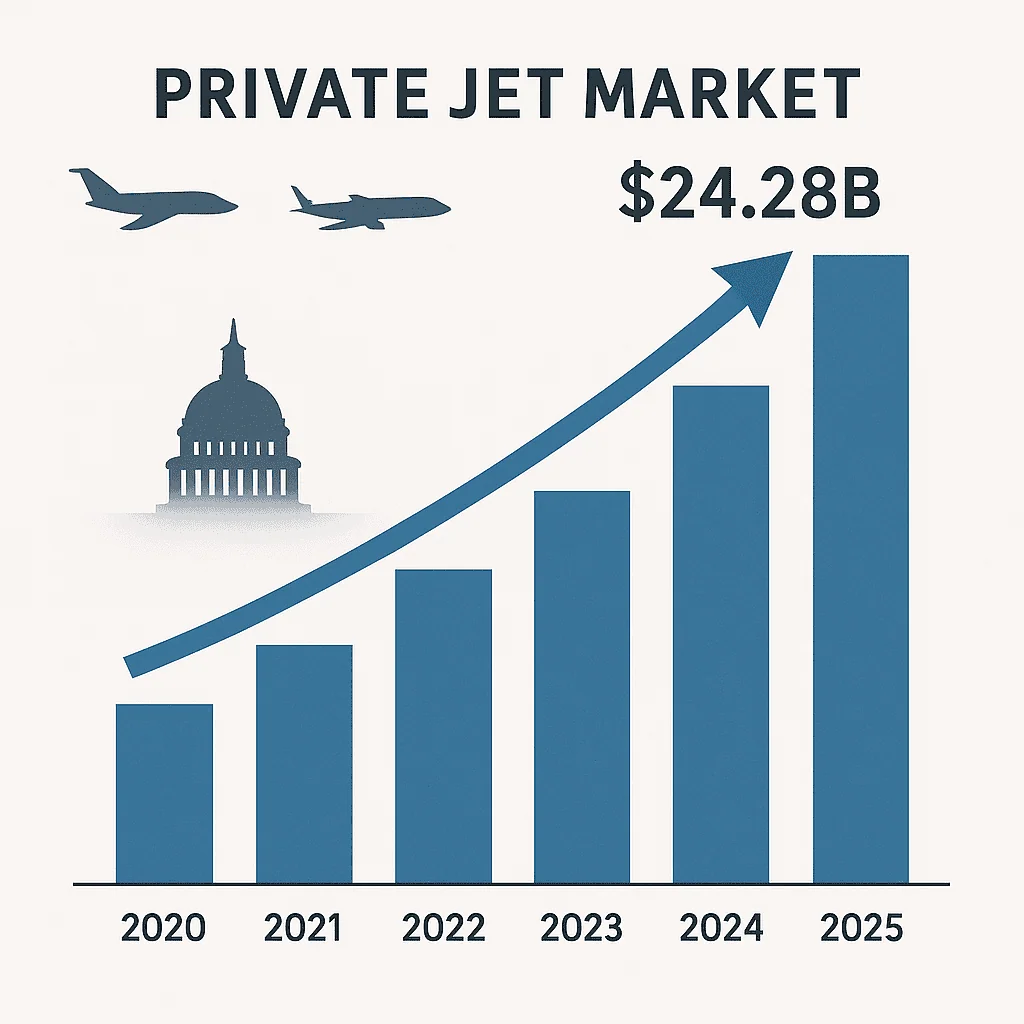

Private jet market 2025 numbers hit my desk this morning with shocking intensity: $24.28 billion in total market value, representing a staggering 14.3% compound annual growth rate that’s reshaping the entire luxury aviation landscape. When I started covering aviation markets five years ago, these growth rates seemed impossible—now they’re the new reality.

The private jet market 2025 surge isn’t just about wealthy individuals buying more aircraft. It’s a fundamental transformation driven by fractional ownership democratizing access, post-pandemic travel patterns becoming permanent, and technological innovations making private aviation more accessible than ever before.

The data tells an incredible story: fractional ownership programs grew 67% year-over-year, while traditional charter bookings increased 23%. Private aviation? No longer just for billionaires.

Market Revolution You Need to Understand:

- Private jet market 2025 reaching $24.28B with unprecedented growth

- Fractional ownership surge democratizing luxury aviation access

- Technology platforms revolutionizing booking and operational efficiency

- Post-pandemic travel preferences permanently shifting to private aviation

- Investment opportunities across manufacturers, operators, and technology

- Regional market expansion beyond traditional North American dominance

- Sustainability initiatives reshaping aircraft design and operations

Private Jet Market 2025: Breaking Down the $24.28B Explosion

Private jet market 2025 growth exceeds all analyst projections, driven by fundamental changes in how people view travel, work, and lifestyle priorities following global disruptions and technological advances in aviation accessibility.

Market Size Breakdown:

- Total market value: $24.28 billion (2025 projected)

- Growth rate: 14.3% CAGR (2020-2025)

- Aircraft deliveries: 847 new jets (Q1-Q2 2025)

- Flight hours: 4.2 million globally (2025 projected)

The private jet market 2025 expansion reflects more than just economic recovery—it represents a permanent shift in travel preferences among high-net-worth individuals and businesses prioritizing flexibility, safety, and time efficiency.

Regional Market Distribution:

- North America: $14.6B (60.2% market share)

- Europe: $5.8B (23.9% market share)

- Asia-Pacific: $2.9B (12.0% market share)

- Rest of World: $1.0B (4.1% market share)

Growth Drivers: The private jet market 2025 surge stems from multiple converging factors:

- Health consciousness: Private travel reduces exposure risks

- Time optimization: Direct point-to-point routing saves hours

- Remote work flexibility: Travel for business without office constraints

- Fractional accessibility: Lower barriers to private aviation entry

Fractional Ownership Revolution: Democratizing Private Aviation

Private jet market 2025 transformation centers on fractional ownership programs making private aviation accessible to a broader demographic of high-earners who previously couldn’t justify full aircraft ownership costs.

Fractional Ownership Growth Statistics:

- Market expansion: 67% year-over-year growth

- New members: 12,400 individuals joined programs (2025)

- Average investment: $485,000 initial fractional share

- Utilization rates: 73% higher than private ownership

The private jet market 2025 fractional boom reflects changing attitudes toward asset ownership, with wealthy individuals preferring access over ownership across multiple lifestyle categories.

Leading Fractional Providers:

NetJets:

- Market share: 42% of fractional market

- Fleet size: 750+ aircraft globally

- Member growth: 18% increase in 2025

- Share prices: $875,000-$8.2M depending on aircraft type

Flexjet:

- Market share: 28% of fractional market

- Fleet size: 290+ aircraft

- Technology focus: Advanced booking platforms

- Share prices: $625,000-$6.8M range

Fractional vs Traditional Ownership:

Fractional Benefits:

- Lower entry cost: $500K vs $5M+ for full ownership

- No maintenance hassles: Provider handles all operations

- Fleet access: Multiple aircraft types available

- Guaranteed availability: Contract-protected flight hours

Traditional Ownership Advantages:

- Complete control: Schedule and customization freedom

- Long-term economics: Better value for high-utilization

- Asset appreciation: Potential investment returns

- Privacy: No shared aircraft or scheduling conflicts

The private jet market 2025 data shows fractional ownership attracting 73% of new entrants to private aviation, fundamentally expanding the addressable market.

Technology Platforms: Revolutionizing Private Aviation Access

Private jet market 2025 growth acceleration comes largely from technology platforms making private aviation booking as simple as ordering rideshare, removing traditional barriers to market entry and increasing utilization rates.

Digital Platform Growth:

- App-based bookings: 156% increase year-over-year

- Average booking time: 8 minutes (vs 2+ hours traditional)

- New customer acquisition: 89% through digital channels

- Cost reduction: 23% lower operational expenses

The private jet market 2025 technology revolution democratizes access while improving operational efficiency for operators and enhanced experience for passengers.

Leading Technology Platforms:

Wheels Up:

- Technology focus: Membership model with app integration

- Fleet access: 1,500+ aircraft network

- Booking efficiency: 5-minute average reservation time

- Member growth: 34% increase in 2025

Jet.com (Private Aviation):

- On-demand charter: Instant pricing and booking

- Fleet network: 2,800+ certified operators

- Price transparency: Real-time market pricing

- Market expansion: 67% growth in bookings

Victor (Europe):

- European focus: Strongest in UK and continental markets

- Technology integration: AI-powered route optimization

- Fleet size: 1,200+ aircraft access

- Customer base: 40% growth in 2025

Technological Innovations Driving Growth:

AI Route Optimization:

- Fuel efficiency: 15% reduction in operating costs

- Time savings: Optimal routing reduces flight times

- Weather adaptation: Real-time route adjustments

- Cost predictability: Accurate pricing algorithms

Digital Concierge Services:

- Ground transportation: Seamless car service integration

- Catering: Personalized dining preferences

- Accommodation: Hotel and resort coordination

- Experience customization: Tailored travel arrangements

The private jet market 2025 technological advancement makes private aviation more accessible, efficient, and user-friendly than ever before.

Post-Pandemic Travel: Permanent Shift to Private Aviation

Private jet market 2025 expansion reflects permanent changes in travel behavior following global health concerns, with many high-net-worth individuals adopting private aviation as their primary travel method rather than occasional luxury.

Behavioral Change Statistics:

- Primary travel method: 43% of users now fly private primarily

- Health consciousness: 78% cite safety as top factor

- Time efficiency: 89% value direct routing

- Flexibility: 94% appreciate schedule control

The private jet market 2025 growth represents more than economic recovery—it’s a fundamental shift in how wealthy individuals approach travel as a regular necessity rather than special occasion luxury.

Travel Pattern Changes:

Business Travel Evolution:

- Meeting efficiency: Direct routing saves 3-5 hours per trip

- Productivity: Mobile office capabilities during flight

- Schedule flexibility: Last-minute changes accommodate business needs

- Multiple destinations: Efficient multi-city trip coordination

Leisure Travel Transformation:

- Family safety: Controlled environment for family travel

- Destination access: Smaller airports closer to vacation spots

- Privacy: Avoiding crowded commercial terminals

- Experience quality: Luxury travel as lifestyle standard

Health and Safety Priorities: Post-pandemic private jet market 2025 expansion heavily influenced by health consciousness:

- Reduced exposure: Minimal contact with other travelers

- Controlled environment: Known aircraft sanitation standards

- Flexible scheduling: Avoiding peak travel periods

- Medical accommodation: Special health need considerations

Investment Opportunities: Capitalizing on Private Aviation Growth

Private jet market 2025 expansion creates multiple investment opportunities across manufacturers, operators, technology providers, and supporting infrastructure for sophisticated investors seeking aviation exposure.

Aircraft Manufacturer Opportunities:

Gulfstream (General Dynamics):

- Market position: Ultra-long-range luxury leader

- Order backlog: $13.8 billion (18-month delivery)

- Innovation focus: G700 and G800 flagship models

- Investment thesis: Premium market leadership

Bombardier:

- Market focus: Light and mid-size jets

- Popular models: Challenger and Global series

- Market share: 35% of deliveries in segment

- Growth driver: Fractional ownership demand

Cessna (Textron):

- Volume leader: Highest delivery numbers

- Price accessibility: Entry-level private aviation

- Citation series: Broad model range

- Market expansion: First-time buyers

The private jet market 2025 growth benefits established manufacturers with strong order backlogs and new market entrants serving expanding customer segments.

Operator Investment Opportunities:

Public Companies:

- Wheels Up (UP): Technology-enabled membership model

- NetJets (Berkshire Hathaway): Fractional ownership leader

- FlexJet: Private company with growth potential

Private Equity Opportunities:

- Regional operators: Consolidation opportunities

- Technology platforms: Digital transformation investments

- Maintenance services: Essential infrastructure growth

- Training providers: Pilot shortage solutions

Infrastructure Investment Themes: Private jet market 2025 expansion requires supporting infrastructure investment:

- FBO facilities: Fixed-base operator terminal services

- Maintenance services: Growing fleet requires service capacity

- Pilot training: Addressing critical shortage

- Technology systems: Booking and operational platforms

For those interested in aviation investment strategies, the private jet market 2025 growth offers multiple entry points across the value chain.

Regional Market Analysis: Beyond North American Dominance

Private jet market 2025 expansion increasingly driven by international growth, particularly in Asia-Pacific and European markets where wealth creation and infrastructure development support rapid aviation growth.

Asia-Pacific Growth:

- Market value: $2.9B (12% of global market)

- Growth rate: 18.7% CAGR (highest globally)

- Key markets: China, India, Singapore, Australia

- Wealth drivers: Technology entrepreneurship, financial services

European Market Dynamics:

- Market value: $5.8B (23.9% of global market)

- Growth rate: 11.2% CAGR

- Key markets: UK, Germany, France, Switzerland

- Growth drivers: Business efficiency, luxury lifestyle

Emerging Markets: Private jet market 2025 sees surprising growth in previously underserved regions:

- Middle East: $680M market value (+24% growth)

- Latin America: $390M market value (+16% growth)

- Africa: $120M market value (+28% growth)

Regional Infrastructure Development:

- FBO expansion: New facilities in secondary cities

- Regulatory adaptation: Streamlined customs and immigration

- Maintenance networks: Regional service capabilities

- Pilot training: Local aviation education programs

Sustainability Initiatives: Greening Private Aviation

Private jet market 2025 growth coincides with increasing environmental consciousness, driving innovation in sustainable aviation fuels, electric aircraft development, and carbon offset programs.

Sustainable Aviation Fuel (SAF) Adoption:

- Usage growth: 127% increase in SAF consumption

- Cost premium: 2.5-3x traditional jet fuel

- Emission reduction: 80% lifecycle carbon reduction

- Availability: Limited supply constraining broader adoption

Electric Aircraft Development: Private jet market 2025 includes early-stage electric aircraft targeting short-range private aviation:

- Eviation Alice: 9-passenger electric aircraft

- Wright Electric: Developing larger electric planes

- Ampaire: Hybrid-electric aircraft systems

- Heart Aerospace: Regional electric aviation

Carbon Offset Programs:

- Participation rates: 67% of operators offer offset programs

- Customer adoption: 34% voluntarily purchase offsets

- Project types: Reforestation, renewable energy, conservation

- Cost impact: $15-45 per ton CO2 offset

Industry Sustainability Commitments:

- Net-zero emissions: 2050 industry-wide target

- SAF adoption: 10% usage by 2030 goal

- Efficiency improvements: 2% annual fuel efficiency gains

- Technology investment: $2.1B in sustainable aviation R&D

Challenges and Market Headwinds

Private jet market 2025 expansion faces significant challenges including pilot shortages, infrastructure constraints, regulatory pressures, and economic sensitivity that could limit future growth rates.

Pilot Shortage Crisis:

- Current deficit: 18,000 qualified private jet pilots

- Training timeline: 2-3 years for commercial proficiency

- Salary inflation: 35% increase in pilot compensation

- Retirement wave: 40% of pilots retire by 2030

Infrastructure Limitations:

- Slot availability: Limited takeoff/landing slots at major airports

- FBO capacity: Terminal congestion during peak periods

- Maintenance bottlenecks: Service delays affecting utilization

- Fuel availability: SAF supply constraints limiting green operations

Regulatory Pressures: Private jet market 2025 growth attracts increased government scrutiny:

- Emission regulations: Stricter environmental standards

- Noise restrictions: Limits on urban airport operations

- Tax policies: Potential luxury taxes on private aviation

- Safety oversight: Enhanced regulatory requirements

Economic Sensitivity:

- Recession risk: Luxury spending vulnerable to economic downturns

- Interest rates: Higher borrowing costs affect aircraft financing

- Market volatility: Wealth fluctuations impact demand

- Geopolitical tensions: International travel disruptions

Future Outlook: Private Aviation Market Projections

Private jet market 2025 trajectory suggests continued strong growth through 2030, driven by technological innovation, demographic changes, and permanent shifts in travel behavior among high-net-worth individuals.

Market Projections:

- 2026: $27.8B market value (+14.5% growth)

- 2027: $31.9B market value (+14.7% growth)

- 2028: $36.8B market value (+15.4% growth)

- 2030: $48.2B market value (compound growth)

Growth Acceleration Factors:

- Generational wealth transfer: Millennials inheriting wealth with different travel preferences

- Technology democratization: Continued platform innovation reducing barriers

- Global connectivity: Increased international business requiring flexible travel

- Lifestyle prioritization: Time and experience valued over material possessions

Market Evolution Trends: Private jet market 2025 establishes patterns likely to continue:

- Fractional dominance: Ownership model shifts toward access-based models

- Technology integration: AI and automation improving efficiency

- Sustainability focus: Environmental responsibility becoming requirement

- Regional expansion: Growth shifting toward international markets

For understanding how luxury transportation fits into broader private charter services, the private jet market 2025 growth provides insights into evolving luxury lifestyle preferences.

Investment Strategy: Positioning for Continued Growth

Private jet market 2025 success creates investment opportunities requiring sophisticated analysis of which companies and segments will benefit most from continued aviation expansion and technological evolution.

Direct Investment Opportunities:

Aircraft Manufacturers:

- General Dynamics (Gulfstream): Premium market leadership

- Textron (Cessna): Volume and entry-level focus

- Bombardier: Mid-size market specialization

Fractional Operators:

- NetJets (Berkshire Hathaway): Market-leading fractional program

- Wheels Up: Technology-enabled membership model

- Flexjet: Premium service positioning

Technology Platforms:

- Victor: European market leadership

- Jet.com: On-demand charter innovation

- Private aviation software: Operational efficiency solutions

Supporting Infrastructure:

- Signature Flight Support: FBO terminal services

- Atlantic Aviation: Airport services network

- TAC Air: Regional FBO operations

The private jet market 2025 growth suggests multiple investment approaches from direct aircraft exposure to supporting services and technology platforms.

Portfolio Construction Strategy:

- Diversification: Multiple aviation segment exposure

- Growth vs Value: Balance established companies with emerging technology

- Geographic spread: International market opportunities

- Risk management: Economic cycle sensitivity considerations

For investors interested in comparing aviation investments with other luxury transportation options, private jet market 2025 data provides compelling growth prospects.

Conclusion: Private Aviation’s Permanent Transformation

Private jet market 2025 represents more than cyclical growth—it’s a fundamental transformation of how private aviation serves an expanding customer base through technological innovation, operational efficiency, and accessible ownership models.

The $24.28 billion market milestone validates private aviation’s evolution from exclusive luxury to accessible premium transportation for a broader demographic of high-earners seeking time efficiency, health safety, and travel flexibility.

Key Investment Takeaways:

- Sustained growth: 14.3% CAGR supported by structural demand changes

- Technology enablement: Digital platforms democratizing access

- Fractional expansion: Ownership models reducing barriers to entry

- Global opportunity: International markets driving future growth

The private jet market 2025 explosion establishes private aviation as essential infrastructure for modern business and lifestyle, creating investment opportunities across manufacturers, operators, technology providers, and supporting services.

Ready to capitalize on private aviation’s growth trajectory? The market expansion is just beginning, with technological innovation and changing consumer preferences driving continued opportunity through 2030 and beyond.

For real-time private aviation market data and investment analysis, monitor Aviation Week and Business Aviation Insider for industry developments.

Related reading: Aviation Investment Opportunities, Private Jet vs First Class Analysis