The urban air mobility market 2025 has reached a revolutionary milestone, transforming from futuristic concept to commercial reality. With market valuations climbing from $4.54 billion in 2024 to a projected $97.4 billion by 2033, urban air mobility is reshaping city transportation through electric vertical takeoff and landing (eVTOL) aircraft and advanced air taxi services.

This explosive growth represents a compound annual growth rate of 36.70% from 2025-2033, driven by breakthrough eVTOL certifications, massive vertiport infrastructure development, and unprecedented airline partnerships. The urban air mobility market 2025 showcases companies like Joby Aviation leading FAA certification with 70% Stage 4 completion, while over 200 vertiport projects advance globally.

This comprehensive analysis examines verified urban air mobility market 2025 data, eVTOL company rankings by certification progress, vertiport infrastructure scaling, investment trends exceeding $12 billion, and realistic commercialization timelines shaping the future of urban transportation.

Urban Air Mobility Market 2025: Verified Growth and Scale

The urban air mobility market 2025 represents one of the fastest-growing transportation sectors globally. According to verified market research, the global urban air mobility market size was valued at USD 4.54 billion in 2024, with IMARC Group projecting growth to USD 97.4 billion by 2033, exhibiting a CAGR of 36.70% from 2025-2033.

Current Market Fundamentals:

Multiple research firms document consistent explosive growth patterns:

- IMARC Group: $4.54B (2024) to $97.4B (2033) at 36.70% CAGR

- MarketsandMarkets: $3.8B (2023) to $28.5B (2030) at 33.5% CAGR

- Grand View Research: $3.58B (2023) to $29.19B (2030) at 34.2% CAGR

- Straits Research: $2.8B (2024) to $11.8B (2033) at 17.29% CAGR

Market Segmentation Analysis:

By Application:

- Air taxis dominate with 44% market share in 2024

- Cargo logistics emerging as fastest growth segment at 25.26% CAGR

- Emergency services and tourism applications scaling rapidly

By Technology:

- eVTOL aircraft segment contributes 51.8% share in 2025

- Fixed-wing electric aircraft showing strong regional adoption

- Hybrid propulsion systems gaining traction for longer routes

By Operation Mode:

- Piloted aircraft controlled 55.10% of 2024 revenue

- Autonomous operations planned for post-2027 deployment

- Regulatory preference for crewed platforms during initial commercialization

Understanding this market growth requires examining complementary transportation technologies, including electric aircraft development and sustainable aviation fuel adoption that support comprehensive aviation decarbonization.

Revolutionary Technology: eVTOL Aircraft Market Expansion

The urban air mobility market 2025 centers on electric vertical takeoff and landing (eVTOL) aircraft technology that enables point-to-point urban transportation without traditional runway requirements. According to IMARC Group, the global eVTOL aircraft market size reached USD 13.9 billion in 2024 and is expected to reach USD 37.0 billion by 2033, exhibiting a growth rate (CAGR) of 11.4% during 2025-2033.

Technology Advantages Driving Adoption:

Environmental Impact: eVTOL aircraft produce 85% fewer emissions compared to traditional helicopters and small aircraft when accounting for the entire energy supply chain. This positions urban air mobility as a key solution for sustainable urban transportation.

Operational Efficiency: Air taxis can replace a 60-90 minute commute by car with a 10-20 minute ride in the sky, offering dramatic time savings for urban travelers willing to pay premium pricing.

Battery Technology Breakthroughs: New lithium-sulfur batteries developed in 2024 achieved energy densities of 400Wh/kg, representing a 60% improvement over traditional lithium-ion systems. This advancement extends practical range and reduces charging times for commercial operations.

Urban Integration Benefits: eVTOL aircraft require minimal ground infrastructure compared to traditional aviation, with vertiports occupying significantly less space than conventional airports while serving dense urban areas.

Market Applications Scaling:

Air Taxi Services: Commercial passenger services targeting business travelers, affluent commuters, and tourism markets. Companies project initial pricing of $3-8 per mile, gradually decreasing as operations scale.

Cargo and Logistics: Same-day delivery applications leveraging eVTOL payload capacity for time-sensitive freight, particularly serving e-commerce and medical supply chains.

Emergency Services: Medical evacuation, disaster response, and law enforcement applications where vertical flight capability provides critical operational advantages.

The technology development parallels innovations in sustainable aviation fuel production and electric aircraft certification progress, creating a comprehensive transformation toward sustainable aviation.

Top 10 eVTOL Companies Ranked by Certification Progress

The urban air mobility market 2025 competitive landscape features companies at various stages of regulatory certification, with clear leaders emerging based on FAA and international regulatory progress.

#1: Joby Aviation – Certification Leader

Headquarters: Santa Cruz, California, USA

Founded: 2009

Status: Public (NYSE: JOBY)

Market Cap: ~$5.5 billion

Aircraft Specifications (S4):

- Passengers: 4 + 1 pilot

- Range: 150 miles

- Cruise Speed: 200 mph

- Propulsion: 6 tilting electric rotors

Certification Progress: Joby leads the industry with approximately 70% of Stage 4 FAA certification requirements completed as of Q3 2025. The company has started final assembly of its first FAA-conforming aircraft at Marina, California, targeting Type Inspection Authorization (TIA) flight testing by late 2025.

Key Achievements:

- First eVTOL company to complete three of five FAA certification stages

- Over 40,000 flight miles completed across multiple aircraft

- Strategic partnerships with Delta Air Lines and L3Harris Technologies

- $991 million cash reserves with $250 million Toyota investment

Recent Developments:

- FAA Part 145 Repair Station Certificate received for maintenance operations

- Propulsion system certification plan accepted by FAA

- Commercial operations targeting early 2026 launch

#2: Archer Aviation – Manufacturing Focus

Headquarters: San Jose, California, USA

Founded: 2018

Status: Public (NYSE: ACHR)

Market Cap: ~$4.6 billion

Aircraft Specifications (Midnight):

- Passengers: 4 + 1 pilot

- Range: 100 miles (optimized for frequent flights)

- Cruise Speed: 150 mph

- Propulsion: 12 electric motors (6 forward, 6 aft)

Certification Progress: Archer’s FAA Type Certification remains at 15% completion as of August 2025, though the company has secured foundational certifications including Part 135 air carrier and Part 141 pilot training certificates.

Strategic Advantages:

- Partnership with Stellantis for manufacturing scale

- United Airlines strategic partnership with planned aircraft orders

- UAE commercial launch targeting late 2025 (optimistic given certification progress)

Recent Milestones:

- Final airworthiness criteria issued by FAA for Midnight aircraft

- First three conforming aircraft under construction

- $1.03 billion liquidity position supporting development

#3: EHang – First Certified eVTOL (China)

Headquarters: Guangzhou, China

Founded: 2014

Status: Public (NASDAQ: EH)

Aircraft Specifications (EH216-S):

- Passengers: 2 (autonomous operation)

- Range: 19 miles (limited urban applications)

- Top Speed: 81 mph

- Propulsion: 16 electric rotors

Certification Achievement: First and only eVTOL with Type Certification (China’s CAAC) achieved in October 2023. Currently conducting commercial operations in multiple Chinese cities.

Market Position: Limited international expansion due to range constraints and regulatory differences, but demonstrates commercial viability of autonomous eVTOL operations.

#4: Eve Air Mobility – Embraer Heritage

Headquarters: Melbourne, Florida, USA (Embraer spinoff)

Founded: 2020

Status: Public (NYSE: EVEX)

Aircraft Specifications (Eve-100):

- Passengers: 4 + 1 pilot

- Range: 60 miles

- Cruise Speed: 150 mph

- Propulsion: 8 electric rotors

Development Progress: Full-scale mockup unveiled at Paris Air Show 2025 with design enhancements including four-blade propellers and wheeled landing gear.

Strategic Position: Leveraging Embraer’s 50+ year aerospace expertise and established airline relationships for market entry.

#5: Lilium – European Technology Leader

Headquarters: Munich, Germany

Founded: 2015

Status: Public (NASDAQ: LILM) – Currently in bankruptcy proceedings

Aircraft Specifications (Lilium Jet):

- Passengers: 6 + 1 pilot

- Range: 155 miles

- Cruise Speed: 175 mph

- Propulsion: 30 ducted electric fans

Development Status: Unique ducted fan technology with European certification focus, though financial difficulties have impacted development timeline.

For broader context on aviation market dynamics, see our analysis of private jet market trends and luxury travel services that could integrate with urban air mobility offerings.

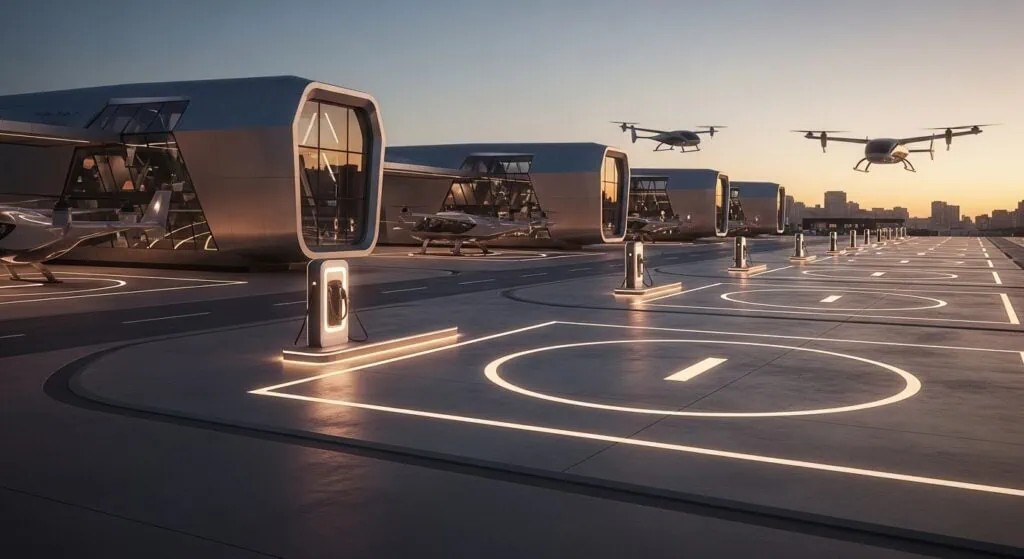

Vertiport Infrastructure: Building the Urban Air Mobility Market 2025

The urban air mobility market 2025 requires comprehensive infrastructure development, with vertiports serving as critical takeoff and landing hubs enabling urban air traffic networks.

Current Infrastructure Development:

Global Vertiport Pipeline:

- Over 200 vertiport projects in various development stages globally

- 156 vertiports operational by early 2025

- Additional 350 under construction across major metropolitan areas

Investment Scale: Major real estate developers recognize the value proposition, with 42% of new premium commercial developments including vertiport facilities in their plans. This represents billions in coordinated infrastructure investment.

Regional Infrastructure Leaders:

North America:

- Florida constructing two vertiports at SunTrax testing facility in Polk County

- First advanced air mobility aerial test bed with dedicated airspace

- Statewide network planned connecting major metropolitan areas

Asia-Pacific:

- China initiated over 30 pilot UAM projects in key cities

- Singapore developing smart city integration with vertiport networks

- Japan’s government-backed programs including comprehensive framework development

Europe:

- Germany investing €1.3 billion in UAM research and development

- UK government allocated £3 million for UAM projects with 60% London resident acceptance

- Amsterdam and other major cities incorporating UAM into transportation master plans

Infrastructure Requirements:

Technical Specifications:

- High-power charging systems (500kW-2MW capacity)

- Weather protection and passenger facilities

- Air traffic management integration

- Ground transportation connectivity

Regulatory Compliance:

- Safety certification for passenger operations

- Environmental impact assessments

- Noise mitigation measures

- Integration with existing airspace management

Economic Models:

- Public-private partnerships for development funding

- Revenue sharing between operators and infrastructure providers

- Integration with existing transportation pricing and payment systems

The infrastructure development timeline aligns with broader aviation sustainability initiatives, including sustainable aviation fuel distribution networks and electric aircraft charging infrastructure.

Investment Analysis: Funding the Urban Air Mobility Market 2025

The urban air mobility market 2025 has attracted massive capital investment reflecting confidence in commercial viability and growth potential.

Total Market Investment:

Advanced Air Mobility Funding: The global advanced aerial mobility market is estimated at USD 12.39 billion in 2025, with substantial private and public investment supporting development.

Corporate Investment Patterns:

Public Company Valuations:

- Joby Aviation: ~$5.5 billion market capitalization

- Archer Aviation: ~$4.6 billion market capitalization

- Eve Air Mobility: Public via SPAC structure

- EHang: Nasdaq-listed with proven commercial operations

Strategic Corporate Partnerships:

Airline Industry Investment:

- Delta Air Lines partnership with Joby Aviation

- United Airlines strategic investment in Archer Aviation

- Southwest Airlines MOU with Archer for California airport networks

- American Airlines partnerships with multiple eVTOL developers

Automotive Industry Participation:

- Toyota $1 billion+ investment in Joby Aviation

- Stellantis manufacturing partnership with Archer Aviation

- Hyundai Motor Group Supernal eVTOL division development

Defense Contracts:

- U.S. Air Force Agility Prime program supporting multiple companies

- Military applications driving technology development and validation

- Government funding supporting certification and testing programs

Capital Requirements Analysis:

Development Costs:

- eVTOL aircraft development: $500M-$2B per company to certification

- Infrastructure development: $50-100M per major vertiport

- Operations scaling: $200-500M for initial route networks

Cash Burn and Runway:

- Joby Aviation: ~$500-540M annual burn with runway into 2026

- Archer Aviation: Similar burn rates with $1.03B liquidity

- Industry consensus: Break-even by 2026-2028 for leading companies

Revenue Projections:

Market Size Validation: Eve Air Mobility’s Global Market Outlook projects an estimated in-service vehicle fleet of 30,000 eVTOLs by 2045, supporting an estimated three billion passengers and creating potential revenue of $280 billion.

Pricing Models:

- Initial air taxi pricing: $3-8 per mile

- Target pricing: $1-3 per mile at scale

- Cargo delivery: Premium pricing for time-sensitive freight

The investment landscape includes emerging opportunities in tokenized aviation assets and institutional blockchain adoption that could create new financing mechanisms for urban air mobility infrastructure.

Regional Market Dynamics and Regulatory Progress

The urban air mobility market 2025 shows distinct regional development patterns based on regulatory frameworks, infrastructure investment, and market characteristics.

North America: Market Leadership

Market Position: North America dominates with 46.89% of 2024 revenue, supported by clear FAA certification pathways and deep venture funding pools.

Regulatory Progress:

- FAA eVTOL Integration Pilot Program launched September 2025

- Powered-lift aircraft category established for eVTOL operations

- Type certification process advancing with multiple companies

Infrastructure Development:

- Fixed-base-operator chains constructing vertiport clusters at major airports

- State-level initiatives supporting UAM development

- Military programs accelerating technology readiness

Key Markets:

- California leading development with multiple manufacturers

- Florida establishing comprehensive test facilities and networks

- Texas developing urban air mobility corridors

Europe: Regulatory Innovation

Market Characteristics: Strong government support with €1.3 billion German investment and comprehensive EU regulatory frameworks.

Challenges and Opportunities:

- 64% of European residents express noise concerns despite eVTOL aircraft measuring below helicopter decibel levels

- EASA environmental technical specifications addressing community concerns

- Acceptance campaigns shifting sentiment through demonstration flights

Leading Markets:

- Germany: Volocopter and Lilium headquarters with industrial support

- UK: Government funding and 60% London resident acceptance

- Netherlands: SkyNRG partnerships and infrastructure development

Asia-Pacific: Rapid Scaling

Growth Profile: Fastest growing region with massive government support and urban density driving demand.

China Leadership:

- Over 30 pilot UAM projects in key cities

- Target: 100 eVTOL aircraft production annually by 2025

- EHang commercial operations demonstrating market viability

Regional Development:

- Japan: SkyDrive Initiative and government framework development

- South Korea: K-UAM Grand Challenge with Seoul vertiport construction

- Singapore: Smart city integration with advanced urban planning

The regional analysis shows coordinated global development while sustainable aviation fuel mandates and electric aircraft certification progress create supportive regulatory environments for urban air mobility adoption.

Challenges and Realistic Timeline Assessment

The urban air mobility market 2025 faces significant obstacles requiring realistic assessment of commercialization timelines and operational challenges.

Certification Timeline Reality:

Current Progress Assessment:

- Joby Aviation: 70% Stage 4 completion, targeting 2026 commercial operations

- Archer Aviation: 15% certification completion, 2025 UAE launch appears optimistic

- Industry consensus: First commercial operations 2026-2027 for leading companies

Regulatory Complexity: FAA type certification involves extensive multi-stage processes requiring demonstration of safety across all aircraft systems and operational scenarios. Even leading companies face 2-3 additional years of testing and validation.

Infrastructure Development Challenges:

Vertiport Construction Timeline:

- Planning and permitting: 2-3 years minimum

- Construction and certification: 1-2 years additional

- Network integration: Ongoing operational challenge

Air Traffic Management: Integration with existing aviation systems requires new technologies and procedures not yet fully developed or validated at commercial scale.

Market Acceptance Factors:

Public Perception:

- Noise concerns despite quieter operation than helicopters

- Safety validation requiring extensive operational history

- Pricing acceptance for premium transportation service

Economic Viability:

- High initial capital costs requiring sustained demand

- Competition with existing transportation modes

- Infrastructure utilization rates determining financial sustainability

Realistic Market Timeline:

2025-2026: Initial Operations

- Limited commercial launches in select markets

- High pricing for early adopter demographics

- Proof-of-concept route validation

2027-2029: Scaling Phase

- Expanded route networks in major metropolitan areas

- Infrastructure development supporting higher frequency operations

- Cost reduction through operational optimization

2030+: Market Maturation

- Mainstream adoption with competitive pricing

- Integration with multimodal transportation systems

- Technology evolution enabling autonomous operations

The urban air mobility market 2025 represents genuine transformation potential while requiring realistic expectations about development timelines and market penetration rates. Success depends on coordinated progress across technology, regulation, infrastructure, and market acceptance factors.

Key Takeaways: Urban Air Mobility Market 2025

Market Fundamentals

Verified Growth Trajectory: The urban air mobility market 2025 valued at $4.54 billion growing to $97.4 billion by 2033 represents legitimate transformation opportunity driven by proven technology and regulatory progress.

Technology Readiness: eVTOL aircraft market reaching $13.9 billion in 2024 demonstrates commercial viability with companies like Joby Aviation achieving 70% FAA Stage 4 certification completion.

Industry Leadership

Certification Leaders:

- Joby Aviation: 70% Stage 4 FAA progress, targeting 2026 commercial operations

- Archer Aviation: 15% completion but strong manufacturing partnerships

- EHang: Only certified eVTOL with commercial operations in China

Infrastructure Development: Over 200 vertiport projects globally with 156 operational facilities demonstrating coordinated market preparation.

Investment Reality

Capital Requirements: $12+ billion invested across the advanced air mobility sector with public companies maintaining strong cash positions through certification phases.

Strategic Partnerships: Major airline investments (Delta, United, Southwest) and automotive partnerships (Toyota, Stellantis) providing validation and operational expertise.

Regional Dynamics

North America Leadership: 46.89% market share with clear regulatory pathways and venture capital support.

Global Expansion: China leading operational deployment while Europe focuses on environmental integration and Asia-Pacific scales infrastructure development.

Timeline Assessment

Realistic Commercialization: 2026-2027 for initial operations, 2030+ for mainstream adoption, requiring sustained investment and operational validation.

Market Integration: Urban air mobility complements rather than replaces existing transportation while creating new premium mobility options for time-sensitive travelers.

The urban air mobility market 2025 represents the convergence of electric aviation technology, urban planning innovation, and regulatory evolution creating new transportation possibilities. Success requires continued coordination across technology development, infrastructure investment, and market acceptance factors while maintaining realistic expectations about adoption timelines and operational challenges.

Companies with proven certification progress, strategic partnerships, and sustainable business models are best positioned to capitalize on this transformative market opportunity. The integration with broader aviation sustainability initiatives, including sustainable aviation fuel adoption and electric aircraft development, creates comprehensive transformation toward sustainable urban transportation systems.