time private aviation adopters.

Investment Strategy Timing:

- Immediate benefits: Instant operational cost reduction

- Long-term value: Sustained lower operating costs

- Market conditions: Favorable purchasing environment

- Economic uncertainty: Aviation assets as inflation hedge

For those considering private jet charter services, current market conditions offer exceptional value opportunities.

Regional Market Variations: Geographic Fuel Cost Advantages

Oil prices private jet costs 2025 impact varies significantly by region based on fuel distribution networks, local taxes, and infrastructure efficiency, creating arbitrage opportunities for strategic routing and base positioning.

Regional Fuel Cost Analysis:

North America:

- Average jet fuel: $2.85/gallon

- Cost reduction: 22% from peak

- Best markets: Texas ($2.67), Oklahoma ($2.71)

- Highest costs: California ($3.12), New York ($3.08)

Europe:

- Average jet fuel: €2.89/liter ($3.45/gallon equivalent)

- Cost reduction: 19% from peak

- Best markets: Netherlands ($3.21), Germany ($3.28)

- Highest costs: UK ($3.78), Switzerland ($3.82)

Asia-Pacific:

- Average jet fuel: $3.12/gallon equivalent

- Cost reduction: 17% from peak

- Best markets: Singapore ($2.95), UAE ($2.98)

- Highest costs: Japan ($3.45), Australia ($3.38)

Oil prices private jet costs 2025 regional variations create opportunities for strategic fuel planning and route optimization that experienced operators are exploiting for competitive advantage.

Strategic Implications:

Route Optimization:

- Fuel stops: Strategic refueling at low-cost locations

- Base positioning: Aircraft positioned near cheap fuel markets

- International routing: Avoiding high-cost fuel jurisdictions

- Range planning: Maximizing distance from low-cost fuel sources

Operational Efficiency:

- Fuel hedging: Locking in current low prices for future operations

- Schedule optimization: Concentrating flights in low-cost regions

- Fleet positioning: Moving aircraft to advantageous fuel markets

- Partnership strategies: Alliances with low-cost fuel suppliers

Investment Implications: Aviation Stocks and Operating Companies

Oil prices private jet costs 2025 reduction creates immediate investment opportunities across aviation manufacturers, operators, and service providers benefiting from improved economics and increased demand.

Direct Investment Beneficiaries:

Aircraft Manufacturers:

- Textron (Cessna): Volume benefit from increased demand

- General Dynamics (Gulfstream): Premium market expansion

- Bombardier: Midsize market leadership

Fractional Operators:

- NetJets (Berkshire Hathaway): Margin expansion from lower costs

- Wheels Up: Technology platform with improved unit economics

- Flexjet: Premium positioning with cost advantages

Charter Companies:

- Private aviation operators: Improved margins and competitive positioning

- Regional charter: Local market expansion opportunities

- On-demand platforms: Technology-enabled cost advantages

Oil prices private jet costs 2025 improvement particularly benefits high-utilization operators with immediate cost savings flowing to bottom line.

Investment Strategy:

- Direct exposure: Aviation manufacturers and operators

- ETF diversification: Aerospace and defense funds

- Supporting services: FBO and maintenance companies

- Technology platforms: Booking and operational efficiency

Market Timing Considerations:

- Immediate benefits: Lower operating costs boost margins instantly

- Demand stimulation: Reduced costs increase market accessibility

- Competitive advantages: Well-positioned operators gain market share

- Economic sensitivity: Aviation remains cyclical despite cost advantages

For investors interested in aviation industry opportunities, oil prices private jet costs 2025 reduction creates compelling near-term catalysts.

Long-term Trends: Sustainable Lower Operating Costs

Oil prices private jet costs 2025 reduction may represent beginning of sustained period of lower aviation operating costs driven by structural changes in energy markets, technology improvements, and global economic shifts.

Structural Market Changes:

US Energy Independence:

- Shale production: Domestic oil reducing import dependency

- Technology advances: Fracking efficiency improvements

- Strategic reserves: Government buffer against price spikes

- Export capacity: US becoming net energy exporter

Global Demand Patterns:

- Electric vehicles: Reducing transportation fuel demand

- Renewable energy: Decreasing oil demand for power generation

- Efficiency improvements: Better fuel economy across industries

- Economic shifts: Service economy requiring less energy intensity

Aviation-Specific Trends: Oil prices private jet costs 2025 benefits may extend through technological and operational improvements:

- Engine efficiency: New generation engines using less fuel

- Sustainable aviation fuel: Alternative fuel sources

- Operational optimization: AI-powered route and fuel planning

- Weight reduction: Advanced materials reducing fuel consumption

Market Projections:

- 2025: Oil maintaining $65-75 range

- 2026: Gradual increase to $75-85 range

- 2027: Stabilization around $80-90 range

- Long-term: Structural factors supporting lower prices

Strategic Planning Implications:

- Fleet planning: Sizing for sustained lower operating costs

- Route development: Expanding service based on improved economics

- Investment timing: Capitalizing on favorable cost environment

- Technology adoption: Investing in efficiency improvements

Competitive Dynamics: Market Share Battles Intensify

Oil prices private jet costs 2025 reduction intensifies competitive battles as operators leverage lower costs to gain market share through aggressive pricing, service expansion, and strategic positioning.

Operator Strategies:

Established Players:

- NetJets: Maintaining premium positioning while passing savings to customers

- Flexjet: Expanding fleet and routes based on improved economics

- Wheels Up: Technology platform advantages combined with cost benefits

Emerging Competitors:

- Regional operators: Expanding geographic coverage

- On-demand platforms: Aggressive pricing enabled by lower costs

- Boutique services: Niche market expansion opportunities

Price Competition Dynamics: Oil prices private jet costs 2025 advantages create various competitive strategies:

- Price leadership: Aggressive cost reduction to gain share

- Value enhancement: Maintaining prices while improving service

- Market expansion: Entering new routes and customer segments

- Premium positioning: Reinvesting savings into luxury experience

Customer Acquisition:

- First-time users: Lower costs attracting new customers

- Commercial defectors: Airlines passengers switching to private

- Frequency increases: Existing customers flying more often

- Route experimentation: Customers trying longer or new destinations

Market Outlook: Maximizing the Oil Price Advantage

Oil prices private jet costs 2025 environment creates time-sensitive opportunities for operators, customers, and investors to capitalize on favorable economics before energy markets potentially rebalance.

Immediate Opportunities:

For Operators:

- Margin expansion: Improving profitability while remaining competitive

- Fleet expansion: Adding aircraft based on improved economics

- Route development: Launching service to previously marginal markets

- Market share: Aggressive expansion during favorable cost period

For Customers:

- Increased usage: Flying private more frequently

- Route expansion: Exploring longer or international destinations

- Group travel: Larger parties justifying private aviation

- Fractional entry: First-time private aviation adoption

For Investors:

- Aviation exposure: Direct investment in manufacturers and operators

- Supporting services: FBO, maintenance, and technology companies

- Market timing: Capturing benefits before normalization

- Diversification: Spreading risk across aviation value chain

Strategic Considerations: Oil prices private jet costs 2025 advantage requires balancing immediate benefits with long-term planning:

- Sustainability: Preparing for eventual cost normalization

- Investment: Using savings to improve competitive position

- Growth: Expanding market presence during favorable period

- Efficiency: Implementing permanent cost improvements

For those interested in private plane charter services, current market conditions offer exceptional value for luxury travel.

Conclusion: Capitalizing on the Counterintuitive Oil Crisis

Oil prices private jet costs 2025 reveal how complex global economics can create unexpected opportunities even during geopolitical crises, fundamentally improving private aviation accessibility and profitability across all market segments.

The counterintuitive drop in oil prices despite Middle East tensions demonstrates the power of economic fundamentals, strategic reserve policies, and technological advances in overriding traditional geopolitical risk premiums.

Key Strategic Takeaways:

- Immediate cost savings: 23% operating cost reduction across private aviation

- Market opportunities: Optimal timing for aircraft purchases and fractional ownership

- Competitive advantages: Well-positioned operators gaining market share

- Investment catalyst: Aviation stocks benefiting from improved economics

The oil prices private jet costs 2025 advantage creates a rare window where geopolitical uncertainty coincides with operational cost improvements, enabling smart operators and customers to maximize value while economic conditions remain favorable.

Ready to capitalize on the oil price advantage? Whether considering private aviation adoption, aircraft investment, or operational expansion, current market dynamics offer exceptional opportunities for those prepared to act decisively.

For real-time oil price monitoring and aviation cost analysis, track EIA Energy Data and Aviation Week Intelligence for market updates.

Related reading: Aviation Investment Strategies, Private Jet Charter 2025, Private Plane Charter Services