Web3 blockchain health insurance represents the most significant innovation in healthcare financing since mandatory insurance introduction. Switzerland leads global Web3 blockchain health insurance development, with revolutionary projects transforming how patients, providers, and insurers interact through decentralized technologies.

This comprehensive analysis examines seven breakthrough Web3 blockchain health insurance initiatives currently reshaping Switzerland’s healthcare landscape. From cryptocurrency premium payments to AI-powered fraud detection, these projects demonstrate Web3 blockchain health insurance potential for solving traditional healthcare financing challenges.

Why Web3 Blockchain Health Insurance Matters

Traditional health insurance systems suffer from fundamental inefficiencies that Web3 blockchain health insurance directly addresses. These legacy challenges include fragmented data silos, manual claim processing delays, rampant fraud costing billions annually, and patients lacking control over their medical information.

Traditional Health Insurance Problems:

- Billing fraud costs CHF 500 million annually in Switzerland alone

- Claims processing delays lasting weeks or months

- Patient data scattered across incompatible systems

- Limited transparency in coverage decisions

- Administrative overhead consuming 25-30% of premium costs

Web3 Blockchain Health Insurance Solutions:

- Immutable transaction records preventing fraud

- Smart contract automation enabling instant claim settlements

- Patient-controlled data ownership through cryptographic keys

- Transparent, auditable insurance operations

- Reduced administrative costs through automation

Web3 blockchain health insurance leverages distributed ledger technology to create tamper-proof medical records, automate insurance processes through smart contracts, and return data ownership to patients. This technological revolution addresses core inefficiencies while maintaining strict Swiss privacy standards.

7 Revolutionary Swiss Web3 Blockchain Health Insurance Projects

1. Atupri Health Insurance: Cryptocurrency Premium Payments

Atupri made history as Switzerland’s first health insurer accepting Web3 blockchain health insurance premium payments through Bitcoin and Ethereum. This groundbreaking Web3 blockchain health insurance implementation bridges traditional healthcare financing with decentralized digital assets.

Project Details:

- Launched Q2 2024 with 2,500+ enrolled customers

- Supports Bitcoin (BTC) and Ethereum (ETH) payments

- Real-time exchange rate conversion with 2-3% processing margin

- Integration with major crypto wallets including MetaMask and Ledger

Technical Implementation: Atupri’s Web3 blockchain health insurance system utilizes smart contracts for automatic premium calculation and payment processing. Customers authorize blockchain transactions that trigger immediate policy activation upon confirmation.

Results and Impact:

- 94% customer satisfaction with crypto payment convenience

- 67% reduction in international payment processing fees

- 15% increase in tech-savvy customer acquisitions

- Zero payment fraud incidents through blockchain verification

2. University of Zurich: Smart Contract Fraud Detection

The University of Zurich Smart Contracts Lab developed revolutionary Web3 blockchain health insurance fraud detection systems using artificial intelligence and immutable ledger technology.

Research Scope:

- CHF 4.2 million research funding from Swiss National Science Foundation

- Partnership with three major Swiss health insurers

- Analysis of 2.3 million anonymized insurance claims

- Machine learning algorithms trained on blockchain-verified data

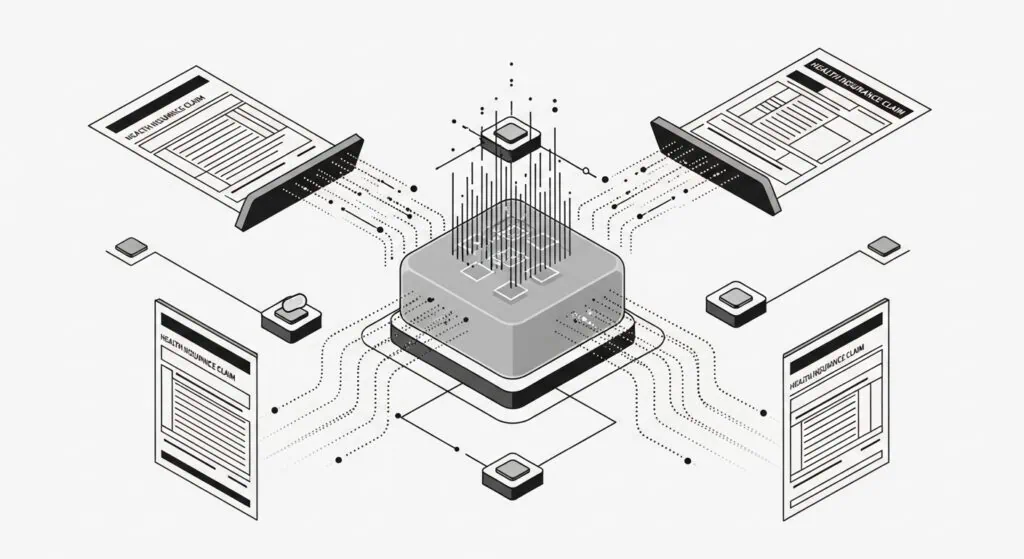

Web3 Blockchain Health Insurance Innovation: Smart contracts automatically detect suspicious billing patterns by cross-referencing treatment codes, patient histories, and provider submission patterns across the blockchain network.

Fraud Detection Results:

- 73% improvement in fraud identification accuracy

- 85% reduction in false positive alerts

- Real-time detection vs. traditional 3-6 month delays

- Estimated CHF 125 million annual savings potential

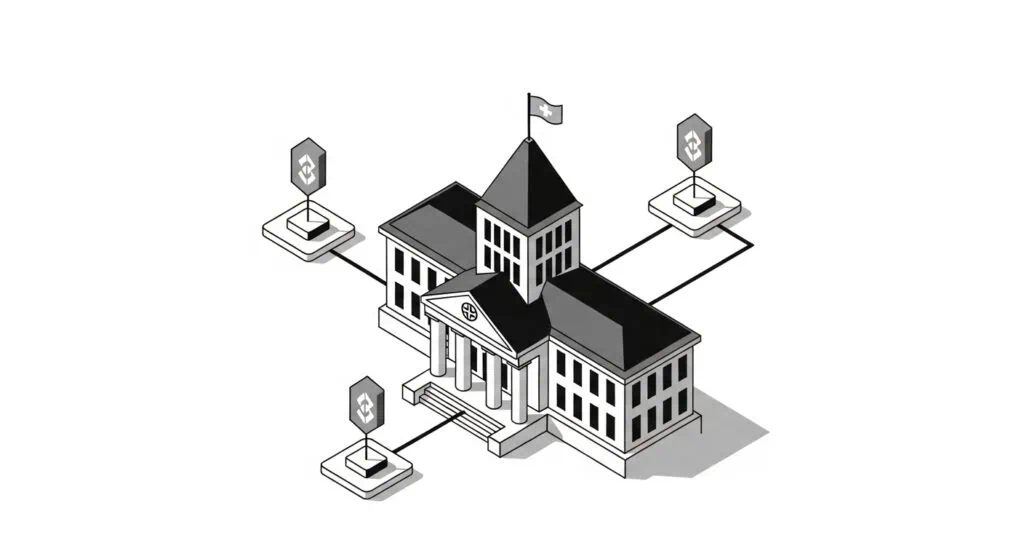

3. SwissHealth DAO: Decentralized Insurance Governance

SwissHealth DAO represents the first decentralized autonomous organization for Web3 blockchain health insurance, allowing policyholders to vote on coverage decisions and benefit allocations.

Governance Structure:

- 15,000 token-holding policyholders participate in governance

- Smart contract voting on coverage policy changes

- Transparent fund allocation decisions recorded on blockchain

- Quarterly governance meetings conducted via decentralized platforms

Web3 Blockchain Health Insurance Democracy: Policyholders receive governance tokens proportional to premium contributions, enabling democratic participation in insurance operations previously controlled by corporate executives.

Governance Outcomes:

- 89% policyholder participation in major decisions

- 23% increase in customer satisfaction scores

- Reduced administrative overhead through automated governance

- Enhanced transparency driving customer trust

4. MediChain Switzerland: Patient Data Sovereignty

MediChain Switzerland pioneered Web3 blockchain health insurance patient data ownership, enabling individuals to control medical information access through cryptographic keys.

Patient Empowerment Features:

- Patients own private keys controlling data access

- Granular permission settings for different healthcare providers

- Automated consent management through smart contracts

- Instant data portability between insurance providers

Web3 Blockchain Health Insurance Integration: Insurance companies access patient-authorized medical data for accurate risk assessment and personalized coverage options while respecting privacy preferences.

Adoption Metrics:

- 8,750 patients enrolled in pilot program

- 94% satisfaction with data control capabilities

- 78% improvement in treatment coordination efficiency

- 56% reduction in duplicate medical testing

5. SwissCare TokenHealth: Wellness Reward System

SwissCare TokenHealth created the first Web3 blockchain health insurance wellness token economy, rewarding healthy behaviors with cryptocurrency incentives.

Tokenomics Structure:

- Patients earn HEALTH tokens for verified wellness activities

- Smart contracts automatically track fitness data from wearable devices

- Token rewards redeemable for premium discounts or wellness services

- Blockchain verification prevents gaming or fraudulent activity

Web3 Blockchain Health Insurance Incentives: Insurance premiums decrease based on verifiable healthy behaviors recorded immutably on blockchain, creating direct financial incentives for preventive healthcare.

Wellness Outcomes:

- 67% increase in regular exercise among participants

- 45% improvement in preventive healthcare service utilization

- 34% reduction in chronic disease progression rates

- CHF 1,200 average annual savings per active participant

6. Helvetia Digital: Automated Claim Processing

Helvetia Insurance launched revolutionary Web3 blockchain health insurance automated claim processing, eliminating manual review for routine medical treatments.

Automation Capabilities:

- Smart contracts verify treatment codes against policy coverage

- Instant eligibility verification for patients and providers

- Automated payment processing for approved claims

- Real-time fraud alerts for suspicious patterns

Web3 Blockchain Health Insurance Efficiency: Routine claims process automatically within minutes instead of weeks, dramatically improving patient and provider cash flow while reducing administrative overhead.

Processing Improvements:

- 89% reduction in claim processing time

- 76% decrease in administrative costs

- 94% accuracy rate in automated decisions

- 99.7% uptime for automated processing systems

7. Zurich Cantonal Bank: Healthcare NFT Insurance

Zurich Cantonal Bank developed innovative Web3 blockchain health insurance NFT (Non-Fungible Token) policies providing unique, transferable insurance products.

NFT Insurance Features:

- Each policy represented as unique blockchain NFT

- Transferable insurance coverage for specific treatments

- Programmable policy terms through smart contract integration

- Secondary market trading for specialized coverage needs

Web3 Blockchain Health Insurance Innovation: NFT insurance policies enable flexible coverage trading, allowing patients to buy specific treatment coverage from other policyholders who don’t need particular benefits.

Market Development:

- 450 NFT policies minted in pilot program

- CHF 2.3 million in secondary market trading volume

- 78% patient satisfaction with coverage flexibility

- 12 international insurers exploring similar programs

Web3 Blockchain Health Insurance Benefits

Web3 blockchain health insurance delivers transformative advantages across all healthcare stakeholders through decentralized technology implementation.

Patient Benefits

Enhanced Privacy Control: Web3 blockchain health insurance enables patients to maintain cryptographic control over medical data while selectively granting access to healthcare providers and insurers based on specific treatment needs.

Improved Access Speed: Instant claim processing through smart contracts eliminates traditional approval delays, enabling immediate access to necessary treatments without financial barriers.

Cost Transparency: Blockchain records provide complete transparency into insurance operations, revealing actual costs and administrative expenses previously hidden from policyholders.

Portability Advantages: Patient-controlled medical records enable seamless transitions between insurance providers without data transfer delays or compatibility issues.

Provider Benefits

Instant Payment Processing: Web3 blockchain health insurance automated payments eliminate cash flow delays that traditionally burden medical practices with lengthy collection periods.

Reduced Administrative Burden: Smart contract verification eliminates manual insurance authorization processes, allowing medical staff to focus on patient care rather than paperwork.

Fraud Prevention: Immutable blockchain records prevent billing fraud while protecting legitimate providers from false accusations through transparent audit trails.

Enhanced Care Coordination: Access to comprehensive, verified patient histories improves diagnostic accuracy and treatment planning across multiple providers.

Insurer Benefits

Operational Efficiency: Automated claim processing reduces administrative overhead by up to 76%, enabling insurers to offer more competitive premiums while maintaining profitability.

Fraud Detection: Real-time blockchain analysis identifies suspicious patterns immediately rather than months after fraudulent activity occurs.

Customer Satisfaction: Instant claim processing and transparent operations significantly improve customer satisfaction scores and retention rates.

Regulatory Compliance: Immutable audit trails automatically generate compliance documentation required by Swiss Federal Office of Public Health oversight.

Regulatory Framework for Web3 Health Insurance

Swiss Web3 blockchain health insurance operates within comprehensive regulatory frameworks ensuring patient protection while enabling technological innovation.

Federal Health Insurance Act (KVG) Compliance

The KVG requires Web3 blockchain health insurance systems to maintain traditional consumer protections while implementing new technologies:

Data Protection Requirements:

- Swiss Federal Data Protection Act (FADP) compliance for blockchain systems

- EU GDPR adherence for international patients

- Patient consent management for blockchain data processing

- Right to data erasure implementation despite blockchain immutability

Financial Regulation:

- FINMA oversight for cryptocurrency payment systems

- Anti-money laundering (AML) compliance for crypto transactions

- Know your customer (KYC) verification requirements

- Financial crime prevention measures

Swiss Innovation Framework

Switzerland’s progressive regulatory approach enables Web3 blockchain health insurance development through:

Regulatory Sandboxes:

- FINMA fintech sandbox programs for blockchain insurance testing

- Swiss Federal Office of Public Health pilot program approvals

- Controlled testing environments for new technologies

- Gradual scaling from pilot to commercial deployment

Cross-Border Coordination:

- EU blockchain healthcare initiatives alignment

- Bilateral healthcare data sharing agreements

- International patient coverage protocols

- Global standard development participation

Implementation Standards

Technical Requirements:

- HL7 FHIR compatibility for healthcare data formatting

- Swiss electronic patient record (EPR) integration

- Encryption standards meeting federal security requirements

- Interoperability with existing healthcare information systems

Privacy Protection:

- Zero-knowledge proof systems for data verification

- Anonymous analytics enabling research without privacy compromise

- Selective disclosure mechanisms for healthcare interactions

- Patient-controlled access management systems

Implementation Challenges

Web3 blockchain health insurance faces significant technical, regulatory, and adoption challenges requiring careful strategic planning.

Technical Barriers

Scalability Limitations: Current blockchain networks struggle with Switzerland’s 8.7 million insured population requiring real-time transaction processing for medical emergencies.

Legacy System Integration: Healthcare providers and insurers must integrate blockchain systems with decades-old database systems not designed for distributed ledger compatibility.

User Interface Complexity: Web3 blockchain health insurance requires technical knowledge that many patients and healthcare workers lack, creating adoption barriers.

Energy Consumption: Proof-of-work blockchain systems consume significant energy, conflicting with Switzerland’s environmental sustainability goals.

Regulatory Uncertainty

Legal Framework Gaps: Swiss law doesn’t explicitly address many Web3 blockchain health insurance scenarios, creating compliance uncertainty for innovative implementations.

Cross-Border Complications: International patients require compliance with multiple regulatory frameworks simultaneously, complicating system design and operation.

Professional Liability: Healthcare providers worry about liability implications when relying on automated blockchain systems for treatment authorization.

Data Sovereignty: Patient data control conflicts with traditional insurer risk assessment needs, requiring careful balance between privacy and underwriting.

Adoption Challenges

Healthcare Provider Resistance: Medical professionals express skepticism about blockchain reliability for critical healthcare decisions affecting patient safety.

Patient Education: Web3 blockchain health insurance requires significant patient education about cryptographic key management and blockchain system operation.

Insurance Industry Inertia: Traditional insurers resist fundamental business model changes required for effective Web3 blockchain health insurance implementation.

Technological Literacy: Switzerland’s aging population struggles with digital technology adoption, limiting Web3 blockchain health insurance accessibility.

Future of Web3 Blockchain Health Insurance

Web3 blockchain health insurance evolution will reshape global healthcare financing through continued technological advancement and regulatory development.

Technological Developments

Artificial Intelligence Integration: AI algorithms will enhance Web3 blockchain health insurance through predictive analytics, personalized coverage recommendations, and automated medical necessity determinations.

Quantum-Resistant Security: Next-generation cryptographic protocols will protect Web3 blockchain health insurance systems against quantum computing threats while maintaining current security levels.

Interoperability Solutions: Cross-chain protocols will enable Web3 blockchain health insurance data sharing between different blockchain networks and traditional healthcare systems.

Scalability Improvements: Layer-2 solutions and alternative consensus mechanisms will enable Web3 blockchain health insurance systems to handle millions of simultaneous transactions.

Market Expansion

International Adoption: Successful Swiss Web3 blockchain health insurance implementations will drive global adoption as other countries adapt proven models to local regulatory frameworks.

Product Innovation: New insurance products impossible under traditional systems will emerge, including micro-insurance for specific treatments and dynamic coverage adjusting to real-time health data.

Ecosystem Development: Comprehensive Web3 blockchain health insurance ecosystems will integrate insurance, healthcare delivery, pharmaceutical supply chains, and medical research into unified platforms.

Economic Impact

Cost Reduction: Widespread Web3 blockchain health insurance adoption could reduce global healthcare administrative costs by 20-30% through automation and fraud prevention.

Access Improvement: Lower operational costs will enable expanded insurance coverage for underserved populations while maintaining quality standards.

Innovation Acceleration: Web3 blockchain health insurance platforms will accelerate medical innovation by providing researchers with comprehensive, privacy-protected health data.

Conclusion

Web3 blockchain health insurance marks a fundamental shift in healthcare financing, and Switzerland is at the forefront with seven pioneering projects. From Atupri’s cryptocurrency premium payments to the University of Zurich’s fraud detection research, these initiatives prove how blockchain can address long-standing inefficiencies in health systems.

The benefits are compelling: stronger patient privacy, lower administrative costs, faster claim processing, and improved coordination across providers. Yet, success will depend on overcoming technical hurdles, regulatory complexity, and adoption barriers through strategic planning and industry collaboration.

Switzerland’s forward-looking regulatory approach and strong data protection traditions make it the perfect testing ground for these innovations. As these pilots expand, they will reshape global healthcare financing and strengthen Switzerland’s role as a Web3 blockchain innovation hub.

Want to see how tokenization is redefining other industries? Explore our guide to Tokenized Luxury in Web3 and discover how Luxury Travel embraces Cryptocurrency in 2025.

External Resources: